Get your Self Assessment wrapped up in time for Christmas

With Christmas nearly here, HM Revenue and Customs (HMRC) is encouraging Self Assessment customers to put their tax return at the top of their to-do list.

With Christmas nearly here, HM Revenue and Customs (HMRC) is encouraging Self Assessment customers to put their tax return at the top of their to-do list.

More than 50,000 customers have used the app to make £50 million in Self Assessment payments since February 2022, HM Revenue and Customs (HMRC) has revealed.

Customers have been able to pay their Self Assessment tax bill via the free and secure HMRC app since February 2022.

Thousands of people are now choosing to use the app to make Self Assessment payments because it is a quick and easy wa

The UK Government hub in Cardiff, Tŷ William Morgan has today, 5 December 2022, been formally opened by David TC Davies MP, Secretary of State for Wales.

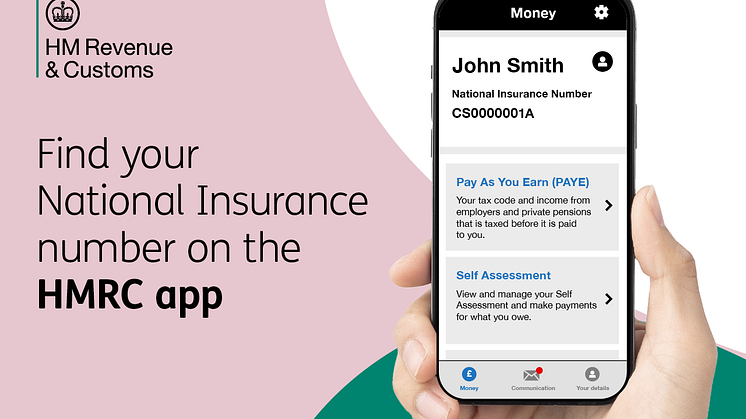

As tens of thousands of people start seasonal jobs over the next few weeks, they can use the HM Revenue and Customs (HMRC) app to save them time to find details they need to pass on to their employer.

In the 12 months up to October 2022, HMRC received almost 3 million calls from people asking for information that is now readily available on the app, with more than 340,000 using it to access emp

More than 401,300 families benefitted from £44.4 million in government funding towards childcare costs in September 2022, HM Revenue and Customs (HMRC) has revealed.

One of the UK’s biggest ever illegal tobacco factories has been dismantled after a raid in Leicester. The state-of-the-art factory, which was capable of producing more than seven million cigarettes a week, was uncovered in an operation by HM Revenue and Customs (HMRC) with support from law enforcement partners in Poland.

Since 6 April 2022, almost 21,600 Self Assessment customers, who were unable to pay their tax bill in full, have set up a payment plan to spread the cost into manageable monthly instalments, HM Revenue and Customs (HMRC) has revealed.

HM Revenue and Customs (HMRC) is reminding Self Assessment customers that they must declare COVID-19 payments in their tax return for the 2021 to 2022 tax year.

More than 2.9 million people claimed at least one Self-Employment Income Support Scheme (SEISS) payment up to 5 April 2022. These grants are taxable and should be declared on tax returns for the 2021 to 2022 tax year before the deadline

Teville Gate House, HM Revenue and Customs’ (HMRC) most southern specialist site was formally opened today (1 November 2022), by Chief Finance Officer, Justin Holliday.

Teville Gate House in Worthing is one of 5 HMRC specialist sites located around the UK. Specialist sites accommodate HMRC employees where their work cannot be done elsewhere across the estate.

Adjacent to the train station, t

With 100 days to go until the deadline for online returns, HM Revenue and Customs (HMRC) is reminding Self Assessment customers that the countdown to complete their tax return has begun.

Self Assessment customers have until 31 January 2023 to submit their online return for the 2021 to 2022 tax year.

More than 66,000 taxpayers beat the clock and filed their tax return on 6 April – the first

More than one million claimant families receiving tax credits, and no other means-tested benefits, will get their second Cost of Living Payment from Wednesday 23 November 2022, HM Revenue and Customs (HMRC) has confirmed.

HM Revenue and Customs’ (HMRC) Belfast Regional Centre and UK Government hub was formally opened today (19 October 2022) by Chris Heaton-Harris MP, Secretary of State for Northern Ireland. Erskine House on Chichester Street, a short walk from Belfast City Hall, is one of HMRC’s 14 new regional centres across the UK.