Press release -

SMRT reports $25.3 million Profit for 2Q FY2015

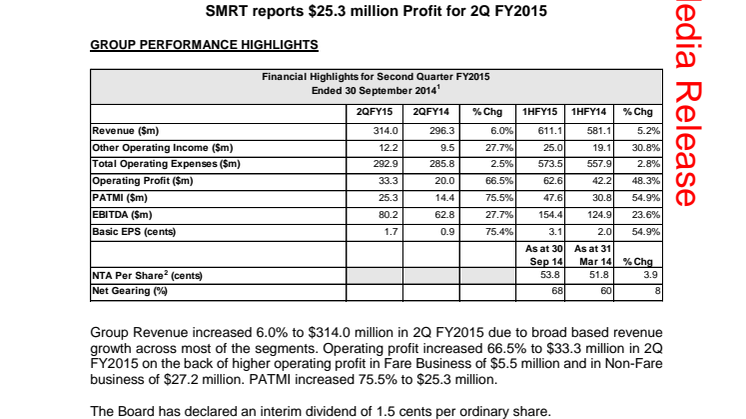

GROUP PERFORMANCE HIGHLIGHTS

Financial Highlights for Second Quarter FY2015 Ended 30 September 2014

| 2QFY15 | 2QFY14 | % Chg | 1HFY15 | 1HFY14 | % Chg | |

| Revenue ($m) | 314.0 | 296.3 | 6.0% | 611.1 | 581.1 | 5.2% |

| Other Operating Income ($m) | 12.2 | 9.5 | 27.7% | 25.0 | 19.1 | 30.8% |

| Total Operating Expenses ($m) | 292.9 | 285.8 | 2.5% | 573.5 | 557.9 | 2.8% |

| Operating Profit ($m) | 33.3 | 20.0 | 66.5% | 62.6 | 42.2 | 48.3% |

| PATMI ($m) | 25.3 | 14.4 | 75.5% | 47.6 | 30.8 | 54.9% |

| EBITDA ($m) | 80.2 | 62.8 | 27.7% | 154.4 | 124.9 | 23.6% |

| Basic EPS (cents) | 1.7 | 0.9 | 75.4% | 3.1 | 2.0 | 54.9% |

| As at 30 Sep 14 | As at 31 Mar 14 | % Chg | ||||

| NTA Per Share (cents) | 53.8 | 51.8 | 3.9 | |||

| Net Gearing (%) | 68 | 60 | 8 |

Group Revenue increased 6.0% to $314.0 million in 2Q FY2015 due to broad based revenue growth across most of the segments. Operating profit increased 66.5% to $33.3 million in 2Q FY2015 on the back of higher operating profit in Fare Business of $5.5 million and in Non-Fare business of $27.2 million. PATMI increased 75.5% to $25.3 million.

The Board has declared an interim dividend of 1.5 cents per ordinary share.

Operating expenses rose 2.5% to $292.9 million due mainly to higher staff and depreciation costs, partially offset by lower energy expenditure. Staff costs rose 3.8% to $123.0 million due to increased headcount and salary increments. Depreciation increased 9.1% to $49.4 million with the capitalisation of a newer taxi as well as a larger train fleet. Energy costs fell 8.7% to $40.0 million on lower average electricity tariff, partially offset by higher diesel cost and consumption.

Total assets rose 15.3% to $2.4 billion from $2.1 billion as at 31 March 2014 due to higher property, plant and equipment, with the addition of rail operating assets, trains, taxis and buses as well as higher trade and other receivables.

The Group ended the quarter with cash balance of $170.7 million, lower by $36.5 million compared to start of the quarter. It generated $129.0 million of cash flows from operations, offset against $153.4 million outflow in investing activities, and $12.4 million in financing cash outflow due mainly to dividend payment. The Group’s total borrowings stood at $740.9 million, translating to a net gearing of 68%.

Business Performance

Revenue and Operating Profit by Business For Second Quarter FY2015 Ended 30 September 2014

| Revenue | Operating Profit | |||||

| S$m | 2QFY15 | 2QFY14 | % Chg | 2QFY15 | 2QFY14 | % Chg |

| Train | 165.2 | 160.5 | 3.0 | 7.6 | 1.0 | 648.8 |

| LRT | 2.5 | 2.7 | (8.5) | (0.7) | (0.4) | (64.7) |

| Bus | 60.7 | 55.2 | 10.0 | (1.4) | (7.4) | 80.6 |

| Fare Subtotal | 228.4 | 218.4 | 4.6 | 5.5 | (6.8) | 180.8 |

| Taxi | 35.1 | 32.4 | 8.3 | 3.4 | 2.1 | 62.9 |

| Rental | 30.1 | 24.2 | 24.4 | 19.0 | 18.6 | 2.5 |

| Advertising | 9.4 | 8.6 | 9.5 | 5.2 | 4.8 | 9.3 |

| Engineering Services | 3.7 | 6.6 | (43.9) | (0.9) | 0.9 | (197.5) |

| Other Services | 7.3 | 6.1 | 19.0 | 0.5 | (0.3) | 278.6 |

| Non-Fare Subtotal | 85.5 | 77.9 | 9.9 | 27.2 | 26.1 | 4.1 |

| Investment Holding/ Group Elimination |

- | - | n.m | 0.7 | 0.7 | (5.8) |

| Total | 314.0 | 296.3 | 6.0 | 33.3 | 20.0 | 66.5 |

Fare Business

The Group’s overall Fare business recorded an operating profit of $5.5 million for 2Q FY2015, an improvement from an operating loss of $6.8 million in the previous corresponding period. This was due mainly to better performance in both the Train and Bus operations. Operating profit from Train operations increased by $6.6 million on the back of higher revenue and lower electricity costs, partially offset by higher depreciation. LRT losses, however, widened from $0.4 million to $0.7 million. Bus operations improved from an operating loss of $7.4 million to a lower operating loss of $1.4 million due mainly to higher revenue and productivity gains.

Non-Fare Business

Operating

profit from theNon-Fare business

increased by 4.1% due largely to improving profitability of Taxi, Rental and Advertising.

Taxi

profit increased 62.9% to $3.4 million due to higher rental

contribution and lower special tax on diesel vehicles arising from replacement

of diesel taxis with hybrid taxis, and lower insurance expense resulting from

better claim experience. Rental profit increased by 2.5% to $19.0

million, due mainly to higher rental renewal rates of commercial spaces. Advertising profit increased by 9.3% to

$5.2 million, due mainly to increased advertising on trains, stations and

taxis.

Outlook and Prospects

The Fare business environment will continue to be challenging owing to heightened operational demands on service, reliability and capacity. The Group will strive to achieve further gains from its ongoing productivity improvement efforts and initiatives to help mitigate the impact of the increased cost pressures. The Group is continuing its discussions with the authorities on the transition to a new rail financing framework.

The recent tender called by the authorities on the first package of routes under the new bus contracting model will not have an impact on the results of the Group for the next 12 months.

The Group will continue to grow its Non-Fare business by building on its rail engineering capabilities, and exploring local out-of-network and international opportunities.

SMRT’s President and Group Chief Executive Officer, Mr Desmond Kuek, said: “We will continue our efforts to drive productivity improvement to help mitigate the impact of the increased cost pressures. With the recent incorporation of Singapore Rail Engineering in the Group, we are making a good start in building on our existing rail engineering capabilities for future growth.”

-- End --

Topics

- Media, Communication

SMRT Corporation Ltd (SMRT) is the leading multi-modal public transport operator in Singapore. SMRT serves millions of passengers daily by offering a safe, reliable and comprehensive transport network that consists of an extensive MRT and light rail system which connects seamlessly with its island-wide bus and taxi operations. SMRT also markets and leases the commercial and media spaces within its transport network, and offers engineering consultancy and project management as well as operations and maintenance services, locally and internationally.