Press release -

PwC: Female millennials critical to future growth of Financial Services globally

News release

| Date | Tuesday 9 June 2015 |

| Contact |

Candy Li Tel: +65 6236 7429 Mobile: +65 8613 8820 E-mail: candy.yt.li@sg.pwc.com Natalie Choo Tel: +65 6263 4309 Mobile: +65 9738 1415 E-mail: natalie.yl.choo@sg.pwc.com |

PwC: Female millennials critical to future growth of Financial Services globally

Singapore, 9 June 2015 -- Female millennials are set to play a critical part in the future growth of financial services (FS) globally, concludes a report just published by PwC. According to the report, ‘Female millennials in financial services: strategies for a new era of talent’, financial services firms that do not possess the attributes these discerning women (born between 1980 and 1995) seek from prospective employers, or, offer a clear path of career progression, will struggle to tap into this pool of talent and retain it and risk losing out to competitors.

PwC’s survey of over 8,000 female millennials across twelve industries, of which 596 are working in FS (banking and capital markets, insurance and asset management) and 63 (11%) are working in banking and capital markets in Singapore, uncovered the perceptions, aspirations and characteristics of women in financial services, to help businesses to define and refine strategies for recruitment, retention and career development.

The report underlines that the increased presence of women in FS can improve the ability to build relationships and engender trust, giving firms an edge. Women can also bring new perspectives to strategy and leadership – research* of over 90,000 companies in 35 countries, shows a clear link between the level of female board representation and market performance. This is most marked where women have a strong presence across all levels of leadership.

Female millennials in FS are ambitious

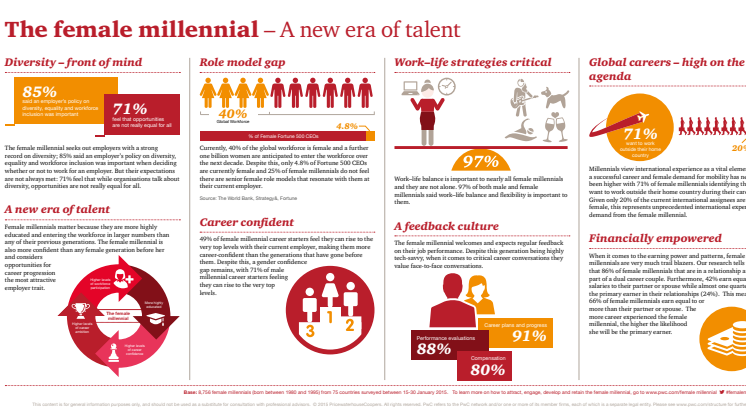

PwC’s survey shows 60% of female millennials in FS see opportunities for career progression as the most important attribute in an employer. A lack of them is also the number one reason why female millennials in FS left their last job, with 34% citing it among the top three reasons.

Worryingly, barely a third (35%) feel they can rise to senior levels within their current organisation, half the proportion of men working within FS.

They expect to be rewarded well

At 57%, pay is just behind career progression as the most important attribute in an employer. Good benefits packages including pensions and healthcare is next on the list (36%).

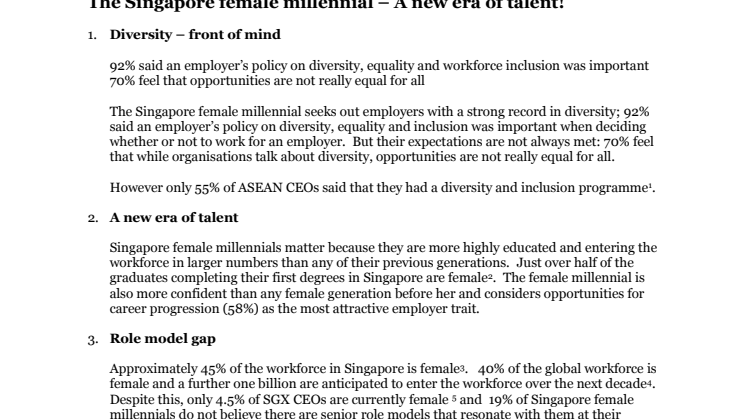

- They value diversity, equality and inclusiveness

- More than four-fifths of female millennials in FS (87%) say an employer’s policy on diversity, equality and inclusiveness is important when choosing whether to work for them Yet, 61% of female millennials in FS say their employer isn’t doing enough to encourage diversity (in insurance this is an even higher 64%), and 73% believe FS firms talk about diversity, but opportunities are not equal for all (80% in insurance). Half believes promotion is biased towards men.

- They want flexibility

- 30% of female millennials in FS cite flexible working arrangements as an attraction and almost all see work-life balance as important. However, more than half (53%) believe taking advantage of flexibility and work-life balance programmes would have negative consequences for their careers.

They seek an international career

More than two-thirds of female millennials in FS (68%) would like to work outside their home country and 55% believe they need to gain international experience to further their career. However, 22% feel women are given fewer opportunities to undertake international assignments than men, rising to 30% in insurance.

Different issues to overcome

Thirteen per cent of women taking part in the survey wouldn’t work in insurance because of its image, and 10% wouldn’t work in banking and capital markets, though in asset management this is only 5%.

It would appear insurance has particular issues to overcome. Female millennials in FS believe insurers are doing less to promote equality and more feel promotion is biased towards men in insurance than other FS sectors.

The fact that women within banking and capital markets are significantly less confident about their ability to rise to the top of their organisations than other sectors, suggests the industry not only needs to do more to open up opportunities, but also promote positive role models.

Asset management has more positive senior role models (73% versus 67% for FS as a whole) and participants are more positive about the coaching they receive.

Perceptions of FS more favourable in Asia

However, behind these headline statistics there are significant regional variations. In particular, perceptions of banking and capital markets among all the women taking part in the survey (from across all industries), are much more favourable in Asia-Pacific, perhaps reflecting both the less dramatic impact of the financial crisis and the strong and prominent presence of women within senior leadership within the region.

The increased presence of women in FS can improve the ability to build relationships and engender trust, giving firms an edge, particularly in the growing wealth management sector in Asia. A separate Private Banking & Wealth Management report highlights the growing importance of the female demographic in private banking. While female clients have many requirements similar to men – including the sale of a business to a job loss, marriage, children, educational costs, ageing parents and inter-generational planning, they also often have different attitudes, life stages, risk appetites and decision-making criteria when making decisions about their wealth. Private banks and wealth managers need to better understand the different networks of influence on which many female clients rely for decision making.

Karen Loon, PwC Singapore’s Banking and Capital Markets Leader and Diversity Leader, comments:

“There is clearly a danger that if expectations aren’t met, women will simply be put off joining the financial services sector or vote with their feet and leave. Within this highly networked generation, the poor perceptions of current staff can quickly spread and discourage potential recruits.

At a time when 70% of FS CEOs see the limited availability of key skills as a threat to their growth prospects, it clearly is vital to make the most of all the available talent, including women. But the importance of women succeeding in the workplace goes further. With many organisations still continuing to focus on the changes required to their culture, the attraction, retention and success of women at all levels of the organisations will surely be an important factor in their successful transformation.”

ENDS

Notes to Editors:

*‘Women on Boards and Firm Financial Performance: A Meta-Analysis’, Lehigh University, 2014 (http://www1.lehigh.edu/news/gender-diversity-plus-corporate-boards)

PwC’s report ‘ Female millennials in financial services: strategies for a new era of talent’puts the female millennial front of mind and is based on international research with 10,105 millennial respondents from over 70 countries worldwide, 8,756 of whom were female millennials, nearly 600 of whom work in financial services (398 from banking and capital markets, 115 from insurance and 83 from asset management).

Female millennials are becoming a larger and larger part of the global talent pool, and this report makes one thing clear, when it comes to the female millennial: we really are talking about a new era of female talent.

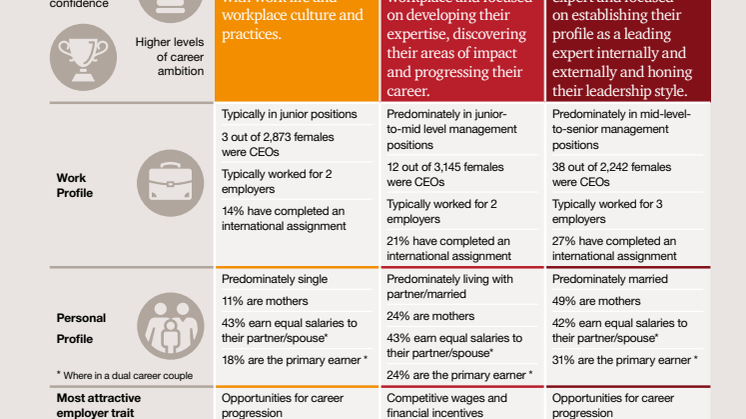

The survey shares interesting research results, case studies and voice of the female millennial profiles. In addition, it brings the unique approach of taking a deeper look at the female millennial through the use of a career stage differential.

The twelve industry sectors covered in the report are Financial Services, Defence, Oil & Gas, Government & Public Services, Chemicals, Metals, Forest, Paper & Packaging, Energy, Utilities & Mining, Industrial Manufacturing, Healthcare, Automotive, Engineering & Construction.

Topics

Categories

About PwC

PwC helps organisations and individuals create the value they’re looking for. We’re a network of firms in 157 countries with more than 184,000 people who are committed to delivering quality in assurance, tax and advisory services. Tell us what matters to you and find out more by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2014 PricewaterhouseCoopers. All rights reserved.