The Economic Power of Gender Equality

This post by MD Anna Ryott is part of the UN Foundations blog series, “Her Goals: Our Future,” which highlights the connections between girls and women and the Sustainable Development Goals.

This post by MD Anna Ryott is part of the UN Foundations blog series, “Her Goals: Our Future,” which highlights the connections between girls and women and the Sustainable Development Goals.

Swedfund invests MUSD 5 through a loan in Acleda Bank, a bank with strong focus on social and economic development. The loan enables the Bank's continued expansion in rural areas and thus contributes to increased employment and development of domestic production.

Swedfund invests MUSD 5 in Tanzanian National Microfinance Bank (NMB) through a syndicated loan led by the Dutch Development Bank FMO. The funds will primarily be used for on-lending to small-and-medium enterprises (SMEs) and corporate borrowers, thereby contributing to job creation in Tanzania.

Swedfund invests MUSD 10 in the Nigerian Ecobank through a subordinated term loan. The investment is made in conjunction with, among others, the Dutch development bank FMO and is an important contribution to the development of the country’s private sector.

Scania and the development financier of the Swedish state Swedfund are establishing a partnership to develop the production of biogas as an automotive fuel in the Indian city of Nagpur. The biogas will be produced from digested sludge from one of the city’s wastewater treatment plants in collaboration with local companies.

Swedfund, is selling its stake in the Kenyan insurance company UAP. The sale, to Old Mutual, entails a capital gain exceeding SEK 160 million for Swedfund. ”In only three years we have succeeded in achieving Swedfund’s primary targets for the business. We have realized substantial value, created employment opportunities and fair employment conditions,” states Anna Ryott, MD at Swedfund.

For sustainability issues to be taken seriously, they must be integrated in corporate governance. As a development financier, we want to prove that it’s possible. That was the idea behind our Integrated Report 2013.

Swedfund invests MEUR 8 in AfricInvest Fund III LLC, a pan-African fund focused on small and medium enterprises in Sub-Saharan Africa. Through this investment Swedfund will contribute to stimulating growth, job creation and sustainable development in more companies in the region.

On October 12, Swedfund increased its financial commitment to the Interact Climate Change Facility (ICCF) by providing an additional MEUR 5 for climate change projects in emerging markets.

H&M and Swedfund have initiated a unique cooperation with the aim of contributing to the development of a responsible textile industry in Ethiopia with high social and environmental standards.

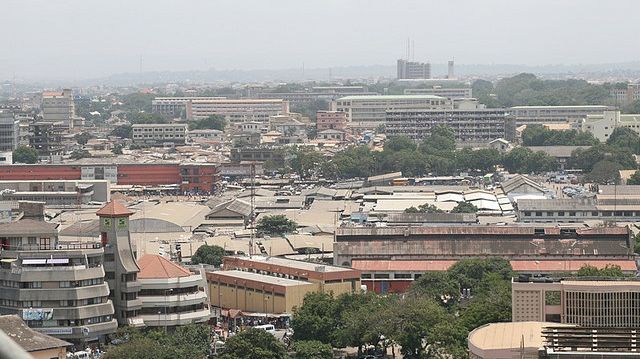

Swedfund provides Fidelity Bank, an indigenous Ghanaian bank with a strong focus on small and medium sized enterprises (SMEs) a MUSD 14 long-term subordinated loan. By supporting the banking sector in Ghana, Swedfund will contribute to job creation, increased demand and private sector development.

Addax Bioenergy has now started its first production of bioethanol and renewable electricity at the plant in Makeni, Sierra Leone. Production is estimated at 85,000 m3 of bioethanol per year by the end of 2016 and the plant is expected to contribute approximately 20% of the country’s current production of electricity.

For the first time, Swedfund presents an integrated report that equates sustainability reporting with the financial statements and clearly describes the positive development outcomes as a result of Swedfund investments.

One of Swedfunds investments in Georgia, TBC Bank, was awarded Best Bank in Georgia and Best CSR in the region in the Europe Banking Awards arranged by EMEA Finance magazine.

On March 13th 2014, Swedfund continued an ongoing stakeholder dialogue that began in the spring of 2013. Among other civil society organizations, representatives of Diakonia, Action Aid and Forum Syd participated in this latest meeting. The dialogue was chaired by Lars-Olle Larsson, Senior Manager of ESG issues at Swedfund.

Swedfund, in partnership with DEG and lead investor Quadria Capital, invests in the specialist healthcare provider Medica. The investment will facilitate Medica becoming the leading hospital chain in Eastern India. Medica’s mission is to provide high quality healthcare services at an affordable cost.

Swedfund and The Africa Health Fund through The Abraaj Group invests equity in a well established chain of private hospitals in Eastern Africa.

Development Partners International (DPI) launches its second fund, African Development Partners II (ADP II). Through an investment in ADP II, Swedfund sees an opportunity to contribute to the expansion of a number of growing companies in Central and Sub-Saharan Africa.

Addax Bioenergy has become the first in Sierra Leone to be registered as a Clean Development Mechanism (CDM) project of the United Nations Framework Convention on Climate Change (UNFCCC). It is also the first sugarcane-based power generation project for ethanol production to be registered as a CDM project in Africa.

Swedfund International AB is participating with MUSD 10 in a long-term subordinated loan facility to TBC Bank in Georgia arranged by FMO, the Dutch development bank.