Press release -

Kommuninvest issues its sixth Green Bond

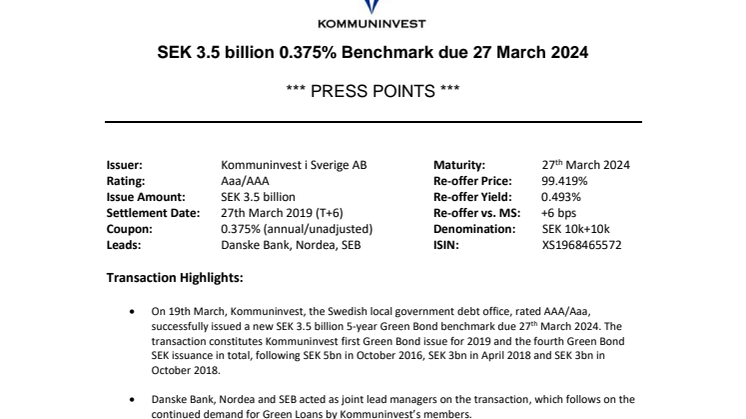

Kommuninvest has issued a new SEK 3.5 billion green bond, its sixth to date and the fourth in Swedish krona. Mirroring Kommuninvest’s previous forays in the green bond market, solid demand and an oversubscribed transaction enable pricing at 2 b.p. inside the issuer’s regular Swedish krona benchmark curve.

The new green bond attracted a total of 21 domestic and international institutional investors, including Alecta, Catella, Folksam, LF Bank Treasury, Länsförsäkringar Liv, Sak and Fondliv, Nordea Investment Management, Robur, SEB Investment Management, SEB Treasury, SHB Treasury, Skandia and Storebrand Asset Management / SPP Fonder. The five-year bond matures in March 2024.

- We constantly look for investments that combine financial value with a green profile. Our investment in Kommuninvest's green bond makes it possible to stimulate the green transition of municipalities while we create good returns and contribute to better pensions for our customers, says Alexander Onica, Portfolio Manager at the pension company Skandia.

Since Kommuninvest launched its green finance programme in June 2015, SEK 23.9 billion has been issued in six green bonds, making Kommuninvest the largest Swedish issuer. Four of the green bonds have been issued in Swedish kronor and two in US dollars. The order book in Tuesday’s transaction amounted to over SEK 6 billion, with participation from investors in six countries.

Christian Ragnartz, Head of Debt Management at Kommuninvest, commented the transaction:

- We are pleased to see the continued strong investor interest and good pricing for our green bonds in SEK. Sweden currently has one of the world's most developed markets for green financing, and an increasing supply of green bonds. Lower funding costs for green bonds demonstrate the value of these instruments and makes it easier for Kommuninvest to stimulate the municipal sector's green transition.

Kommuninvest allocates green bond proceeds to lending for green investments, e.g. Green loans. As of mid-March 2019, Kommuninvest's portfolio of Green loans amounted to SEK 29.2 billion in disbursements to 242 projects in 115 municipalities and regions. Kommuninvest expects to continue to grow its green loan portfolio, and to be able to be a frequent issuer of green bonds, in multiple currencies. Kommuninvests projected long-term funding needs, over 1-year maturity, amounts to SEK 100-120 billion for 2019.

More information

Please see Press Points (attached) for transaction details and statistics, and our Green Bonds web page

Contact information

Christian Ragnartz, Head of Debt Management, tel: +46 10 470 87 06, christian.ragnartz@kommuninvest.se

Björn Bergstrand, Head of Sustainability/Senior Investor Relations Manager, tel: +46 70 886 94 76, email: bjorn.bergstrand@kommuninvest.se

Related links

Topics

Kommuninvest is a municipal cooperation for efficient and sustainable financing of housing, infrastructure, schools, hospitals etc. Together, we get better loan terms than each one individually. Since its inception in 1986, the Kommuninvest collaboration has helped lower the local government sector’s borrowing costs by many billion kronor. Currently, 289 municipalities and regions are members of this voluntary cooperation, out of a total of 310 Swedish local governments. With total assets exceeding SEK 400 billion (USD ~43 billion), Kommuninvest is the largest lender to the local government sector. The head office is located in Örebro.