Press release -

SMRT’s 3QFY14 PATMI Declined 44.1% on $9 million Fare Losses

GROUP PERFORMANCE HIGHLIGHTS

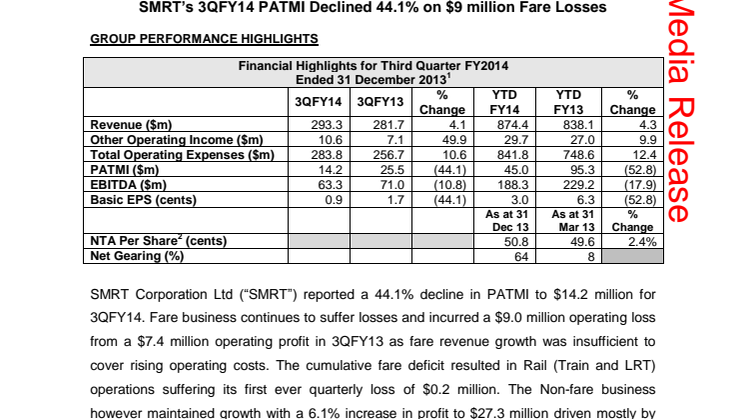

Financial Highlights for Third Quarter FY2014 Ended 31 December 2013

| 3QFY14 | 3QFY13 | % Change | YTD FY14 | YTD FY13 | % Change | |

| Revenue ($m) | 293.3 | 281.7 | 4.1 | 874.4 | 838.1 | 4.3 |

| Other Operating Income ($m) | 10.6 | 7.1 | 49.9 | 29.7 | 27.0 | 9.9 |

| Total Operating Expenses ($m) | 283.8 | 256.7 | 10.6 | 841.8 | 748.6 | 12.4 |

| PATMI ($m) | 14.2 | 25.5 | (44.1) | 45.0 | 95.3 | (52.8) |

| EBITDA ($m) | 63.3 | 71.0 | (10.8) | 188.3 | 229.2 | (17.9) |

| Basic EPS (cents) | 0.9 | 1.7 | (44.1) | 3.0 | 6.3 | (52.8) |

| As at 31 Dec 13 | As at 31 Mar 13 | % change | ||||

| NTA Per Share (cents) | 50.8 | 49.6 | 2.4% | |||

| Net Gearing (%) | 64 | 8 |

Operating expenses rose 10.6% to $283.8 million mainly on higher staff and depreciation expenses. Staff costs rose 21.4% to $119.6 million due to increased Train and Bus headcount, and impact of the wage revision exercise in 4QFY13. Depreciation rose 10.2% to $45.8 million due to capitalisation of operating assets taken over from Land Transport Authority (LTA) in 1QFY14 and a newer taxi fleet. R&M incurred was $27.4 million. Electricity and diesel costs declined 5.2% to $38.8 million due to favourable electricity contract entered earlier in FY14 which offset higher diesel price and higher energy consumption.

Other operating expenses rose 6.7% to $54.8 million due

mainly to higher expenses associated with costs for schemes introduced by LTA

(including travel discounts) to incentivise commuters to shift their travel

times away from morning peak hours.

Total assets declined 11.5% to $2.0 billion as at 31 December 2013 with cash balance of $127.8 million following payment for the 17 trains and operating assets taken over from LTA.

The Group ended the quarter with cash balance of $127.8 million, $45.5

million lower from $173.3 million as at start of quarter. Operating cash inflow

declined to $50.0 million from $59.5 million in line with lower profitability

and higher interest paid. Investing cash outflow rose to $89.6 million compared

to $74.6 million with further business investments. The Group’s total

borrowings stood at $628.5 million, representing a net gearing of 64%.

Business Performance

Revenue and Operating Profit by Business for Third Quarter FY2014 Ended 31 December 2013

| Revenue | Operating Profit | |||||

| S$m | 3QFY14 | 3QFY13 | % Change | 3QFY14 | 3QFY13 | % Change |

| Train | 156.3 | 152.6 | 2.4 | 0.4 | 14.7 | (97.2) |

| LRT | 2.5 | 2.6 | (2.2) | (0.6) | (0.3) | (92.0) |

| Bus | 57.3 | 55.5 | 3.3 | (8.9) | (7.0) | (26.2) |

| Fare Subtotal | 216.1 | 210.7 | 2.6 | (9.0) | 7.4 | n.m |

| Taxi | 32.9 | 34.3 | (4.1) | 1.5 | 2.9 | (49.1) |

| Rental | 24.8 | 22.3 | 11.2 | 18.5 | 16.9 | 9.2 |

| Advertising | 10.8 | 8.5 | 27.4 | 6.9 | 5.4 | 29.1 |

| Engineering & Other Services | 8.6 | 5.9 | 46.8 | 0.4 | 0.6 | (22.3) |

| Non-fare Subtotal | 77.2 | 71.0 | 8.7 | 27.3 | 25.8 | 6.1 |

| Group Elimination / Investment Holding | - | - | - | 1.8 | (1.1) | 262.2 |

Details of the operating metrics are shown in the Annex on page 4.

Despite Train and Bus revenue rising 2.4% and 3.3% with a 2.2% and 5.1% increase in ridership, respectively, the Fare business recorded a loss of $9 million. Train EBIT dropped sharply to $0.4 million from $14.7 million, LRT continued to be loss making at $0.6 million, and Bus losses widened to $8.9 million from $7.0 million, as a result of rising operating costs not being matched by corresponding fare adjustment. The fare losses year-to-date stand at $20.7 million compared to a profit of $44.7 million last year.

The Non-fare business maintained growth with a 6.1% increase in profit. Rental EBIT rose 9.2% to $18.5 million with the opening of Woodlands Xchange and higher rental renewal rates compared to last year. Advertising EBIT rose 29.1% to $6.9 million on higher revenue.Taxi EBIT declined to $1.5 million from $2.9 million due to higher staff costs, depreciation due to newer models and higher repair and maintenance. Engineering and other services EBIT remained relatively flat despite higher revenue due mainly to higher operating costs.

OUTLOOK AND PROSPECTS

SMRT’s President and Chief Executive Officer, Mr Desmond Kuek, said: “Our fare business continues to face cost pressures arising from ongoing efforts to meet heightened demands on service, reliability and capacity. The impact of rising costs will be mitigated partially next year by the recently approved fare adjustments, and our continuing efforts to drive higher productivity and cost efficiency. We are engaging the authorities on a timely transition to a viable and sustainable model for the Trains and Bus businesses.

We will continue to leverage on SMRT’s core engineering competency and commercial expertise to support business expansion in both fare and non-fare businesses. Sportshub is expected to commence operations within the next few months and we will continue to explore rail business opportunities overseas.”

- End -

Topics

- Media, Communication

Categories

- smrt management

- smrt ceo

- desmond kuek

- smrt financial performance

- smrt financials

SMRT Corporation Ltd (SMRT) is the leading multi-modal public transport operator in Singapore. SMRT serves millions of passengers daily by offering a safe, reliable and comprehensive transport network that consists of an extensive MRT and light rail system which connects seamlessly with its island-wide bus and taxi operations. SMRT also markets and leases the commercial and media spaces within its transport network, and offers engineering consultancy and project management as well as operations and maintenance services, locally and internationally.