News -

Kommuninvest publishes 2018 assurance report on its green bonds framework

Kommuninvest, the Swedish local government funding agency, has published its third assurance report regarding its green bonds framework. The report, performed by Kommuninvest’s external auditor KPMG, provides assurance on the management of proceeds obtained from the issuance of green bonds.

Kommuninvest issued its inaugural green bond in March 2016, for USD 600 million, and has since issued three additional green bonds, for SEK 5 billion, USD 500 million and SEK 3 billion, in October 2016, May 2017, and April 2018, respectively. Issued green bonds finance lending to Swedish municipal investment projects in renewable energy, energy efficiency, green buildings, public transport and water management. As of June 2018, Kommuninvest had built up a green loan book amounting to over SEK 30 billion (USD 3.3 billion), committing funds to some 180 investment projects in 90 Swedish municipalities and county councils/regions.

Kommuninvest’s green bond framework is aligned with the Green Bond Principles (GBP), of which Kommuninvest is a member. The GBP recommends issuers to use an external review to confirm the alignment of their green bonds with the key features of the GBP, to provide investors and other interested parties with independent assurance.

Kommuninvest engages such external input in two ways. Firstly, the green bonds framework has a second party opinion from Cicero, the Oslo-based climate and environmental research institute. The second opinion is available here and in the Green Bonds section of Kommuninvest’s website.

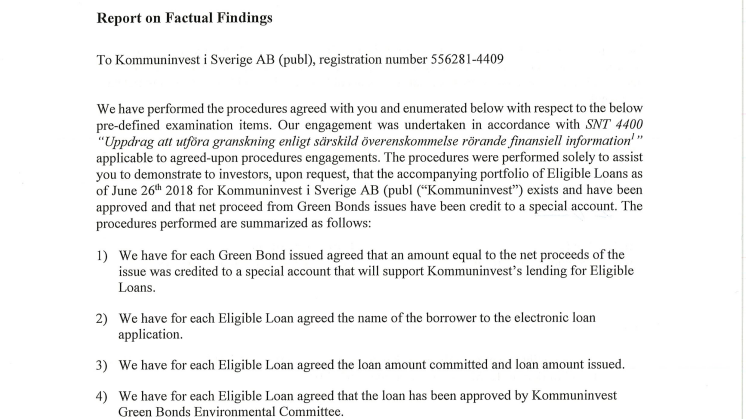

Secondly, Kommuninvest engages its external auditor to provide assurance on the management of proceeds obtained from the issuance of green bonds. The first such review was performed in March 2016. The third review, which has formed the basis for the report published today, was performed in June 2018.

The report has been undertaken in accordance with the Swedish standard for agreed-upon procedures engagements, SNT 4400, which is based on the International Standard on Related Services, ISRS 4400. The report, including the list of Eligible Loans that were part of the review, are available for download below.