Nyhet -

Trevor Greetham´s Investment Clock January 2012: Reflation means central bank ease

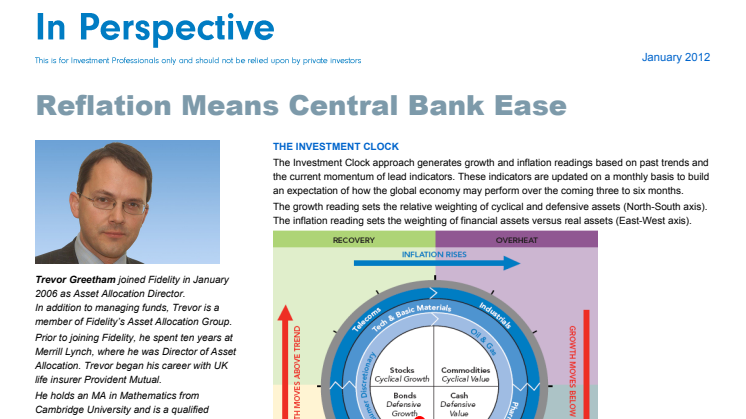

THE INVESTMENT CLOCK

The Investment Clock approach generates growth and inflation readings based on past trends and the current momentum of lead indicators. These indicators are updated on a monthly basis to build an expectation of how the global economy may perform over the coming three to six months.

The growth reading sets the relative weighting of cyclical and defensive assets (North-South axis). The inflation reading sets the weighting of financial assets versus real assets (East-West axis).

Please see attached document for charts explaining the text below.

MACROECONOMIC HEADLINES

- The Investment Clock is now firmly in Reflation, which favours bonds over equities and commodities, and within equities, defensive sectors over economically sensitive areas.

- Global growth indicators remain weak and inflation is peaking. This will encourage central banks to ease monetary policy aggressively in an attempt to get things moving. The Fed and Bank of England are implementing quantitative easing, the ECB is cutting interest rates and China has started to ease curbs on lending.

- Downside risk is concentrated inEuropewhere sovereign and banking stress remains intense and a new recession is under way but there are tentative signs of recovery in the US.

ASSET ALLOCATION HEADLINES

- We remain significantly underweight in stocks and commodities and significantly overweight in bonds and cash. Real estate is a moderate underweight position.

- Within equity markets, we continue to favour the US which is a large overweight within the equity portfolio; economic data has been relatively resilient, the stock market has relatively defensive attributes and, the US also has the most flexibility to stimulate its economy to protect economic growth and jobs. Within sectors, we prefer defensive areas such as healthcare and consumer stocks at the expense of cyclical areas like materials and industrials.

Global growth

The global growth scorecard remains in negative territory.

Global growth deteriorated in the second half of 2011 H2 as business confidence weakened and economists downgraded their GDP forecasts. Global growth conditions have improved a little over the last couple of months, however, on the back of a rise in the US ISM survey and initial monetary easing moves by the European Central Bank (ECB) and the Peoples Bank of China (PBOC).

There are clear signs of improvement in theUSeconomy. The ISM business survey hit a low at the time of the S&P ratings downgrade in August. It has been rising gradually ever since and the OECD lead indicator for G7 industrial production may also be troughing.

Meanwhile, European economies are moving into recession and unemployment rates are rising. This marks the most significant divergence between the world’s two largest economic blocs since the early 1990s.

Inflation

The inflation scorecard remains in negative territory.

Leading indicators of global inflation continues to point downwards, suggesting Consumer Price Inflation (CPI) rates have peaked. Headline inflation appears to be peaking. If this trend is sustained, fear of deflation will once more become the prime concern in the developed, debt-ridden economies. As a result, central banks will continue to ease monetary policy until growth recovers but it is important not to position for this too soon.

Will the US and Europe decouple?

The major economies were rarely heading in the same direction as each other in the early 1990s.

- The US was on its way into recession during Germany’s 1990 re-unification boom.

- German boom turned to bust in 1991-2 just as the US recovered.

Japan’s economy was also out of step with the US. The peak of its asset price bubble in 1990 ushered in a slowdown that mirrored the German experience.

A desynchronised world economy is not a strong world economy. US and global stock market indices moved sideways over the period. Short term correlations between the markets remained positive but there were huge relative performance shifts.

The US equity market underperformed Germany by 40% in 1989-90, outperformed by 80% between 1990-2 and underperformed by 25% in 1993-4. These swings were explained by turning points in the relative level of business confidence in the two economies.

This analysis is consistent with our current positioning: underweight global stocks versus bonds but with US equities held at a large overweight.

The investment clock

The growth and inflation readings feed into the Investment Clock model to determine a probability for each of the four cycles of the Clock prevailing in the coming three to six month period.

By plotting indicators for growth and inflation against each other in two dimensions, we monitor the economic cycle as it evolves. The investment clock trail remains in the Reflation phase. This environment typically favours government bonds. In recent years, equities and commodities have performed poorly at this stage of the cycle. Within equities, defensive sectors like pharmaceuticals and consumer staples are preferred to economically sensitive sectors, such as industrials and basic materials.

Reflation is characterised by aggressive central bank action to get things moving, so we will be keeping a look out for any sign of recovery. Diversification across a range of asset classes remains an attractive proposition and there will be lots of opportunities to add value through a sensible tactical asset allocation policy.

Trevor Greetham joined Fidelity in January 2006 as Asset Allocation Director. In addition to managing funds, Trevor is a member of Fidelity’s Asset Allocation Group. Prior to joining Fidelity, he spent ten years at Merrill Lynch, where he was Director of Asset Allocation. Trevor began his career with UK life insurer Provident Mutual. He holds an MA in Mathematics from Cambridge University and is a qualified actuary.

This document is for investment professionals only and should not be relied upon by private investors. It must not be reproduced or circulated without prior permission. This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Fidelity/ Fidelity International means FIL Limited, and its subsidiary companies. Unless otherwise stated, all views are those of the Fidelity organisation. Investors should note that the views expressed may no longer be current and may have already been acted upon by Fidelity. The research and analysis used in this material is gathered by Fidelity for its use as an Investment Manager and may have already been acted upon for its own purposes. Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. Fidelity only offers information on its own products and services and does not provide investment advice based on individual circumstances. Fidelity, Fidelity Worldwide Investment and the Fidelity Worldwide Investment and F symbol are trademarks of FIL Limited. Past performance is not a reliable indicator of future results. The value of investments and the income from them can go down as well as up and investors may not get back the amount invested. Fidelity’s legal representative in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Paying agent for Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Malta: Growth Investments Limited is licensed by the MFSA. Fidelity Funds is promoted in Malta by Growth Investments Ltd in terms of the EU UCITS Directive and Legal Notices 207 ad 309 of 2004. The Fund is regulated in Luxembourg by the Commission de Surveillance du Secteur Financier. Issued by FIL Investments International (registered in England and Wales), authorised and regulated in the UK by the Financial Services Authority. SSO4855/0113

Ämnen

- Finans

Kategorier

- reflation

- investment clock

- trevor greetham

- fidelity worldwide investment

- fidelity international

- fidelity