Nyhet -

Dodd-Franks påverkan och konsekvenser

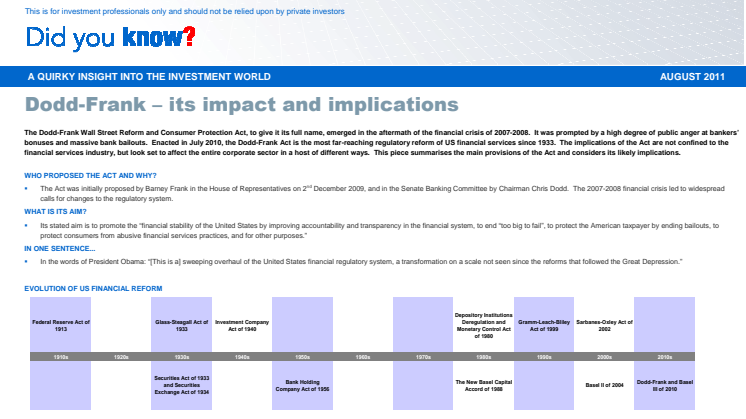

The Dodd-Frank Wall Street Reform and Consumer Protection Act, to give it its full name, emerged in the aftermath of the financial crisis of 2007-2008. It was prompted by a high degree of public anger at bankers’ bonuses and massive bank bailouts. Enacted in July 2010, the Dodd-Frank Act is the most far-reaching regulatory reform of US financial services since 1933. The implications of the Act are not confined to the financial services industry, but look set to affect the entire corporate sector in a host of different ways. This piece summarises the main provisions of the Act and considers its likely implications.

WHO PROPOSED THE ACT AND WHY?

The Act was initially proposed by Barney Frank in the House of Representatives on 2nd December 2009, and in the Senate Banking Committee by Chairman Chris Dodd. The 2007-2008 financial crisis led to widespread calls for changes to the regulatory system.

WHAT IS ITS AIM?

Its stated aim is to promote the “financial stability of the United States by improving accountability and transparency in the financial system, to end “too big to fail”, to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and for other purposes.”

IN ONE SENTENCE...

In the words of President Obama: “[This is a] sweeping overhaul of theUnited Statesfinancial regulatory system, a transformation on a scale not seen since the reforms that followed the Great Depression.”

WHERE DOES THIS LEAVE INVESTORS?

- For investors, the Dodd Frank Act could lead to a range of compelling new opportunities. Whenever major regulatory changes occur, new investment terrains open up for exploration.

- For businesses it is likely to cost time and money, particularly if complying with new regulations involves expensive new systems.

- Certain types of trading strategies are likely to be reviewed, given the new tax implications for foreign and tax-exempt products.

- A lot of the detail of the Act is yet to be decided, many investment houses are continuing to lobby to ensure the best possible outcome for their clients.

- It is possible that the Act will encourage a burst of M&A activity, given the need for greater infrastructure.

- Many investors will be pleased by the introduction of higher levels of transparency and clearer pricing.

- Operational issues are granted more attention than they have received in the past. Firms will be forced to comply. In the words of Professor Irwin Corey: “If we don’t change direction soon, we’ll end up where we’re going.”

- On the downside, it is possible that the reduction in the number of counterparties will lead to low levels of market liquidity. Also, for some managers, the cost of hedging portfolios is likely to rise.

This information is for Investment Professionals only and should not be relied upon by private investors. It must not be reproduced or circulated without prior permission. This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Fidelity/Fidelity International means FIL Limited and its subsidiary companies. Unless otherwise stated, all views are those of Fidelity. Fidelity only offers information on its own products and services and does not provide investment advice based on individual circumstances. Fidelity, Fidelity International and the pyramid Logo are trademarks of FIL Limited. Growth Investments Limited is licensed by the MFSA. Fidelity Funds are promoted in Malta by Growth Investments Ltd in terms of the EU UCITS Directive and Legal Notices 207 and 309 of 2004. The Funds are regulated in Luxembourg by the Commission de Surveillance du Secteur Financier; Our legal representative in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Paying agent for Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich.Issued by FIL Investments International (registered in England and Wales), authorised and regulated in the UK by the Financial Services Authority. SSO4211/0812

Ämnen

- Finans

Kategorier

- finanskrisen

- fidelity international

- fidelity

- konsumentskyddslag

- frank

- consumer protection act

- dodd frank

- dodd