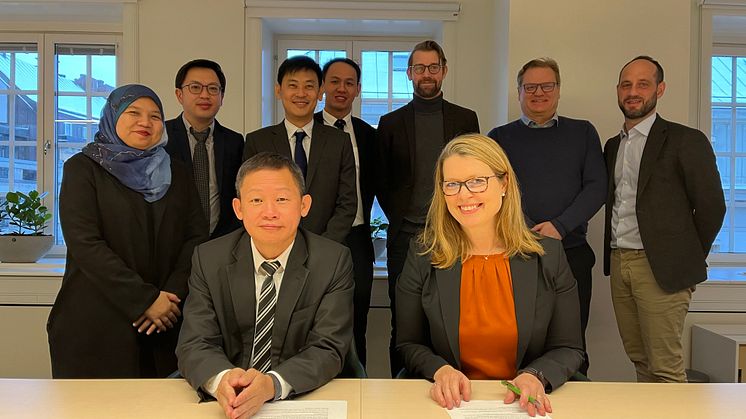

Swedfund invests USD 5 million in Somali fund

Swedfund invests USD 5 million in the Somali fund NHAO (Nordic Horn of Africa Opportunities Fund). "Since the fund aims to support women-led companies and companies employing many young people, this is a very good opportunity to reach companies and businesses directly contributing to jobs and strengthening the Somali economy", says Maria Håkansson, CEO of Swedfund.