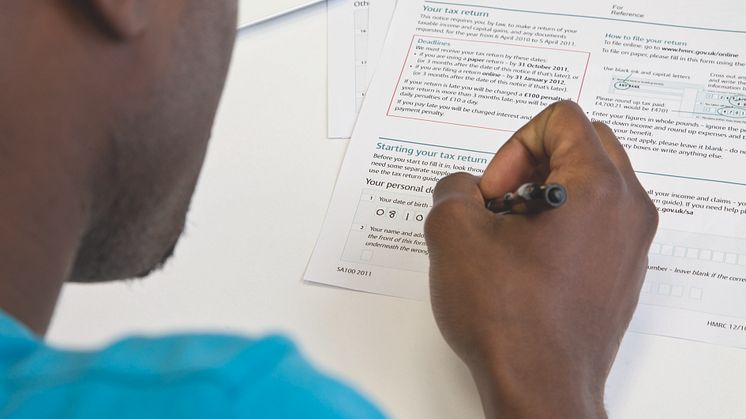

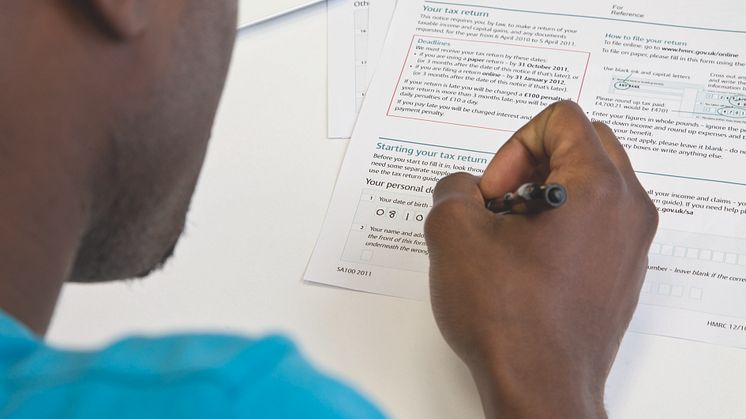

October reminder for paper tax returns

HM Revenue & Customs (HMRC) is reminding anyone sending their 2011/12 tax return on paper that they need to do so by the 31 October deadline, if they want to avoid a penalty.

HM Revenue & Customs (HMRC) is reminding anyone sending their 2011/12 tax return on paper that they need to do so by the 31 October deadline, if they want to avoid a penalty.

HM Revenue & Customs (HMRC) is kicking off its Real Time Information (RTI) awareness campaign next month. This includes writing to over 1.4 million employers.

Small and medium-sized firms are being invited by HM Revenue and Customs (HMRC) to sign up to receive regular emails giving help and support.

HM Revenue and Customs (HMRC) has become the first Government department to sign a contract for the delivery of G-Cloud Services over the Public Services Network.

People selling directly to customers and who haven’t paid all the tax they owe have been offered the opportunity to come forward and pay up under an HM Revenue & Customs (HMRC) campaign.

Taxpayers who failed to submit tax returns have only one week left to take up a special opportunity being offered by HM Revenue & Customs (HMRC).

HM Revenue & Customs (HMRC) has won a key court case defeating a widely-marketed scheme to avoid stamp duty land tax. The decision, subject to any appeal, could save more than £170 million for the UK Exchequer.

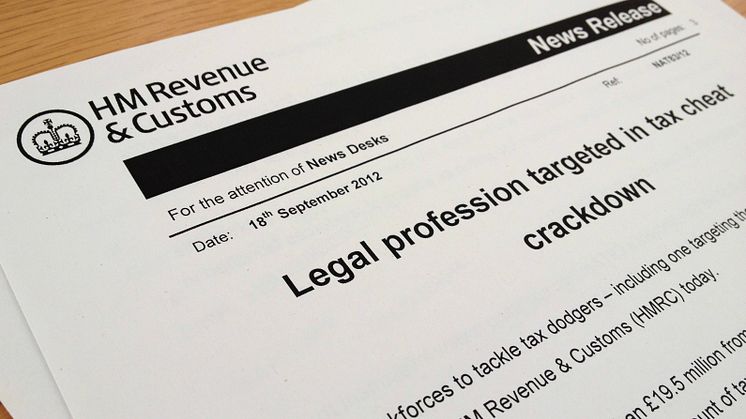

New taskforces to tackle tax dodgers – including one targeting the legal profession – were launched by HM Revenue & Customs (HMRC) today.

HM Revenue & Customs (HMRC) has brought in £500 million in extra tax, since a special unit was set up to deal with the tax affairs of the country’s wealthiest people.

Thousands of higher rate taxpayers who have failed to submit tax returns will receive letters from HM Revenue & Customs (HMRC) this month, reminding them that they have only one month left to take up a special opportunity being offered by the tax authority.

HMRC has won three key court decisions against tax avoidance schemes during July.

How employers report Pay as You Earn (PAYE) details to HM Revenue & Customs is changing. HMRC’s Jane Brothwood* explains to employers what they need to do to prepare.