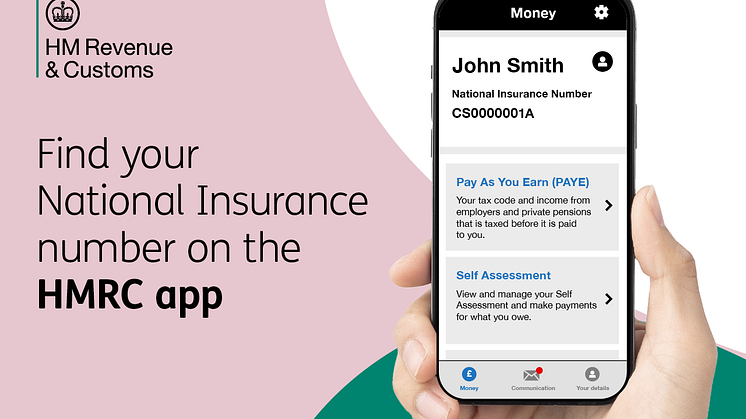

Christmas workers can save time with HMRC app

As tens of thousands of people start seasonal jobs over the next few weeks, they can use the HM Revenue and Customs (HMRC) app to save them time to find details they need to pass on to their employer.

In the 12 months up to October 2022, HMRC received almost 3 million calls from people asking for information that is now readily available on the app, with more than 340,000 using it to access emp