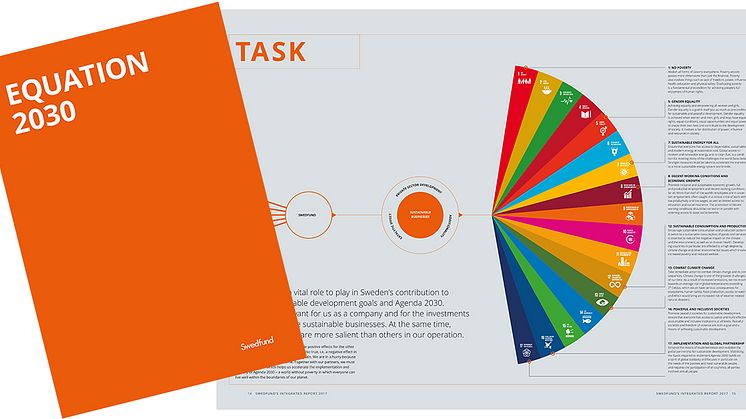

Equation 2030 – Capital that achieves the goals

To Swedfund, Agenda 2030 is a global equation. Our role in the equation is to finance and develop sustainable businesses in the world’s poorest countries. In Swedfund’s Integrated Report 2017 we report our results and our work towards the Global Goals.