Pressmeddelande -

NEW YORK LEDER HYRESTOPPEN

NEW YORK LEDER HYRESTOPPEN

Världens högsta hyror hittas i New York enligt CB Richard Ellis globala översyn av detaljhandeln.

Stockholm, 27 maj 2010 – För bästa läge i New York ligger hyran på 137 000 kr/kvm och år. New York följs av Sydney (92 000), Hong Kong (78 000), London (69 000), Paris (63 000) samt Moskva (58 000). På topp 20-listan ligger Dublin på sista plats med 31 000 kr/kvm och år. Stockholm finns inte ens med på de 20 dyraste Europeiska städerna där Düsseldorf ligger på sista plats med sina ca 26 000 kr/kvm och år. “Steget ner till Stockholm är långt med sina 10 000 – 15 000 kr/kvm . Men det beror på vår begränsande marknad, befolkningsmässigt.” säger Anders Lillsunde, Head of Retail CB Richard Ellis Sverige.

Den ekonomiska återhämtningen syns i en ökande tillförsikt bland detaljhandlare och konsumenter, men än syns inte tilltron i en ökande försäljning. Hyresnivåerna börja återhämta sig på de flesta marknaderna även om detaljhandlarna fortsättningsvis sätter press på hyresvärdarna.

Top 20 Global Retail Rental Markets - lista se bifogad press release

Nedan följer den engelska press releasen.

PRIME RETAIL RENTS STABILISE ACROSS GLOBAL MARKETS

New York Still World’s Most Expensive Retail Location

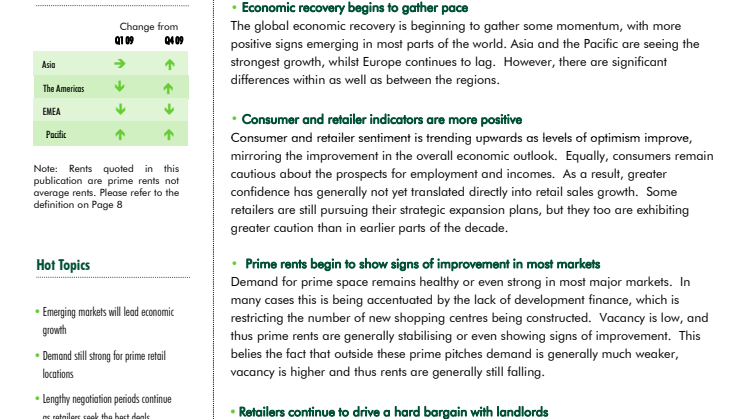

Stockholm, 27 May 2010 – Prime retail rents in the world’s leading shopping destinations stabilised in the majority of markets, and grew in a number of major cities, in the first quarter (Q1) of 2010, according to the latest CB Richard Ellis (CBRE) Global MarketView report on the retail sector. As the global economic recovery begins to gather momentum, consumer and retailer confidence have started to improve. Whilst this has still not translated into retail sales growth in most markets, demand for prime retail space remains healthy and vacancy in the best locations is low. As a result, there are some markets globally where prime rents are rising, and many more where the rate of decline has slowed or rents are now stable.

New York City remains the world’s most expensive retail destination, with prime rents at US$1,725 per sq ft per annum. Sydney remains in second place globally (US$1,155/sq ft/annum), with Hong Kong ranked third (US$974/sq ft/annum). London remains in fourth place, after recording a 20% annual increase in rents since the first quarter of 2009, with ongoing strong demand and low vacancy rates in the prime locations. Paris rounds out the top five locations with rents of US$791/sq ft/annum. Interestingly, some of the fastest growing retail rents have been seen in Latin America, with markets such as Rio de Janeiro, Mexico City and Santiago showing significant quarterly and annual increases.

Whilst there are significant variations between regions and markets, some common themes are generally apparent. Commenting on the overall global picture, Ray Torto, CBRE’s Global Chief Economist, said: “Retailers still face uncertain trading conditions and continue to put pressure on landlords to offer incentive packages. However, market pressures have not stopped retailers from expanding and demand for prime retail space remains strong in many markets across the world. This, combined with low vacancy rates, has created supply-demand imbalances in some markets. However, the rental disparity between prime and secondary locations is generally increasing. Whilst prime space is doing well, secondary units are typically seeing higher vacancy, lower retailer demand and falling rents.”

Commenting on trends in the EMEA region, Peter Gold, Head of Cross-Border Retail - EMEA, CBRE, said: "Whilst performance across Europe remains diverse, many retail markets in Western Europe have rebounded surprisingly well in the first quarter of 2010, including London, Paris and Berlin. In some instances competitive tensions have arisen again, with retailers bidding aggressively to secure the best sites. As elsewhere in the world, the gap between prime and secondary locations and markets remains acute, as was the case in 2009. It is too early to tell whether this gap will reduce during the remainder of the year.”

REGIONAL HIGHLIGHTS

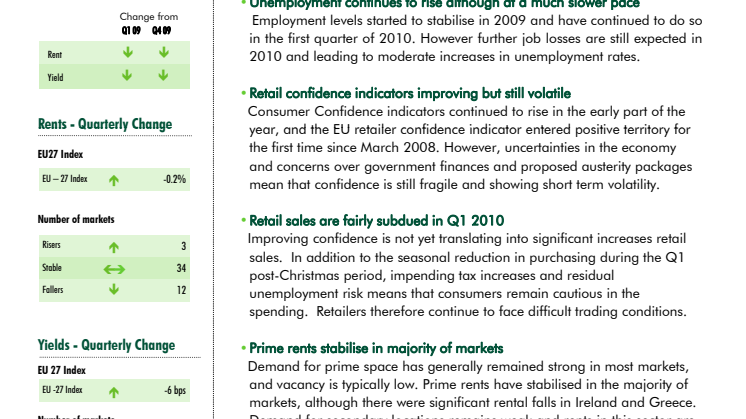

Europe, Middle East & Africa

EMEA continues to dominate the world’s most expensive retail markets, with 10 of the top 20 destinations. London, Paris and Moscow emerged as the three most expensive EMEA markets in Q1 2010. The EU-27 retail rent index decreased by -0.2% in Q1 2010, a decline of -0.5% year-on-year. Overall, the EMEA region had a quarterly decline of -1.7%; prime retail rents fell in several markets, including Abu Dhabi, which experienced a 24.5% decline, and Athens, which fell 12.3% quarter-on-quarter. Occupier demand across EMEA remains fairly stable and retailers continue to negotiate with landlords to secure longer rent-free periods and more favourable lease terms. However, demand for prime stores is strong and this is reflected in the stabilisation and, in some markets, growth in rents.

Americas

U.S. cities continue to lead the most expensive retail rents in the Americas region. Los Angeles and Chicago rank at 12th and 14th, respectively, within the global ranking, following New York as the most expensive destination in the world. The economic recession had the largest impact on luxury goods retailers, whilst discount goods retailers in the region fared better. Retail vacancy rates for all property types are expected to continue increasing in 2010 before beginning to level off in early 2011 as consumer confidence continues to rise. Latin America has seen some of the strongest growth in retail rents, with Santiago and Mexico City seeing increases of 12% and 13% respectively year-on-year.

Asia

The Asia region is helping to lead the recovery, with retail markets generally strengthening in the first quarter of 2010. Few markets are now seeing any significant rental declines, with the majority either stabilising or posting modest growth. Thus far, Asia is the only region of the world where economic growth is starting to feed through into retail sales increases, and this is now starting to impact on real estate markets. With the exception of Japan, retail leasing activity in major Asian cities continued to pick up and a number of international retailers are looking to expand their footprint across the region, particularly in Hong Kong, Beijing and Shanghai. However, the threat of a supply imbalance remains a significant risk in certain cities in mainland China, Singapore and India, which are all expecting large amounts of shopping centre construction to be delivered in the next nine months.

Pacific

In the Pacific region, the Australian economy is already growing strongly, the workforce is expanding and unemployment is now falling. Consumer confidence continued to strengthen in the first quarter of 2010, but interest rates are also moving up, fuelling consumer caution and preventing any significant increase in retail sales. Rents in some shopping centre categories fell slightly this quarter, although CBD retail generally continued its strong performance, with rents either stable or rising in the different sub-markets. In New Zealand, more difficult trading conditions resulted in increasing vacancies, and longer lease up periods in 2009. However there is activity from start up retailers and the current market also provides opportunities for retailers with sufficient resources to secure premises in prime locations that were not available during the past few years. Prime CBD strip retail rents have therefore started to increase.

Top 20 Global Retail Rental Markets - Se bifogad press release

-END-

About CB Richard Ellis

CB Richard Ellis Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services firm (in terms of 2009 revenue). The Company has approximately 29,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through more than 300 offices (excluding affiliates) worldwide. CB Richard Ellis offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. CB Richard Ellis has been named a BusinessWeek 50 “best in class” company for three years in a row. Please visit our website at www.cbre.com.

Ämnen

- Ekonomi, finans

Kategorier

- handel

- prime rent

- global rapport

- uthyrning

- retail

- cbre sweden - real estate - fastighetsrådgivaren

CB Richard Ellis är en världsledande fastighetsrådgivare. Med fler än 300 kontor i över 50 länder hjälper vi dig oavsett om du är fastighetsägare, lokalanvändare eller investerare till en bra affär med hjälp av våra lokala eller globala rådgivare.

Gå gärna in på www.cbre.se så får ni veta mer.