HMRC app speeds up student loan applications

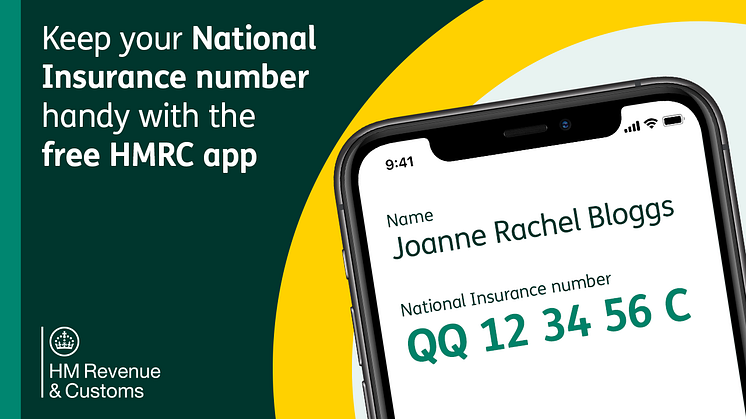

With many A level students planning their next steps in life, those starting university in September can ‘tap the app’ to get National Insurance and tax information they need to complete their student finance applications, HM Revenue and Customs (HMRC) has said.

Anyone applying for a student loan for the 2024/25 academic year is encouraged to start their application now and to get the essential