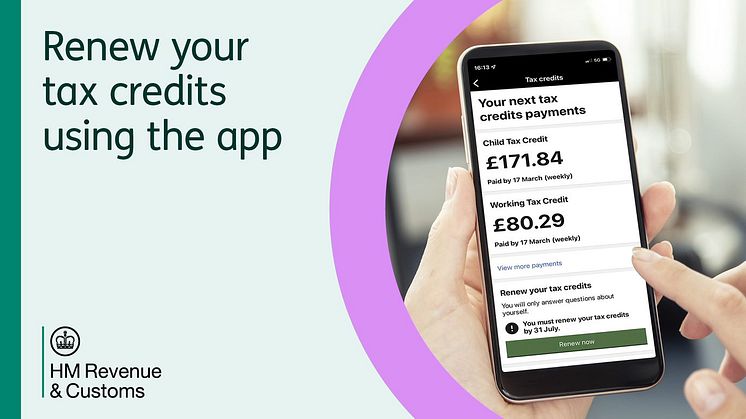

27,844 tax credits customers renew via HMRC app

Almost 28,000 customers have used the HMRC app to renew their annual tax credits claim, HM Revenue and Customs (HMRC) can reveal.

Almost 28,000 customers have used the HMRC app to renew their annual tax credits claim, HM Revenue and Customs (HMRC) can reveal.

Today marks one month until the biggest Alcohol Duty reforms in 140 years come into effect.

On 1 August 2023, the Alcohol Duty system will become much simpler, taxing all alcoholic drinks based on their alcohol by volume (ABV). This replaces the current Alcohol Duty system, which consists of four separate taxes covering beer, cider, spirits, wine and made-wine. It will make the system fairer

Tax credits customers have a month to renew their claim or risk having their payments stopped, HM Revenue and Customs (HMRC) has warned.

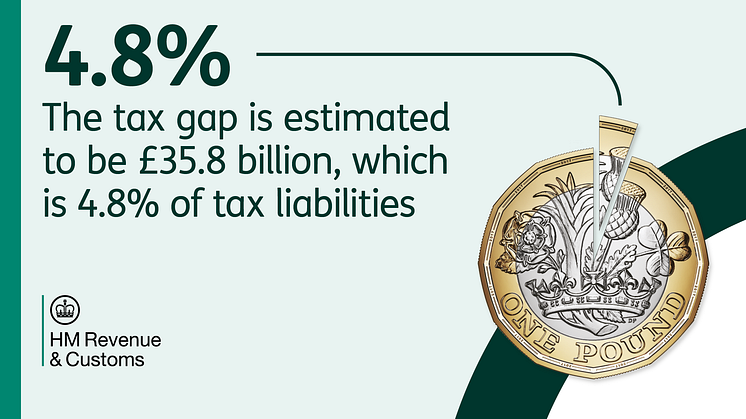

The amount of unpaid UK tax has remained at an all-time low of 4.8%, HM Revenue and Customs (HMRC) revealed today (22 June).

A gang caught red-handed with millions of counterfeit cigarettes at a Lincolnshire farm has been handed prison sentences totalling 26 years.

The small village of Midville, in East Lindsey, was the unlikely base for the gang who were caught with more than 6.5millon cigarettes, worth more than £1.8m in evaded duty.

Officers from HM Revenue and Customs (HMRC) arrested Marcin Kopec, 44, and Woj

Taxpayers now have until 5 April 2025 to fill gaps in their National Insurance record from April 2006 that may increase their State Pension - an extension of nearly two years - the government announced today (12 June).

UK residents who were named in the leaked Pandora Papers are being given the chance to correct their tax affairs.

HM Revenue and Customs (HMRC) is writing to UK residents named in the files of 14 offshore financial service providers. These providers specialise in companies, trusts, and foundations in low, or no tax, jurisdictions.

The letters, which started going out this month, warn recip

Hundreds of businesses fined a total of £3.2 million for breaching anti-money laundering rules have been named by HM Revenue and Customs (HMRC).

The 240 supervised businesses named today were fined between 1 July and 31 December 2022 by HMRC for breaching Money Laundering Regulations aimed at preventing criminals from exploiting illicit cash.

Certain types of business are required to regist

Two companies have been ordered to stop selling specific avoidance schemes immediately or face an initial penalty of £100,000, HM Revenue and Customs (HMRC) announced today.

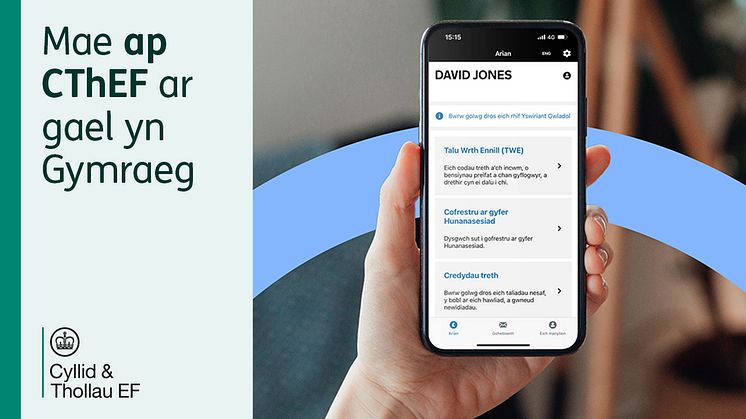

Updates have been delivered to the HM Revenue and Customs (HMRC) app, giving access to most services on the platform in Welsh for the first time.

Almost 2,800 workers in Birmingham were underpaid by £775,000 last year, HM Revenue and Customs (HMRC) has revealed as it approaches local employers to help prevent errors in salaries.

HMRC is writing to more than 8,000 employers in the Birmingham area to highlight common mistakes around the National Minimum Wage (NMW) and National Living Wage (NLW) - offering practical support to help them get

Tax credit claimants should be on their guard against fraudsters, as HM Revenue and Customs (HMRC) warns of the latest tactics being employed by scammers.

HMRC has issued a new alert, providing details of a number of new scams reported that aim to trick people into handing over money or personal information. Criminals use deadlines – like the tax credits renewal deadline on 31 July – to target