Press release -

ASEAN CEOs most optimistic about Global Economy for 2015

News release

| Date | Wednesday, 21 January 2015, 1.45am (SIN/HK) |

| Contact | Candy Li Tel: +65 6236 7429 / Mobile: +65 8613 8820 e-mail: candy.yt.li@sg.pwc.com Daniel Tan Tel: +65 6236 3960 / Mobile: +65 9824 0523 e-mail: daniel.el.tan@sg.pwc.com |

| For more details, go to www.pwc.com/ceosurvey |

ASEAN CEOs most optimistic about Global Economy for 2015

United States has overtaken China as top target for growth for the first time in five years

Russian CEOs go from most confident in 2014 to least in 2015

Singapore , 21 January 2015 – Fewer CEOs than last year think global economic growth will improve over the next 12 months, though confidence in their ability to achieve revenue growth in their own companies remains stable, say the more than 1,300 CEOs interviewed worldwide in PwC’s 18th Annual Global CEO Survey. Results of the survey were released at the opening of the World Economic Forum Annual Meeting in Davos, Switzerland.

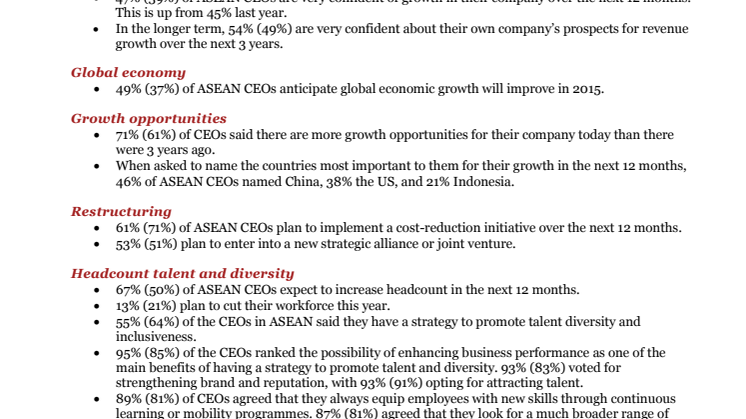

Global Economy

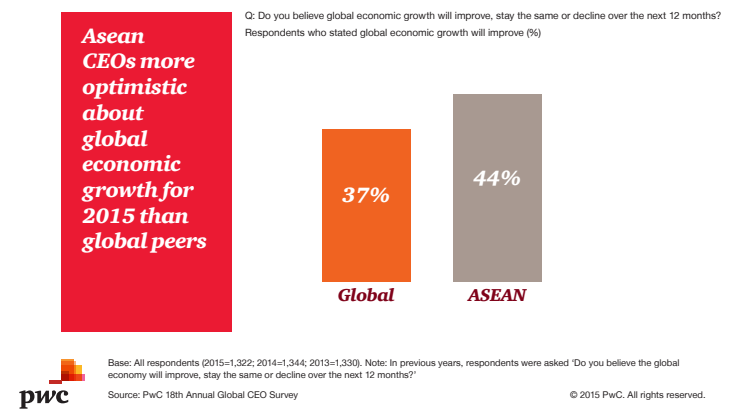

CEOs are less optimistic about global growth prospects than a year ago, with 37% of CEOs thinking global economic growth will improve in 2015. This is down from 44% last year. Significantly, 17% of CEOs believe global economic growth will decline, more than twice as many as a year ago (7%). The remaining 44% expect economic conditions to remain steady.

Regionally, the results show wide variations. CEOs in ASEAN are the most optimistic about the global economy with 49% anticipating improvement, followed by Asia Pacific (45%), the Middle East (44%) and North America (37%). On the other hand, only 16% of CEOs in Central and Eastern Europe expect economic improvement. CEOs in emerging economies like India (59%), China (46%) and Mexico (42%) are more optimistic about the economy than those in developed economies like the US (29%) and Germany (33%).

Revenue Growth

Despite the overall declining outlook for the global economy, CEOs remain confident about prospects for their own company; 39% worldwide said they are ‘very confident’ their company’s revenues will grow in the next 12 months. That’s the same as last year; though up slightly from 36% in 2013.

Regionally, ASEAN CEOs are more confident of revenue growth at 47% when compared with the global average of 39%. This is also up from last year’s figure of 45%. In the longer term, 54% of ASEAN CEOs are very confident of their own company’s prospects for revenue growth over the next three years – higher than the global average of 49%. On top of this, 71% of ASEAN CEOs said that there are more growth opportunities for their company today than there were three years ago, again higher than the global average of 61%.

Commenting on this, Yeoh Oon Jin, Executive Chairman, PwC Singapore said:

“The increase in CEOs’ confidence in their companies’ revenue growth in ASEAN is a strong signal that business sentiment in the region remains strong despite a less optimistic outlook globally. We are confident that Southeast Asia, as a region, will continue to grow as an attractive investment destination. This bodes well for Singapore as we remain as a favoured regional headquarter location.”

CEOs in the Asia Pacific region (45%) are also confident of revenue growth, about the same as last year. The Middle East is still one of the most optimistic regions with 44% of CEOs very confident of revenue growth, although this is down markedly from last year’s 69%. CEO confidence in growth is higher in North America, rising to 43% from 33%. CEOs in Western Europe (31%) and Central and Eastern Europe (30%) are least optimistic about their company’s growth prospects.

Looking country by country, India’s CEOs top the list, with 62% very confident in their short-term growth prospects. Other leading countries include Mexico (50%), the US (46%), Australia (43%) the UK and South Africa (39%), China (36%), Germany (35%) and Brazil (30%). Among the least confident countries are France (23%), Venezuela (22%), Italy (20%), Argentina (17%) and, at the bottom of the list, Russia, with only 16% of CEOs very confident of revenue growth for 2015. This is down from 53% last year when Russia’s CEOs were the most confident in the world.

Commenting on the survey results, Yeoh Oon Jin, Executive Chairman, PwC Singapore, said:

“The world is facing significant challenges: economically, politically and socially. Globally, CEOs overall remain cautious in their near-term outlook for the worldwide economy, as well as for growth prospects for their own companies. While some mature markets like the US appear to be rebounding, others such as the Eurozone continue to struggle. And while some emerging economies continue to expand rapidly, others are slowing. Finding the right strategic balance to sustain growth in this fast changing marketplace remains a challenge.

CEO confidence is down notably in oil-producing nations around the world as a result of plummeting crude oil prices. Russia CEOs, for example, were the most confident in last year's survey, but are the least confident this year. Confidence also slipped among CEOs in the Middle East, Venezuela, and Nigeria.”

Strategies for Growth

Globally, CEOs rank the US as their most important market for growth over the next 12 months, placing it ahead of China for the first time since we started asking this question five years ago. Overall, 38% 0f CEOs say the US is among their top-three overseas growth markets, compared with 34% for China, 19% for Germany, 11% for the UK and 10 % for Brazil.

In contrast, 46% of ASEAN CEOs name China as the most important market to them for growth over the next 12 months, followed by the US (38%), and Indonesia (21%).

CEOs say they will undertake a number of business strategies to strengthen their companies in the coming 12 months. Overall, 71% say they will cut costs, 51% will form strategic alliances or joint ventures, 31% will outsource a business process or function, and 29% will complete a domestic M&A (up from 23% last year). In ASEAN, 61% of CEOs plan to implement cost-reduction initiatives, while 53% plan to enter into a new strategic alliance or joint venture.

What worries CEOs most?

Over-regulation again tops the list of concerns, named by 78% of CEOs worldwide. This is up 6 points from last year and is now at the highest level ever seen in the survey. Countries where concern about over-regulation is particularly high include Argentina (98%), Venezuela (96%), the US (90%), Germany (90%), the UK (87%), and China (85%). In ASEAN, the top threat is listed as geopolitical uncertainty (89%), followed by increasing tax burden (82%), and over-regulation (78%).

Other top concerns cited by CEOs globally are availability of key skills (73%), fiscal deficits and debt burdens (72%), geopolitical uncertainty (72%), increasing taxes (70%), cyber threats and the lack of data security (61%) - going up rapidly from 48% last year – as well as social instability (60%), shifting consumer patterns (60%) and the speed of technological change (58%).

Globally, CEOs concerns are up in all areas compared to last year with the exception of energy costs where they are slightly down at 59%.

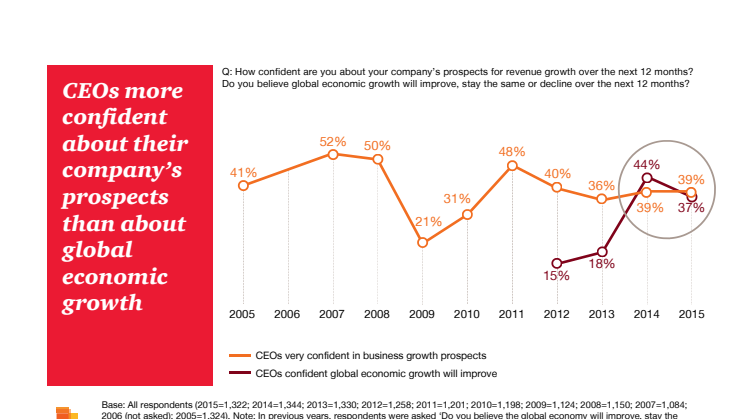

The Competitive Landscape

A third of CEOs worldwide say their company has recently entered or considered entering one or more new industries in the last three years, and more than half (56%) believe that organisations will increasingly compete in new sectors in the next three years. ASEAN CEOs share similar sentiment, at58%.

CEOs worldwide think a significant competitor is emerging or could emerge from the following sectors: technology (32%), retail and wholesale distribution (19%), and communications, entertainment and media (6%). ASEAN CEOs listed Technology (36%), and Retail and Wholesale Distribution (25%).

CEOs globally are also using joint ventures, alliances and informal collaborations to gain a competitive edge, working with suppliers (41%), customers (41%), and academia (32%). The top reasons for collaboration are access to new customers, emerging technologies, new markets and innovation.

Working with Government

CEOs around the world say the top priority of government should be maintaining a competitive and efficient tax system, cited by 67% of survey respondents. In ASEAN, 64% of surveyed CEOs share similar sentiment. Encouragingly, 57% of ASEAN CEOs said that they were seeing changes in the way ‘Governments are increasing implementing more competitive tax policies, which are influencing organisations and decisions on where to operate’.

Likewise, access to a skilled workforce is highly valued by 60% of CEOs worldwide, but just 21% say enough skilled workers are available in their country. Other government priorities for CEOs around the world include physical infrastructure (49%), affordable capital (29%), and digital infrastructure (28%). One notable issue, reducing the risk of climate change, is given priority by only 6%.

The Digital Age

The emergence of digital technology has completely changed how companies do business; 58% of CEOs around the world are concerned about the speed of technological change compared with 47% last year. Mobile technologies are seen by 81% of CEOs globally as most important to their company, followed by data mining and analysis (80%), cybersecurity (78%), socially enabled business processes (61%) and cloud computing (60%). Companies get the most benefit from digital technologies in the areas of operating efficiency (88%), data and data analytics (84%) and customer experience (77%).

“CEOs know that they must be adaptable to disruptive changes in technology impacting their markets. They need to put technology at the core of their business strategy to create value for customers. Finding new ways of thinking and working in this fast evolving competitive landscape is critical to success. Singapore is well-placed to leverage on digital technology both at a national and business level, thanks to the sound infrastructure put in in place by the Singapore government, and Singapore businesses should seize this advantage to work faster, smarter and more securely,” concluded Yeoh Oon Jin, Executive Chairman, PwC Singapore.

Talent Diversity and Adaptability

Half of CEOs around the world say they will increase their headcount over the next 12 months, while 21% expect a decrease (this remains about the same as last year). In ASEAN, 67% of CEOs expect to increase headcount in the next 12 months, with only 13% planning to cut their work force this year.

As CEOs seek to meet the challenge of finding the right people, 81% globally say they are looking for a broader range of skills, compared with 87% in ASEAN. Interestingly, while nearly two-thirds of CEOs’ organisations (64%) worldwide have a diversity and inclusiveness strategy, only 55% of ASEAN CEOs have one. Of those who have such strategies, 95% say it has improved their bottom line in ASEAN, compared with 85% globally.

ASEAN highlights can be found below as Appendix A.

ENDS

Notes to editors:

1. Survey Methodology: For PwC's 18th Annual Global CEO Survey, 1,322 interviews were conducted in 77 countries during the last quarter of 2014. By region, 459 interviews were conducted in Asia Pacific, 455 in Europe, 147 in North America, 167 in Latin America, 49 in Africa and 45 in the Middle East.

The full survey report with supporting graphics can be downloaded at www.pwc.com/ceosurvey.

2. List of country/regional CEO saying they are very confident of 12 month growth.

| Very confident of short-term revenue growth | |||

| 2015 | 2014 | 2013 | |

| India | 62% | 49% | 63% |

| Mexico | 50% | 51% | 62% |

| ASEAN* | 47% | 45% | 40% |

| US | 46% | 36% | 30% |

| Romania | 44% | 39% | 42% |

| Australia | 43% | 34% | 30% |

| Global | 39% | 39% | 36% |

| South Africa | 39% | 25% | 45% |

| UK | 39% | 27% | 22% |

| China/Hong Kong | 36% | 48% | 40% |

| Canada | 36% | 27% | 42% |

| Germany | 35% | 33% | 31% |

| Spain | 35% | 23% | 20% |

| Denmark | 33% | 44% | NA |

| Brazil | 30% | 42% | 44% |

| Japan | 27% | 27% | 18% |

| Switzerland | 24% | 42% | 18% |

| France | 23% | 22% | 13% |

| Venezuela | 22% | 25% | 30% |

| Italy | 20% | 27% | 21% |

| Argentina | 17% | 10% | 26% |

| Russia | 16% | 53% | 66% |

* The ASEAN countries in which interviews were conducted are: Cambodia, Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam.3. List of CEOs planning job increases by industry.

3. Percentage of CEOs expected to boost headcount

| 2015 | 2014 | 2013 | |

| Asset Management | 61% | 58% | 55% |

| Healthcare | 59% | 53% | 43% |

| Pharmaceuticals & Life Sciences | 58% | 44% | 38% |

| Business services | 56% | 62% | 56% |

| Technology | 55% | 63% | 44% |

| Banking & Capital Markets | 53% | 52% | 44% |

| Industrial Manufacturing | 53% | 46% | 36% |

| Mining | 52% | 25% | 39% |

| Engineering & Construction | 51% | 51% | 52% |

| Insurance | 50% | 59% | 39% |

| Chemicals | 50% | 49% | 43% |

| Transport & Logistics | 49% | 40% | 43% |

| Automotive | 49% | 45% | 44% |

| Retail | 46% | 51% | 49% |

| Entertainment & Media | 46% | 53% | 43% |

| Hospitality & Leisure | 45% | 51% | 33% |

| Metals | 41% | 22% | 28% |

| Consumer | 40% | 46% | 40% |

| Communications | 40% | 52% | 36% |

| Energy | 36% | 56% | 39% |

| Power & Utilities | 36% | 36% | 41% |

| Forest, Paper & Packaging | 27% | 45% | 32% |

Related links

Topics

Categories

About PwC

PwC helps organisations and individuals create the value they’re looking for. We’re a network of firms in 157 countries with more than 184,000 people who are committed to delivering quality in assurance, tax and advisory services. Tell us what matters to you and find out more by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2014 PricewaterhouseCoopers. All rights reserved.