Nightclub boss and accountant face the music

A Blackpool nightclub owner and his accountant have been convicted for their involvement in a £4.9 million tax fraud.

A Blackpool nightclub owner and his accountant have been convicted for their involvement in a £4.9 million tax fraud.

There is less than a year to go until sole traders and landlords with an income over £50,000 will be required to use Making Tax Digital (MTD) for Income Tax. The launch on 6 April 2026 marks a significant and ultimately time-saving change in how these individuals will need to keep digital records and report their income to HM Revenue and Customs (HMRC).

HM Revenue and Customs (HMRC) marks its 20th anniversary on 18 April 2025.Two decades on, the department is harnessing the spirit of then Chancellor Gordon Brown’s bold reforms and embarking on a new era of transformation.Supporting the government’s Plan for Change and mission for growth, HMRC is now firmly focused on closing the tax gap, modernising and reforming, and improving customer service.<

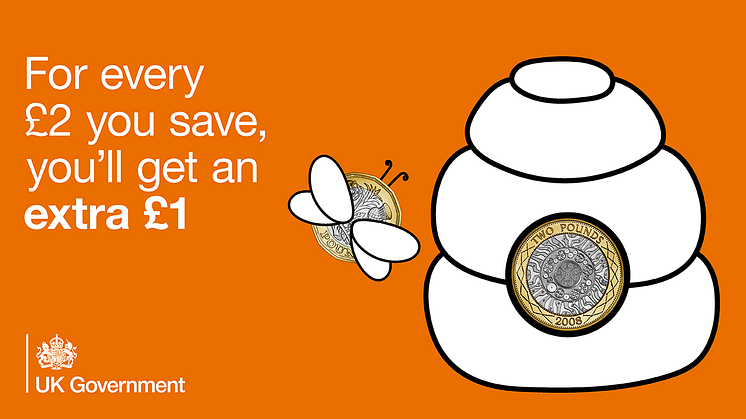

Government’s Help to Save scheme now open to 550,000 more people to help with cost of living

Those saving £50 a month can expect £25 Government top-up, putting more money in people’s pockets

Part of Government’s mission to grow the economy and deliver on our Plan for Change

More than half a million more UK savers are in line for Government bonuses worth up to £25 a month to boost their cash

A money launderer who fled during his 2018 trial has been extradited from the Netherlands and jailed for five-and-a-half years. Javed Ahmad was caught trying to stuff more than £100,000 in a filing cabinet when HM Revenue and Customs (HMRC) officers raided his Burnley office in November 2015.

A crooked accountant who abused his position to orchestrate a £1.7 million tax fraud - spending the stolen cash on lavish holidays and cars - has been jailed for four years.

Child Benefit payments to increase from next week

Parents encouraged to claim and manage Child Benefit via the HMRC app

1.2 million parents have used the digital service to claim their Child Benefit

Families who claim Child Benefit will see an increase in their payment next week, says HM Revenue and Customs (HMRC).

From 7 April 2025, parents will receive £26.05 per week - or £1,354.60 a y

Criminals are exploiting informal money transfer services in the UK to launder an estimated £2 billion annually, concealing the proceeds of serious organised crime that harms communities. HMRC is urging businesses that offer these services – which help diaspora communities send money to relatives abroad – to register for anti-money laundering supervision to protect themselves from criminals.

HM Revenue and Customs (HMRC) has seized nearly 15,000 imported items from delivery warehouses across the UK – in a bid to tackle customs fraud and help level the playing field for honest businesses.

Government launches 12-week e-invoicing consultation on plans to cut paperwork for businesses and help improve productivity Proposals expected to save businesses time and money and speed up payments, creating the conditions to grow the economy, part of the Prime Minister’s Plan for Change Will help businesses get tax right first time with fewer invoicing and VAT return errors UK stakeholders an

As Valentine's Day approaches, anyone who has turned the love for their hobby into a side hustle is being encouraged to 'put a ring on it' and make it official. Whether it’s making extra income from activities such as online content creation, dog walking, or making handcrafted items to sell, HMRC has launched a new campaign to assist people in understanding if they need to declare earnings.

People wanting to maximise their State Pension by plugging gaps in their National Insurance record have contributed to a total of 68,673 years, worth £35 million, using the online service since April last year HM Revenue and Customs (HMRC) has revealed.