Blogginlägg -

The wind power company as merchant energy trader - article by Fredrik Bodecker

A vision of the wind power company doing active hedging - extracting more value from its assets at a controlled risk level.

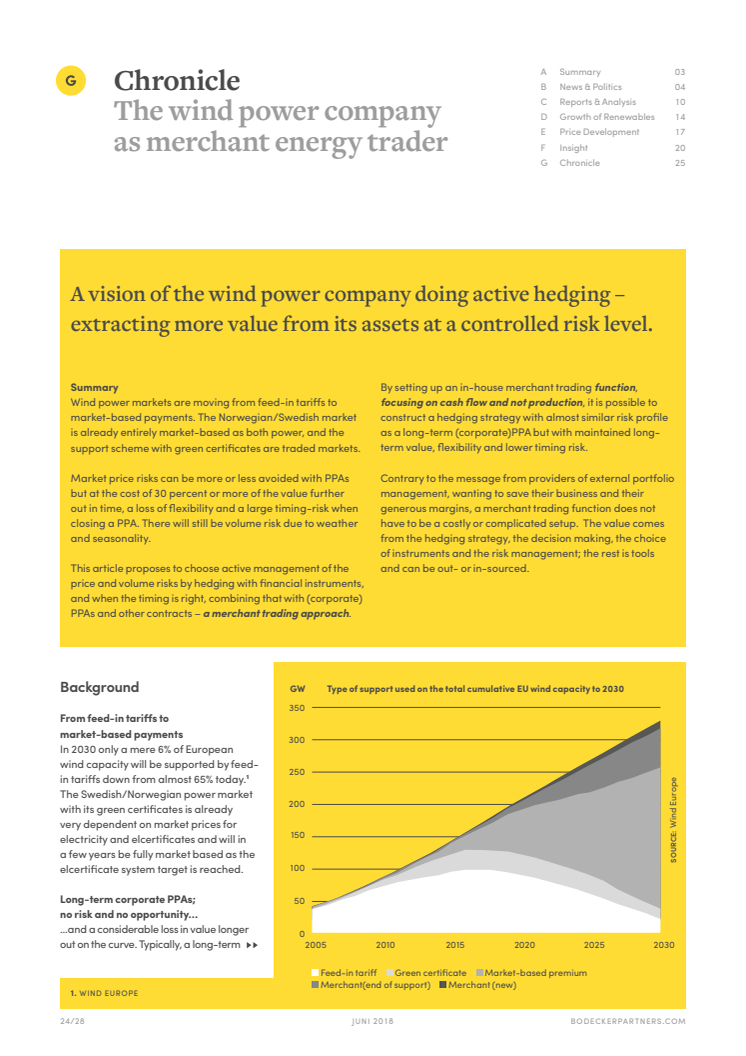

Wind power markets are moving from feed-in tariffs to market-based payments. Market price risks can be more or less avoided with PPAs but at the cost of 30 percent or more of the value further out in time, a loss of flexibility and a large timing-risk when closing a PPA.

By setting up an in-house merchant trading function, focusing on cash flow and not production, it is possible to construct a hedging strategy with almost similar risk profile as a long-term (corporate)PPA but with maintained longterm value, flexibility and lower timing risk.

It does not have to be as complicated and expensive as you may be led to believe!

Ämnen

- EU-frågor

Regioner

- Malmö