Nyhet -

Volatility creates opportunity

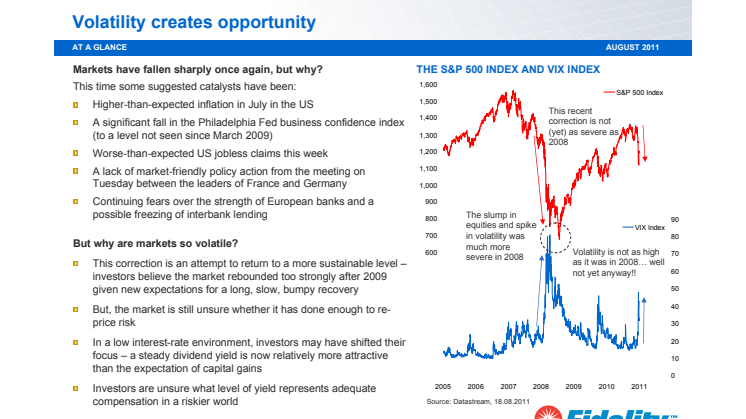

Markets fell sharply yesterday and a number of factors have been blamed for this latest decline. But why are markets so volatile? Some believe that this correction is an attempt by markets to reach a more sustainable level.

This time some suggested catalysts have been:

- Higher-than-expected inflation in July in the US

- A significant fall in the Philadelphia Fed business confidence index (to a level not seen since March 2009) - Worse-than-expected US jobless claims this week

- A lack of market-friendly policy action from the meeting on Tuesday between the leaders of France and Germany Continuing fears over the strength of European banks and a possible freezing of interbank lending

But why are markets so volatile?

This correction is an attempt to return to a more sustainable level – investors believe the market rebounded too strongly after 2009 given new expectations for a long, slow, bumpy recovery. But, the market is still unsure whether it has done enough to re-price risk. In a low interest-rate environment, investors may have shifted their focus – a steady dividend yield is now relatively more attractive than the expectation of capital gains Investors are unsure what level of yield represents adequate compensation in a riskier world.

Market volatility can persist for a long time

When investors are nervous, markets can remain volatile for a long time. This makes investing uncomfortable….but history suggests that these moments can be the best times to enter the market. The volatility we are seeing today is far less severe than what was witnessed after Lehman Brothers collapsed in 2008. If you can stomach daily volatility there could be some fantastic buying opportunities for investors with a longer-term horizon. The key is to look through the volatility and analyse the underlying value available in the market.

“We can certainly argue that equities are cheap. Apart from the depths of 2008, there aren’t many periods in the course of the last 20 years where you could argue that equities were as valued as low as they are today. I think, however, we need to recognise that while equities are cheap, they are cheap for a reason and they may stay cheap for a while longer. I think there is going to be a growing demand from equity investors for jam today, rather than jam tomorrow. That means going forward there is going to be a greater demand for income from equities than there has been over the last 15 or 20 years. The face of equity investment may change, whereby investors who have pursued capital growth will be focused much more on the income generating powers of companies.”

Dominic Rossi, Global CIO, Equities, Fidelity International

This document is for investment professionals only and should not be relied upon by private investors. It must not be reproduced or circulated without prior permission. This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Fidelity/ Fidelity International means FIL Limited, and its subsidiary companies. Unless otherwise stated, all views are those of the Fidelity organisation. Investors should note that the views expressed may no longer be current and may have already been acted upon by Fidelity. The research and analysis used in this material is gathered by Fidelity for its use as an Investment Manager and may have already been acted upon for its own purposes. Fidelity only offers information on its own products and services and does not provide investment advice based on individual circumstances. Fidelity/ Fidelity International and the pyramid logo are trademarks of FIL Limited. Our legal representative in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Paying agent for Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Malta: Growth Investments Limited is licensed by the MFSA. Fidelity Funds is promoted in Malta by Growth Investments Ltd in terms of the EU UCITS Directive and Legal Notices 207 ad 309 of 2004. The Fund is regulated in Luxembourg by the Commission de Surveillance du Secteur Financier. Issued jointly by FIL Investments International (registered in England and Wales), authorised and regulated in the UK by the Financial Services Authority and FIL Distributors International Limited (registered in Bermuda and licensed to conduct investment business by the Bermuda Monetary Authority), licensed as a Financial Services Provider. SSO4198/0812

Ämnen

- Finans

Kategorier

- volatility

- börsras

- fidelity

- fidelity international

- finanskrisen

- market volatility

- återhämtning

- volatile markets