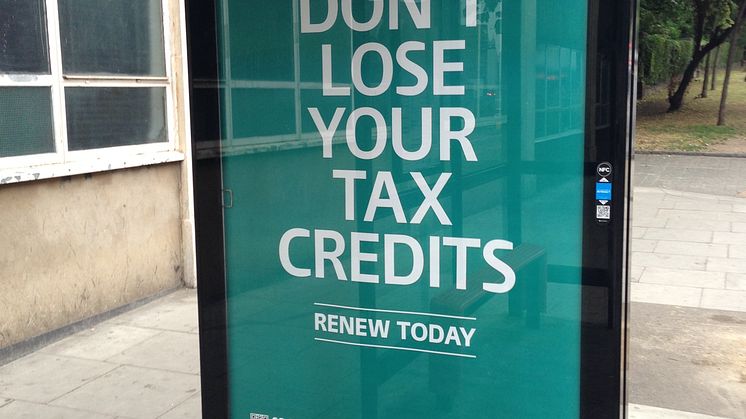

Time is running out for higher income parents to register for Self Assessment

Higher income parents currently receiving Child Benefit have just four weeks to register for Self Assessment with HM Revenue and Customs (HMRC) in order to avoid a penalty.