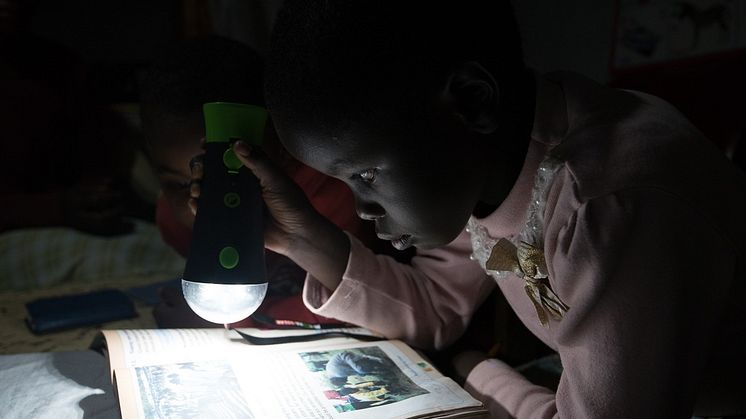

Swedish investment to support financial inclusion

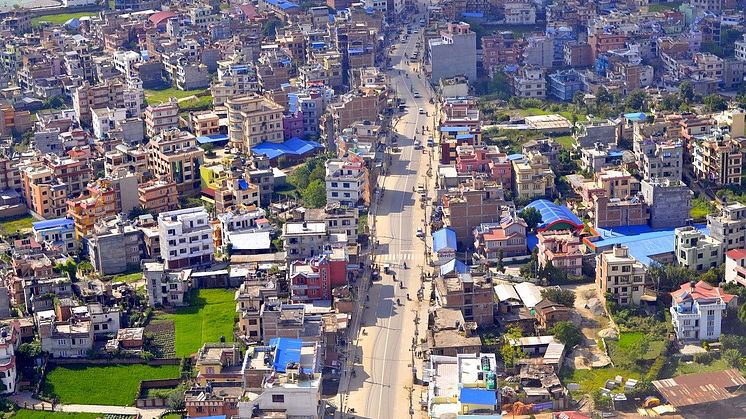

Micro, small and medium-sized companies (MSME’s) create 4 out of 5 jobs in emerging economies. Yet, in developing countries, around 200 million MSME’s lack access to finance, especially companies owned by women. Today Swedfund announces an investment up to 15 MUSD in Accion Digital Transformation Fund, focusing on the digital transformation of financial institutions in developing countries.