Press release -

Interim Report for Duni AB (publ) 1 January – 31 March 2017

Improved income in Table Top

1 January – 31 March

- Net sales amounted to SEK 1,004 m (959). Adjusted for exchange rate movements, net sales increased by 3.3%.

- Earnings per share after dilution amounted to SEK 1.22 (1.16).

- Income strengthened in spite of negative currency effects and higher raw material expenses.

- Income improved in Table Top, the largest business area.

- The Meal Service business area is implementing its marketing investments with continuing strong growth.

- An investment in a logistics property in Osnabrück, Germany, impacted net debt by SEK 55 m.

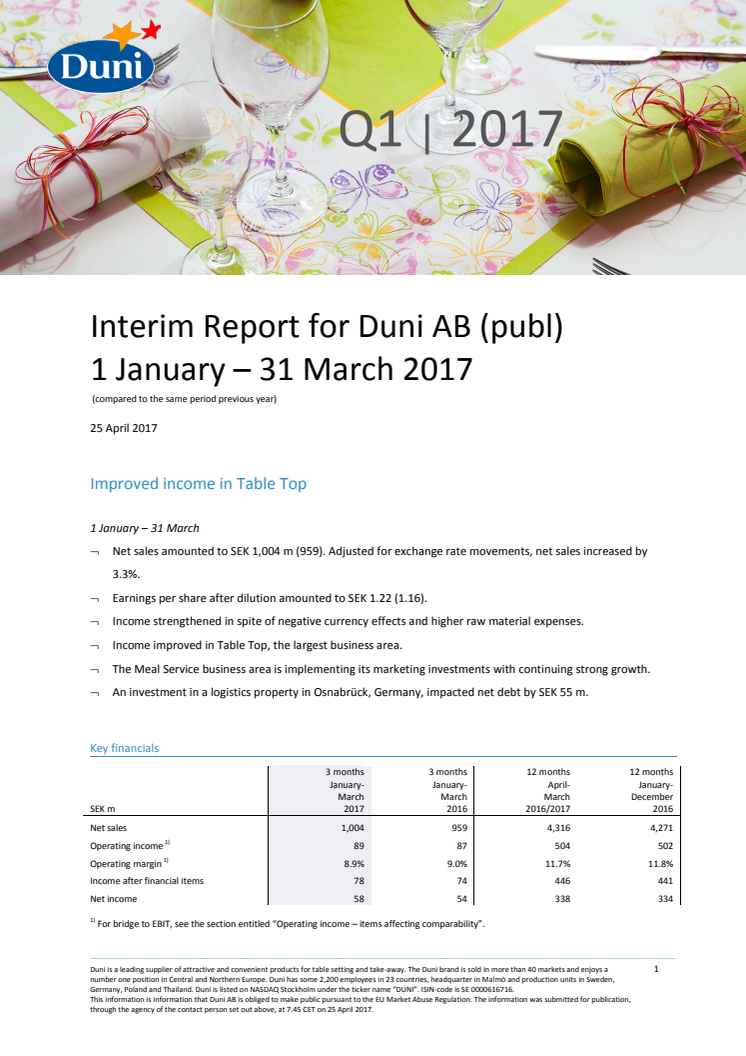

Key financials

| SEK m | 3 months January-March 2017 | 3 months January-March 2016 | 12 months April-March 2016/2017 | 12 months January-December 2016 |

| Net sales | 1,004 | 959 | 4,316 | 4,271 |

| Operating income 1) | 89 | 87 | 504 | 502 |

| Operating margin 1) | 8.9% | 9.0% | 11.7% | 11.8% |

| Income after financial items | 78 | 74 | 446 | 441 |

| Net income | 58 | 54 | 338 | 334 |

1) For bridge to EBIT, see the section entitled “Operating income – items affecting comparability”.

CEO’s comments

“Net sales for the quarter increased by SEK 45 m, resulting in SEK 1,004 m (959). Adjusted for exchange rate movements, net sales for the quarter increased by 3.3%. Operating income increased to SEK 89 m (87), while the operating margin fell marginally to 8.9% (9.0%). Operating margin for the quarter was impacted negatively by currency effects and higher raw material expenses. A quick and relatively high surge in prices was experienced for some raw materials late last year; as a result, we initiated adjustments to the prices we charge our customers. The effect of these price increases will be fully compensated in the second half of the year.

Operating cash flow for the period was SEK -128 m (-59). The lower cash flow is a result of a higher level of investments due to the acquired logistics property in Germany and increased safety stocks in preparation for sales in the coming quarters.

Sales for the quarter exceeded the same period last year in spite of a very weak start. Low sales in January were counterbalanced by historically strong shipments to customers in March. The tendency towards higher inventory fluctuations on the part of our distributors is becoming more pronounced. However, this trend has no correlation to the rate of consumption of our end consumers. Increasing inventory volatility on the distributor level will increase the amount of capacity required in intense periods and, conversely, necessitate greater flexibility in conjunction with unforeseen volume decreases. We have initiated a project to raise inventory transparency at our key customers in order to analyze and manage these fluctuations more effectively in the future.

The Table Top business area increased its net sales to SEK 511 m (503); an improved business area performance is a direct result of the activities initiated as a result of the weak sales trend early 2016 onwards. The trend in Southern and Western Europe remains strong and Central Europe has stabilized. Operating income increased to SEK 64 m (60) and the operating margin strengthened to 12.4% (12.0%).

The Meal Service business area continues to grow faster than the market as a whole, reaching a growth rate of 8.4% in the quarter. We are mainly seeing the effects of expanded sales resources; further, environmentally conscious products account for a higher share of total sales. Net sales reached SEK 162 m (148) and operating income was SEK 2 m (3). Income was impacted negatively by higher purchase prices for plastic-based products and continuing sales force investments.

The Consumer business area reports net sales in parity with the previous year SEK 247 m (248) and operating income decrease to SEK 16 m (19). In recent years, the Easter holiday’s impact on sales has steadily decreased, but our Easter assortment made a positive contribution to the total sales of the business area in 2017. The increased demand for contract production is a major challenge that is driving up the number of item numbers and thus internal complexity. This trend has prompted a more comprehensive review of our assortment, which will be conducted during the year.

The New Markets business area increased its net sales to SEK 70 m (47) and operating income to SEK 7 m (4). This trend is mainly driven by Terinex Siam, which was acquired in August 2016. The business area also saw improvement in markets such as Russia, Thailand and South America. The strengthening of our presence in Southeast Asia thanks to the Terinex Siam production unit also resulted in higher sales of locally produced products to nearby export markets.

Following the somewhat weak start to the quarter, we are broadly satisfied with the final outcome. Several key projects and investments were completed in the past year and we expect that they will now give a boost to our performance. We also see a short-term challenge in the raw material price trend, which we will compensate for fully in the third quarter,”says Thomas Gustafsson, President and CEO, Duni.

Topics

Duni is a leading supplier of innovative table-setting concepts and packaging solutions.

Our brand is built on the belief that every meal represents a golden opportunity for people to enjoy each other's. That is why we have made it our business to bring goodfoodmood to where people meet and eat.

Our products are found in over 40 markets and enjoy a number one position in Central and Northern Europe. We have about 2,200 employees in 23 countries. Our headquarters are in Malmö and our production units are in Sweden, Germany, Poland and Thailand. The company is listed on NASDAQ Stockholm.