Pressmeddelande -

Capgemini ökade resultatet i 2018

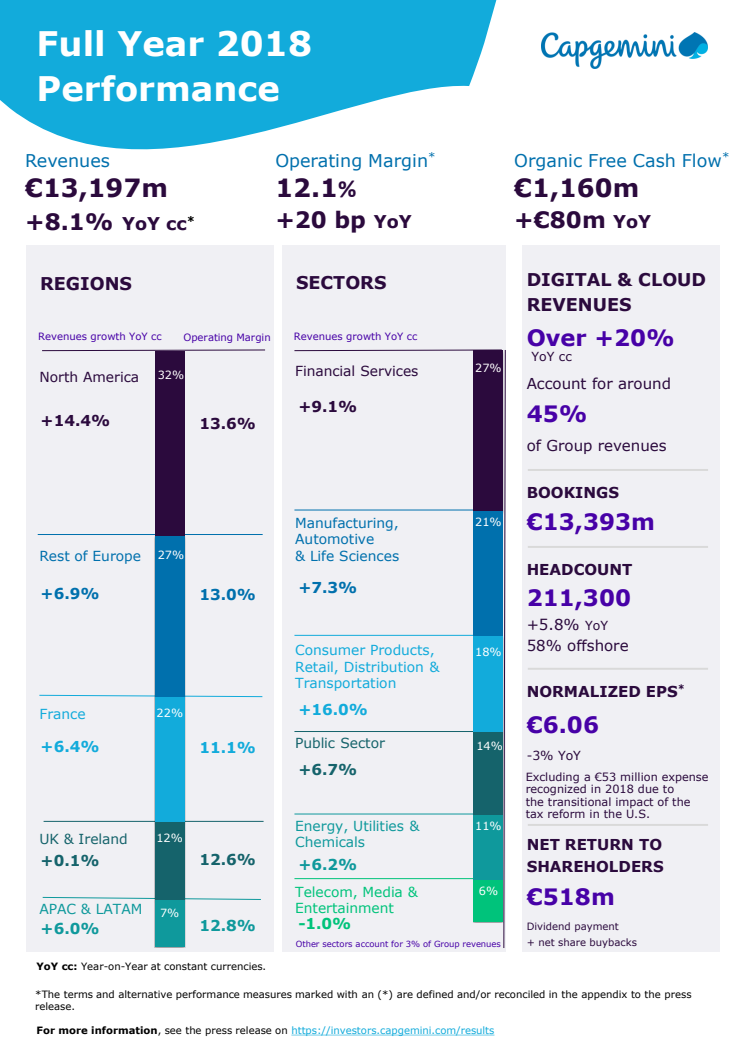

● Rörelseintäkter på 13 197 miljoner euro

● Omsättningstillväxt för helåret på 8,1% vid konstanta valutakurser och 7,8% under fjärde kvartalet

● Rörelsemarginal på 12,1%, en ökning med 20 baspoäng

● Koncernens nettoresultat på 730 miljoner euro

● Organiskt fritt kassaflöde * på 1.160 miljoner euro

● Föreslagen utdelning på 1,70 euro per aktie

Pressmeddelandet som blev skickat ut från Paris kan du läsa här:

The Board of Directors of Capgemini SE, chaired by Paul Hermelin, convened in Paris on February 13, 2019 to review and authorize the issue of the accounts[1] of Capgemini Group for the year ended December 31, 2018.

Paul Hermelin, Chairman and Chief Executive Officer of Capgemini Group, states: “In 2018, we demonstrated once again our capacity to improve our profitability while delivering sustained growth. All regions contributed to our solid top-line momentum, which we maintained in the fourth quarter on top of a particularly demanding comparison basis last year. We reached all the targets we had set for ourselves, including the sales outlook which was raised during the year.

Today, the Group is well positioned to continue outperforming the market, in pursuit of our two strategic priorities.

First, a more dynamic management of our portfolio of services, which enabled Capgemini to be recognized as a world leader in digital and cloud. These high-growth areas will soon account for half of our revenues.

We are confident that our key strengths and solid financial performances will support our success in 2019.”

2018 KEY FIGURES

| (In millions of euros) | 2017 (restated for IFRS15) | 2018 | Change |

| Revenues | 12,525 | 13,197 | +5.4% +8.1% at constant exchange rates* |

| Operating margin* | 1,493 | 1,597 | +7% |

| as a % of revenues | 11.9% | 12.1% | +20 basis points |

| Operating profit | 1,183 | 1,251 | |

| as a % of revenues | 9.4% | 9.5% | |

| Net profit (Group share) | 820 | 730 | |

| Basic earnings per share (€) | 4.88 | 4.37 | -10% |

| Normalized earnings per share (€)* | 6.22 | 6.06[2] | -3% |

| Organic Free Cash Flow* | 1,080 | 1,160 | +80M€ |

| Net cash / (Net debt) | (1,209) | (1,184) | +25M€ |

In 2018, the Group generated revenues of €13,197 million, up 5.4% compared with 2017. Growth is 8.1% at constant exchange rates*, significantly above the 6% to 7% target communicated at the beginning of the year. Organic growth* (i.e. excluding the impact of currency fluctuations and changes in Group scope) was 6.2%. Q4 growth is 7.8% at constant exchange rates and 5.7% organic.

This momentum continues to be supported by Digital & Cloud activities, which grew over 20% at constant exchange rates and now account for around 45% of the Group.

Bookings totaled €13,393 million in 2018, a 9% increase at constant exchange rates year-on-year.

For 2018, operating margin* was €1,597 million, or 12.1% of revenues, an increase of 7% or 20 basis points year-on-year, in line with annual objectives. This further improvement in margin illustrates the Group's ability to combine investments in its talent and its portfolio of sector offerings with profitable growth. It also reflects a stronger gross margin, particularly in the second-half of the year. Geographically, continental Europe and the Asia-Pacific and Latin America region are the main contributors to this performance.

The net financial expense is €80 million, slightly up on €72 million last year. The income tax expense is up from €303 million in 2017 to €447 million this year. The effective tax rate (ETR) increased primarily because, as anticipated, since 2018 the Group does not recognize any new deferred tax assets in the U.S.[3]. In addition, the Group recorded a €53 million expense related to the transitional impact of the U.S. tax reform. Adjusted for this expense, the ETR increased from 27.3% in 2017 to 33.7%.

Net profit (Group share) amounted to €730 million for 2018, down on €820 million for 2017, due to the higher tax expense. Basic EPS (earnings per share) is €4.37. Normalized EPS* is €5.74, or €6.06 adjusted for the transitional tax expense, a level close to that reported in 2017 (-3%).

Organic free cash flow* reached €1,160 million, exceeding the €1,000 million objective set at the beginning of the year. In 2018, the Group benefited from a €65 million improvement in its working capital requirement thanks to a 2-day decrease in DSO (Days Sales Outstanding).

In 2018, Capgemini spent a net amount of €461 million on acquisitions and paid €284 million in dividends. Finally, the Group allocated €464 million to share buybacks, under the multi-year program and to neutralize the dilution resulting from the 5th employee share ownership plan (which led to a net capital increase of €230 million).

The Board of Directors has decided to recommend at the next Shareholders’ Meeting on May 23, 2019, the payment of a dividend of €1.70 per share, the same amount as the previous year. The corresponding payout ratio is 36% of net profit2 (Group share), in line with the Group’s distribution policy.

OUTLOOK

For 2019, the Group targets revenue growth at constant exchange rates of 5.5% to 8.0%, improved profitability with an operating margin of 12.3% to 12.6% and stronger organic free cash flow - on a comparable basis - of over €1.1 billion.

OPERATIONS BY MAJOR REGION

North America (32% of Group revenues) was the most dynamic region of the Group in 2018 with a 14.4% increase in revenue at constant exchange rates. This growth was spurred by investments and acquisitions in Digital. It was mainly driven by the Consumer Goods & Retail, Financial Services and Manufacturing sectors while only the Energy & Utilities sector remained lackluster. The operating margin is largely stable year-on-year (-0.05 point), at 13.6%.

OPERATIONS BY BUSINESS

Consulting Services (6% of Group revenues) reported growth of 37.4% at constant exchange rates. This reflects not only the key contribution of acquisitions in the reference period, but also strong activity in the main regions. Digital transformation demand was particularly buoyant in the Financial Services, Manufacturing and Retail sectors. The Group now benefits from the launch of “Capgemini Invent”, which combines its recognized expertise in the fields of strategy, technology, data science and creative design to support decision-makers in their transformation and digital innovation projects. The operating margin stands at 12.9% of revenues, up 160 basis points year-on-year.

Technology & Engineering Services (15% of Group revenues) grew 5.0% at constant exchange rates. Momentum was strong across all Group regions and particularly North America and the United Kingdom. The operating margin is 13.2%, slightly down from 13.8% in 2017.

Application Services (64% of Group revenues) posted revenue growth of 10.1% at constant exchange rates, fueled by customer demand for Digital and Cloud. This reflects the strong alignment between the Group’s offerings and the new needs of clients. France, North America and the Rest of Europe reported the strongest momentum in 2018. The operating margin rate is 13.6%, up 50 basis points.

Other Managed Services (15% of Group revenues) declined 4.2% at constant exchange rates, mainly impacted by a slowdown in Business Process Outsourcing. In Infrastructure Services, the first-half of the year was marked by a contraction in the UK public sector. In the second half of the year, strong growth in cloud integration and orchestration services contained to a large extent the decline in Infrastructure services. Operating margin for Other Managed Services is 8.7% compared with 9.7% in 2017.

Q4 TRENDS

Group momentum remained strong in Q4. Revenues grew 7.8% year-on-year at constant exchanges rates and 5.7% at constant scope and exchange rates, to €3,502 million for the period.

All Group regions contributed to this growth, which neared or exceeded 10% in North America (+11.2% at constant exchange rates), Asia-Pacific and Latin America (+9.6%) and the United Kingdom & Ireland (+9.0%). The Rest of Europe region slowed slightly (+4.2%) due to a more demanding comparison basis, while France maintained a steady pace, reporting revenue growth of 6.5%.

The businesses’ Q3 momentum generally continued in the final quarter, with Application Services growing 9.3% at constant exchange rates and Consulting Services growing 35.2%. Finally, Other Managed Services continued to contract (-2.1%), while Technology & Engineering Services were up 3.8%.

Q4 bookings totaled €3,929 million, bringing the book-to-bill ratio to 112% for the quarter.

HEADCOUNT

At December 31, 2018, the Group’s total headcount stood at 211,300, up 5.8% year-on-year, with 122,000 employees in offshore centers (58% of the total headcount). Attrition was up to 22% in 2018.

Overall, the balance sheet structure remained broadly unchanged in 2018. At December 31, 2018, the Group had €2,004 million in cash and cash equivalents, compared with €1,988 million a year earlier. After accounting for borrowings of €3,357 million, cash management assets and derivative instruments, Group net debt* is €1,184 million at the end of 2018, comparable to the previous year end (€1,209 million).

Moreover, in April 2018, the Group performed a partial repurchase of the bond issue maturing in 2020 and issued new bonds maturing in 2024 and 2028, extending the average maturity of its bond debt with no significant impact on its future cash coupon. In July, the Group also repaid at maturity a €500 million bond issued in 2015.

[1] Audit procedures on the consolidated financial statements have been completed. The auditors are in the process of issuing their report.

[2] Excluding a €53 million expense recognized in 2018 due to the transitional impact of the tax reform in the U.S.

[3] See details in appendix.

Ämnen

Om Capgemini

Som en global ledare inom konsult- och tekniktjänster och digital transformation ligger Capgemini i framkant av innovation för att bemöta sina kunders behov inom molntjänster, digitalisering och plattformar. Med hjälp av sitt 50-åriga arv och gedigna branschspecifika kompetens gör Capgemini det möjligt för organisationer att förverkliga sina affärsmål genom en rad olika tjänster, från strategi till operation. Capgemini sätter människorna i fokus och drivs framåt av övertygelsen att teknikens affärsvärde kommer från och genom människor. Bolaget är multikulturellt med 200 000 anställda i över 40 länder. 2017 redovisade Capgemini globala intäkter på 12,8 miljarder euro.

Besök oss på www.capgemini.com. People matter, results count.