HMRC responds to PAC report

HM Revenue and Customs (HMRC) has responded to today’s Public Accounts Committee (PAC) report on its Annual Report & Accounts 2012-13.

HM Revenue and Customs (HMRC) has responded to today’s Public Accounts Committee (PAC) report on its Annual Report & Accounts 2012-13.

HM Revenue and Customs grants to voluntary and community sector organisations that help people with taxes, benefits and tax credits led to additional tax of £30.6 million being declared last year.

HM Revenue and Customs (HMRC) is urging first-time Self Assessment filers who haven’t sent in a return to register for its online services now.

A tax tribunal ruling against an income tax avoidance scheme is expected to protect up to £400 million in tax that would otherwise not have been paid.

More than 99 per cent of Pay As You Earn (PAYE) records are now successfully being reported in real time, HM Revenue and Customs (HMRC) announced today as it launched a package of support for micro businesses.

The winners of the HM Revenue and Customs (HMRC) External Engagement Awards 2013 have been announced.

HM Revenue and Customs (HMRC) has announced plans for paperless Self Assessment (SA) tax returns in a consultation document published today.

Care sector workers are in line for nearly £340,000 in back pay as a result of investigations by HM Revenue and Customs (HMRC).

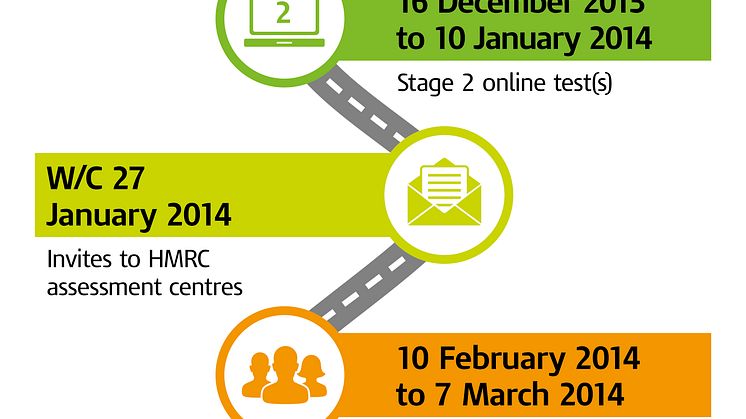

Graduates have a week left to apply to join HM Revenue and Customs (HMRC) as tax trainees next year.

Tax cheats in the North East who try to fraudulently reclaim VAT are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.

Tax cheats in the South East and South who hide their wealth are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.

Tax cheats in the South East and South road transport industry are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.