Press release -

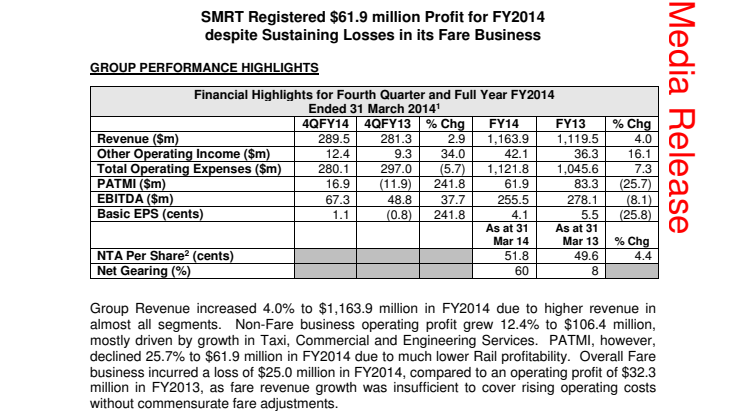

SMRT Registered $61.9 million Profit for FY2014 despite Sustaining Losses in its Fare Business

GROUP PERFORMANCE HIGHLIGHTS

Financial Highlights for Fourth Quarter and Full Year FY2014 Ended 31 March 2014

| 4QFY14 | 4QFY13 | %Chg | FY14 | FY13 | % Chg | |

| Revenue ($m) | 289.5 | 281.3 | 2.9 | 1,163.9 | 1,119.5 | 4.0 |

| Other Operating Income ($m) | 12.4 | 9.3 | 34.0 | 42.1 | 36.3 | 16.1 |

| Total Operating Expenses ($m) | 280.1 | 297.0 | (5.7) | 1,121.8 | 1,045.6 | 7.3 |

| PATMI ($m) | 16.9 | (11.9) | 241.8 | 61.9 | 83.3 | (25.7) |

| EBITDA ($m) | 67.3 | 48.8 | 37.7 | 255.5 | 278.1 | (8.1) |

| Basic EPS (cents) | 1.1 | (0.8) | 241.8 | 4.1 | 5.5 | (25.8) |

| As at 31 Mar 14 | As at 31 Mar 13 | % Chg | ||||

| NTA Per Share (cents) | 51.8 | 49.6 | 4.4 | |||

| Net Gearing (%) | 60 | 8 |

Group Revenue increased

4.0% to $1,163.9 million in FY2014 due to higher revenue in almost all segments. Non-Fare business operating profit grew

12.4% to $106.4 million, mostly driven by growth in Taxi, Commercial and Engineering

Services. PATMI, however, declined

25.7% to $61.9 million in FY2014 due to much lower Rail profitability. Overall Fare business incurred a loss of

$25.0 million in FY2014, compared to an operating profit of $32.3 million in

FY2013, as fare revenue growth was insufficient to cover rising operating costs

without commensurate fare adjustments.

The Board has proposed a final dividend of 1.2 cent per ordinary share (DPS). Including the interim DPS of 1.0 cent, this will bring total DPS in FY2014 to 2.2 cents. This amounts to a 54.1% payout from FY2014 PATMI of $61.9 million.

Operating expenses rose 7.3% to $1,121.8 million due mainly to higher staff, depreciation and other expenses. Staff costs rose due to increased headcount in Train and Bus businesses to support a larger fleet and improve operational performance, as well as the impact of the wage alignment exercise in the last financial year. Depreciation increased due mainly to the capitalisation of the operating assets taken over from the Land Transport Authority (LTA) in 1QFY2014, and a newer taxi and larger bus fleet. Higher other operating expenses were due mainly to higher expenses from costs associated with LTA schemes to incentivise commuters to travel into the city area before the morning peak hour.

Total assets declined 6.8% to $2.1 billion due mainly to lower cash for the payment for 17 trains accrued in FY2013 and operating assets taken over from LTA. During the year, there were purchases of property, plant and equipment related to rail operating assets, taxis, buses and commercial spaces.

The Group ended the year with cash balance of $155.5 million compared to $546.3 million at the start of the year. The Group generated $234.4 million of cash flows from operating activities and $17.2 million from financing activities. The funds were mostly utilised to invest in property, plant and equipment. The Group’s total borrowings stood at $636.4 million, translating to a net gearing of 60%.

Business PerformanceRevenue and Operating Profit by Business for FY2014 Ended 31 March 2014

| Revenue | Operating Profit | |||||

| S$m | FY2014 | FY2013 | % Chg | FY2014 | FY2013 | % Chg |

| Train | 623.8 | 607.9 | 2.6 | 5.5 | 65.1 | (91.6) |

| LRT |

10.3

| 10.7 | (3.0) | (2.1) | (1.0) | (97.6) |

| Bus | 217.8 | 210.8 | 3.3 | (28.4) | (31.7) | 10.6 |

| Fare Subtotal | 851.9 | 829.3 | 2.7 | (25.0) | 32.3 | (177.2) |

| Taxi | 132.5 | 132.1 | 0.3 | 9.6 | 6.4 | 49.7 |

| Rental | 97.6 | 88.4 | 10.4 | 73.4 | 67.0 | 9.6 |

| Advertising | 35.6 | 30.9 | 15.3 | 20.8 | 18.4 | 13.4 |

| Engineering Services | 21.8 | 13.1 | 66.3 | 3.8 | 1.6 | 137.7 |

| Other Services | 24.3 | 25.4 | (4.2) | (1.2) | 1.3 | (191.1) |

| Non-fare Subtotal | 312.0 | 290.0 | 7.6 | 106.4 | 94.7 | 12.4 |

| Investment Holding / Group Elimination | - | 0.2 | (100.0) | 2.8 | 0.5 | 509.5 |

Fare Business

The Group’s overall Fare business recorded a loss of $25.0 million for FY2014. For Train operations, despite a 2.9% increase in ridership, operating profit dropped sharply to $5.5 million from $65.1 million as operating costs, to meet heightened ridership demands and regulatory standards, continued to outpace fare revenue growth. LRT’s losses widened from $1.0 million in FY2013, to $2.1 million in FY2014. For Bus operations, despite a 4.6% increase in ridership and productivity gains, continued to register a loss of $28.4 million for FY2014.

Non-Fare Business

Profit from theNon-Fare business increased by 12.4% due largely to an increase in profits for Taxi, Commercial and Engineering Services. Taxi profits increased 49.7% to $9.6 million due to higher rental contribution from a newer fleet, and lower diesel tax as a result of a smaller diesel fleet. In Commercial, Advertising profits increased by 13.4% to $20.8 million, due to increased advertising on trains, buses and in the network, and Rental profits increased 9.6% to $73.4 million due to increase in lettable space from the redevelopment of Woodlands Xchange and higher rental renewal rates. Engineering profits increased by 137.7% to $3.8 million due mainly to higher contribution from international consultancy projects as well as local engineering and project work.

OUTLOOK AND PROSPECTS

Despite the continuing cost pressures in the Fare business, the Group registered a 4QFY2014 QoQ and YoY improvement in its overall profitability.

The Group’s Fare business will continue to be challenging because of heightened operating requirements, unless there are commensurate and timely fare adjustments. The recently approved fare adjustments will partially offset some of the increased costs. The Group will continue with its productivity efforts in FY2015 to help mitigate the declining profitability in the Fare business.

The Group expects that the impending changes to the rail financing and bus operating models will address the sustainability of its Fare business in Singapore.

The Group also looks forward to the launch of the new Sports Hub retail mall, which is at the doorstep of our Stadium Circle Line Station, in the coming months.

SMRT’s President and Chief Executive Officer, Mr Desmond Kuek, said: “We will continue to improve standards in service, reliability and capacity of our trains and buses. We will continue to grow our Non-Fare business, with new commercial and overseas opportunities, and the strengthening of our local rail engineering capabilities.”

-- End --

Topics

- Media, Communication

Categories

- smrt ceo

- smrt financial performance

- smrt financial

- smrt financials

SMRT Corporation Ltd (SMRT) is the leading multi-modal public transport operator in Singapore. SMRT serves millions of passengers daily by offering a safe, reliable and comprehensive transport network that consists of an extensive MRT and light rail system which connects seamlessly with its island-wide bus and taxi operations. SMRT also markets and leases the commercial and media spaces within its transport network, and offers engineering consultancy and project management as well as operations and maintenance services, locally and internationally.