Nyhet -

Dassault Systèmes Reports Strong Revenue and EPS Growth

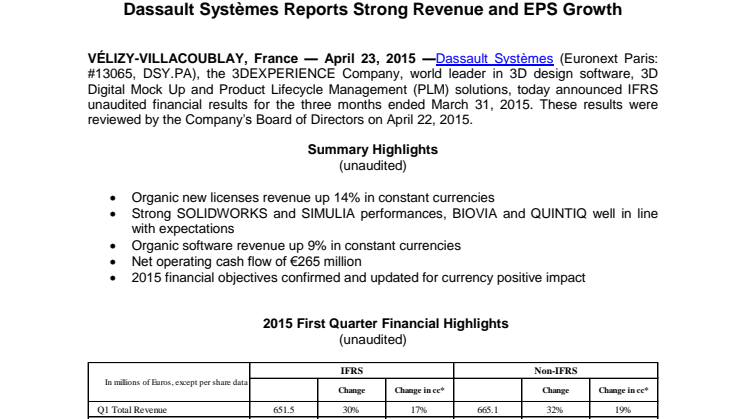

VÉLIZY-VILLACOUBLAY, France — April 23, 2015 —Dassault Systèmes (Euronext Paris: #13065, DSY.PA), the 3DEXPERIENCE Company, world leader in 3D design software, 3D Digital Mock Up and Product Lifecycle Management (PLM) solutions, today announced IFRS unaudited financial results for the three months ended March 31, 2015. These results were reviewed by the Company’s Board of Directors on April 22, 2015.

Summary Highlights

(unaudited)

- Organic new licenses revenue up 14% in constant currencies

- Strong SOLIDWORKS and SIMULIA performances, BIOVIA and QUINTIQ well in line with expectations

- Organic software revenue up 9% in constant currencies

- Net operating cash flow of €265 million

- 2015 financial objectives confirmed and updated for currency positive impact

“It is becoming clearer that our clients’ priority is to provide successful consumer experiences, thus creating significant challenges to adopt open innovation platforms that extend collaboration, modeling and simulation to a new level. This is exactly what our 3DEXPERIENCE platform and Industry Solution Experiences are delivering,” commented Bernard Charlès, Dassault Systèmes President and Chief Executive Officer.

“Life Science is a perfect illustration of it, and why a comprehensive approach can be incredibly valuable. Our brand BIOVIA, integrating our BioIntelligence project and the Accelrys acquisition, leveraging the recent 2015X release of the 3DEXPERIENCE platform, is a true game-changer, powering all types of applications as well as simplifying enterprise integration and transformation.

“More broadly, products as well as processes are becoming more complex. Products are becoming smarter with sophisticated embedded systems, underscoring our development of CATIA Systems, which was further strengthened recently with the technology of Modelon GmbH.

“Finally, looking at our results and future opportunities, we see a year of strong financial performance in 2015. Thanks to multiple access points we can better serve our customer base, reach an expanded market opportunity and accelerate our organic growth.”

2015 First Quarter Financial Summary

- IFRS total revenue increased 17% on software revenue growth of 16% and services and other revenue growth of 27%. On a non-IFRS basis, total revenue increased 19%, on software revenue growth of 18% and services and other revenue growth of 29%. (All growth rates in constant currencies.)

- The Company experienced solid new business activity in multiple industries, most notably Transportation & Mobility, Industrial Equipment, Marine & Offshore, Life Sciences, CPG and Energy, Process & Utilities.

- On an organic basis, the Company has seen a progressive strengthening of its revenue results over the last four quarters, led by improved new licenses revenue dynamic. Excluding acquisitions and in constant currencies, non-IFRS total revenue increased 8%, software revenue grew 9% and new licenses revenue rose 14%.

- From a regional perspective, first quarter non-IFRS revenue in Europe increased 18%, on solid growth in all major countries, and sharply improved results in Southern Europe. In Asia, non-IFRS revenue grew 18% on a strong performance in Korea, well supported by India and Japan. And in the Americas, revenue grew 23% in total with growth in North America offset in part by weaker results in Latin America. (All growth rates in constant currencies.)

Non-IFRS new licenses revenue increased 24% and non-IFRS recurring software revenue grew 16%, reflecting the addition of acquisitions and solid underlying performance. Recurring software revenue reflected principally growth in maintenance where the Company continued to experience high renewal trends across its software brands. (All growth comparisons are in constant currencies.)

By product line, non-IFRS software revenue grew 4% for CATIA and 17% for SOLIDWORKS; ENOVIA software decreased 4%, reflecting a high comparison base. Other software increased 59%, with the addition of the Accelrys and Quintiq acquisitions as well as strong SIMULIA growth. (All growth comparisons are in constant currencies.)

- IFRS operating income increased 38% to €110.5 million and non-IFRS operating income increased 23% to €171.7 million. The non-IFRS operating margin was 25.8% in the 2015 first quarter compared to 27.7% in the year-ago quarter, reflecting acquisition dilution, offset in part by currency tailwinds and organic operating margin improvement. The 2014 first quarter included a one-time R&D tax credit benefit.

- The IFRS effective tax rate increased to 36.1% compared to 35.8% in the 2014 first quarter. The non-IFRS effective tax rate was stable at 35.2%,compared to 35.1% in the year-ago quarter.

- IFRS diluted net income per share increased 29% to €0.27 per share, compared to €0.21 per share on a two-for-one split-adjusted basis in the 2014 first quarter. Non-IFRS diluted net income per share increased 18% to €0.43, compared to €0.37 per share on a two-for-one split-adjusted basis in the year-ago quarter, with a strong increase notwithstanding the favorable impact of the one-time R&D tax credit in the 2014 first quarter.

Cash Flow and Other Financial Highlights

Net operating cash flow was €265 million for the 2015 first quarter, compared to net operating cash flow of €182 million in the year-ago quarter. The growth in net operating cash flow benefited from an increase in working capital in the current quarter.

At March 31, 2015, the Company’s net financial position increased to €1.15 billion, compared to €825.5 million at December 31, 2014. Cash, cash equivalents and short-term investments increased to €1.50 billion and long-term debt was €350.0 million, compared to €1.18 billion, and €350.0 million, respectively, at December 31, 2014.

Cash Dividend Recommendation, Annual Shareholders’ Meeting Date and Filing of Regulatory Annual Report

The Board of Directors has scheduled the Annual Shareholders’ Meeting for May 28, 2015 and is recommending a dividend per share equivalent to €0.43 per share for the fiscal year ended December 31, 2014, representing an increase of approximately 4% compared to the prior year. In addition, as in recent years, it will also be proposed that each shareholder be granted the option to choose to receive payment of the dividend in cash or new shares. Shareholders may choose payment of the dividend in cash or new shares between June 3, 2015 and June 16, 2015, inclusive. Shares will trade ex-dividend as of June 3, 2015, with the ex-dividend date June3, 2015. Dividends will be made payable as from June 25, 2015.

These recommendations are subject to approval by shareholders at the Annual Shareholders’ Meeting. For further information, see the Company’s 2014 Document de Référence filed with the French Autorité des Marchés Financiers (AMF) on March 24, 2015. The 2014 Document de Référence and an English language translation of this document are available on the Company’s website.

Summary of Recent Business, Technology and Customer Highlights

In early March, the Company announced the general availability of Release 2015x of the 3DEXPERIENCE platform, offering a simplified and improved user experience with powerful enhancements that significantly increase productivity on premise as well as on public or private cloud. In addition, R2015x introduces groupings of applications called ‘roles’, designed to cover a broader set of activities users need to accomplish in industry-specific domains. In R2015x, there are 219 roles on premise, 115 roles on public and private cloud. Importantly, R2015X continues the Company’s focus on further advancing ease of interface enabling V5 customers to benefit from their existing deployments while also taking advantage of V6 applications, as well as powerful openness and coexistence capabilities for a heterogeneous environment with a user’s suppliers and other software.

Dassault Systèmes acquires Modelon GmbH, a new milestone to achieve Ready-to-Experience mechatronics systems. With this transaction, Dassault Systèmes reinforces its portfolio of industry-leading content, applications and services. Modelon GmbH’s proprietary, multi-physics modular and reusable content—based on the Modelica open standard modeling language—brings industries beyond digital mock up to deliver functional mock up, transforming the engineering and experimentation of connected vehicles. From electric power storage to electric power distribution, its portfolio delivers a unified picture of complex product subsystem interaction and performance. This accelerates virtual product development and ensures the relevance and quality of Transportation and Mobility industry projects.

El Corte Inglés, a world leader in large department stores, has selected Dassault Systèmes “My Collection for Fashion” industry solution experience to accelerate time-to-market of its private-label fashion collections. Dassault Systèmes’ “My Collection for Fashion” industry solution experience applies collaborative innovation to product development and the consumer experience in order to enhance a brand’s identity. Brand retailers can rely on applications that encompass global sourcing and global collaboration, consumer-led design, virtual prototyping, virtual stores and channels, integrated merchandise assortment planning, product development and social analytics.

Business Outlook

Thibault de Tersant, Senior Executive Vice President, CFO, commented,“All in all, we delivered a strong first quarter with organic software revenue growth increasing to 9% in constant currencies. These results well illustrate and support our 2015 financial objectives.

“Importantly, our first quarter performance underscores the value brought by our multiple growth engines. During the quarter revenue was driven by a diverse set of industries, including Transportation & Mobility, Industrial Equipment and Marine & Offshore in our core industries, well complemented by increased activity in Life Sciences, CPG and Energy, Process & Utilities. We benefited from strong growth for SOLIDWORKS and SIMULIA. And our revenue results also demonstrate that our acquisitions, most notably BIOVIA and QUINTIQ, are delivering on plan.

“Looking forward, we are confirming our 2015 full year financial objectives and updating them for currency. In total we see a year of organic, double-digit new licenses revenue growth, improvement in our underlying operating margin of about 100 basis points, leading to a non-IFRS operating margin of about 30% and earnings per share growth of about 15% to 17%.”

The Company’s second quarter and full year 2015 financial objectives are as follows:

Second quarter 2015 non-IFRS total revenue objective of about €665-675 million based upon the exchange rates assumptions below, representing an increase of about 8% to 10% excluding currency effects; non-IFRS operating margin of about 27%; and non-IFRS EPS of about €0.45 to €0.47, representing growth of about 6% to 11%;

2015 non-IFRS revenue growth objective range of about 11% to 12% in constant currencies at €2.76 to €2.78 billion (based upon the 2015 currency exchange rate assumptions below);

- 2015 non-IFRS operating margin of about 30%, compared to 2014 where the non-IFRS operating margin was 29.8%;

2015 non-IFRS EPS range of about €2.10-2.13, representing a growth objective range of 15% to 17%;

Objectives are based upon exchange rate assumptions of US$1.15 per €1.00 and JPY135 per €1.00 for the 2015 second quarter and US$1.14 per €1.00 and JPY134.8 per €1.00 for the full year.

The Company’s objectives are prepared and communicated only on a non-IFRS basis and are subject to the cautionary statement set forth below.

The 2015 non-IFRS objectives set forth above do not take into account the following accounting elements and are estimated based upon the 2015 currency exchange rates above: deferred revenue write-downs estimated at approximately €38 million, share-based compensation expense, estimated at approximately €19 million and amortization of acquired intangibles estimated at approximately €160 million. The above objectives do not include any impact from other operating income and expense, net principally comprised of acquisition, integration and restructuring expenses. Finally, these estimates do not include any new stock option or share grants, or any new acquisitions or restructurings completed after April 23, 2015.

Today’s Webcast and Conference Call Information

Today, Thursday, April 23, 2015, Dassault Systèmes will first host a meeting in London, which will be simultaneously webcasted at 8:30 AM London time/9:30 AM Paris time and will then also host a conference call at 9:00 AM New York time/ 2:00 PM London time/3:00 PM Paris time. The webcasted meeting and conference call will be available via the Internet by accessing http://www.3ds.com/investors/. Please go to the website at least 15 minutes prior to the webcast or conference call to register, download and install any necessary audio software. The webcast and conference call will be archived for 1 year.

Additional investor information can be accessed at http://www.3ds.com/investors/ or by calling Dassault Systèmes’ Investor Relations at 33.1.61.62.69.24.

2015 Key Investor Relations Events

2014 Annual Shareholders’ Meeting, May 28, 2015

Second Quarter 2015 Earnings, July 23, 2015

Third Quarter 2015 Earnings, October 22, 2015

Ämnen

- Data, Telekom, IT

Kategorier

- 3dexperience

- dassault systèmes

- innovation