Press release -

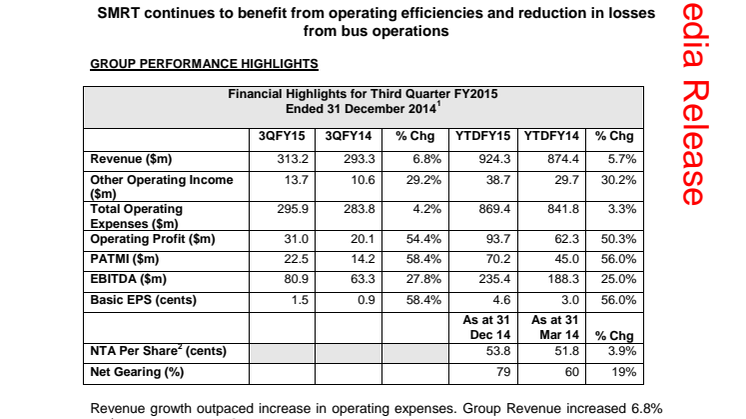

SMRT continues to benefit from operating efficiencies and reduction in losses from bus operations

GROUP PERFORMANCE HIGHLIGHTS

Financial Highlights for Third Quarter FY2015 Ended 31 December 2014

| 3QFY15 | 3QFY14 | % Chg | YTDFY15 | YTDFY14 | % Chg | |

| Revenue ($m) | 313.2 | 293.3 | 6.8% | 924.3 | 874.4 | 5.7% |

| Other Operating Income ($m) | 13.7 | 10.6 | 29.2% | 38.7 | 29.7 | 30.2% |

| Total Operating Expenses ($m) | 295.9 | 283.8 | 4.2% | 869.4 | 841.8 | 3.3% |

| Operating Profit ($m) | 31.0 | 20.1 | 54.4% | 93.7 | 62.3 | 50.3% |

| PATMI ($m) | 22.5 | 14.2 | 58.4% | 70.2 | 45.0 | 56.0% |

| EBITDA ($m) | 80.9 | 63.3 | 27.8% | 235.4 | 188.3 | 25.0% |

| Basic EPS (cents) | 1.5 | 0.9 | 58.4% | 4.6 | 3.0 | 56.0% |

| As at 31 Dec 14 | As at 31 Mar 14 | % Chg | ||||

| NTA Per Share2(cents) | 53.8 | 51.8 | 3.9% | |||

| Net Gearing (%) | 79 | 60 | 19% |

Revenue growth outpaced increase in operating expenses. Group Revenue increased 6.8% to $313.2 million in 3Q FY2015 due to broad based revenue growth across most of the segments. Operating profit increased 54.4% to $31.0 million in 3Q FY2015 on the back of higher operating profit in the Fare business of $1.9 million and in the Non-Fare business of $28.0 million. PATMI increased 58.4% to $22.5 million.

Operating expenses rose 4.2% to $295.9 million due mainly to higher depreciation, repairs and maintenance, staff and other operating expenses, partially offset by lower energy expenditure. Depreciation increased 14.2% to $52.3 million with the capitalisation of a larger train fleet as well as new taxis. Repairs and maintenance costs increased 7.0% to $29.3 million due to Circle Line trains undergoing the first scheduled overhaul since operations started in FY2010 and higher cleaning costs. Repairs and maintenance for Taxi increased due to a larger fleet and overhaul works in line with the life cycle of the fleet. Staff costs increased by 0.6% to $120.3 million due mainly to increased headcount and salary increments, partially offset by write-back of prior years’ provision. Other operating expenses increased by 10.2% to $60.4 million due mainly to contribution to the Public Transport Fund (PTF) as part of the conditions set in the fare adjustment that took effect on 6 April 2014 and early retirement of taxis. Energy costs fell 7.2% to $36.0 million on lower average electricity tariff and diesel cost, partially offset by higher consumption arising from a larger train and bus fleet.

Total assets rose 20.1% to $2.5 billion as at 31 December 2014 due to higher property, plant and equipment, with the addition of rail operating assets, trains, buses and taxis as well as higher trade and other receivables and cash and cash equivalents.

The Group ended the quarter with a cash balance of $197.4 million, higher by $26.7 million compared to the start of the quarter. It generated $33.6 million of cash flows from operations and $104.3 million from financing activities, and utilised $111.5 million to invest mainly in property, plant and equipment. The Group’s total borrowings stood at $859.1 million, translating to a net gearing of 79%.

Business Peformance3

Revenue and Operating Profit by Business

For Third Quarter FY 2015 Ended 31 December 2014

| Revenue | Operating Profit | ||||||

| S$m | 3QFY15 | 3QFY14 | % Chg | 3QFY15 | 3QFY14 | % Chg | |

| Train | 161.8 | 156.3 | 3.5 | 3.2 | 0.4 | 677.9 | |

| LRT | 2.4 | 2.5 | (6.1) | (0.8) | (0.6) | (40.7) | |

| Bus | 59.1 | 54.2 | 9.0 | (0.5) | (8.7) | 94.7 | |

| Fare Subtotal | 223.2 | 213.0 | 4.8 | 1.9 | (8.9) | 121.6 | |

| Taxi | 36.6 | 32.9 | 11.1 | 0.8 | 1.5 | (47.9) | |

| Rental4 | 32.3 | 24.8 | 30.0 | 20.7 | 18.5 | 11.8 | |

| Advertising5 | 9.9 | 10.8 | (8.1) | 6.5 | 6.9 | (6.8) | |

| Engineering Services | 3.7 | 6.0 | (39.1) | (1.2) | 0.9 | (237.6) | |

| Other Services | 7.5 | 5.8 | 30.4 | 1.3 | (0.6) | 329.4 | |

| Non-Fare Subtotal | 90.0 | 80.3 | 12.0 | 28.0 | 27.2 | 2.8 | |

| Investment Holding/ Group Elimination | - | - | n.m | 1.1 | 1.8 | (36.9) | |

| Total | 313.2 | 293.3 | 6.8 | 31.0 | 20.1 | 54.4 | |

Fare Business

The Group’s overall Fare business recorded an operating profit of $1.9 million on total fare revenue of $223.2 million for 3Q FY2015, an improvement from an operating loss of $8.9 million in the previous corresponding period. This was due mainly to better performance in both the Train and Bus operations. Operating profit from Train operations increased by $2.8 million on the back of higher revenue and productivity gains, partially offset by higher repairs and maintenance work on the ageing network and higher depreciation from a larger fleet. Bus operations improved from an operating loss of $8.7 million to a lower operating loss of $0.5 million due mainly to higher revenue and productivity management efforts, partially offset by higher staff costs due to headcount increase resulting from an expanded fleet and contribution to the PTF.

Non-Fare Business

Operating profit from theNon-Fare business increased by 2.8% due largely to improving profitability of Rental and Other Services segments. Rental profit increased by 11.8% to $20.7 million, due mainly to higher rental renewal rates of commercial spaces. Profit from Other Services improved to $1.3 million, from an operating loss of $0.6 million in the previous corresponding period due to higher contribution from external fleet maintenance.

Outlook and Prospects

The business environment continues to be challenging due to structural cost pressures arising from tightened regulatory standards and heightened operational demands on service, reliability and capacity. The impact of the overall rising costs will be partially mitigated next year by the recently approved fare adjustments, the recent decline in energy prices and the Group’s ongoing productivity and cost management efforts. The Group continues to engage the authorities on the transition to a new rail financing framework.

SMRT Buses has recently submitted a bid to the authorities for the first package of routes tendered under the new bus contracting model. Tender evaluation by the authorities is currently underway and the outcome of the tender is not expected to have an impact on the results of the Group for the next 12 months as the implementation of the first package is expected to take place only in May 2016.

The Group will continue to grow its Non-Fare business, deepen and build on its rail engineering capabilities, and explore local out-of-network and international opportunities.

SMRT’s President and Group Chief Executive Officer, Mr Desmond Kuek, said: “We remain committed to providing safe and reliable public transport services while driving productivity improvement efforts to help mitigate the impact of the increased cost pressures. To sustain growth, we are progressing with efforts to expand outside our network and Singapore, and building on our existing rail engineering capabilities.”

1All figures are quoted in Singapore dollars.

2 Excludes intangible assets.

3Details of the operating metrics are shown in the Annex on page 4.

4 Rental – the operating profit comprises EBIT attributed to Transit-oriented Rental business, and Other Property and Retail Management businesses.

5 Advertising – the operating profit comprises EBIT attributed to Transit-oriented Advertising business, and Other Media and Advertising businesses.

-- End --

Topics

- Media, Communication

SMRT Corporation Ltd (SMRT) is the leading multi-modal public transport operator in Singapore. SMRT serves millions of passengers daily by offering a safe, reliable and comprehensive transport network that consists of an extensive MRT and light rail system which connects seamlessly with its island-wide bus and taxi operations. SMRT also markets and leases the commercial and media spaces within its transport network, and offers engineering consultancy and project management as well as operations and maintenance services, locally and internationally.