Pressmeddelande -

PYRAMIS SURVEY REVEALS SURGE IN CONFIDENCE AMONG WORLD’S LARGEST INSTITUTIONAL INVESTORS

PYRAMIS SURVEY REVEALS SURGE IN CONFIDENCE AMONG WORLD’S LARGEST INSTITUTIONAL INVESTORS

Stockholm, 28th October 2014: Confidence has returned among institutional investors worldwide, according to a new survey by Pyramis Global Advisors.

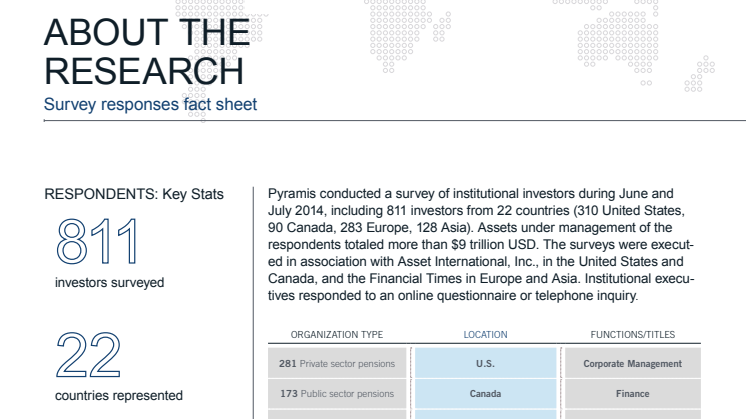

Nine in ten (91%) pension plans and other institutional investors believe they can achieve target returns in five years, significantly higher than the 65 percent reported in 2012, according to the 2014 Pyramis Global Institutional Investor Survey, which includes 811 respondents in 22 countries representing more than USD$9 trillion in assets.

“After years of strong equity returns and below average volatility, institutional investors want to keep their winning streak going,” said Pam Holding, chief investment officer, Pyramis. “Our global survey shows that while the outlook on volatility varies greatly by region, institutions worldwide largely agree that they can continue to grow their portfolios and improve funded status.”

Significant Regional Differences

The Pyramis survey identifies regional differences across such topics as: expectations for market volatility, perspectives on alternatives, investment objectives and investment opportunities. “The survey gives us great insight into the current thoughts of the largest institutional investors worldwide. Nordic results provide some interesting observations such as the level which investors consider themselves fully understanding the risks in their own portfolios. 79% of the investors in Europe, excluding the Nordic countries, believe they fully understand the risks in their portfolios, whereas the corresponding average for the Nordic investors is 88%. In Finland, no less than 100% of the respondents claim they fully understand the risks in their portfolios”, states Henrik Jonsson, Head of Institutional Sales Nordic region, Fidelity Worldwide Investment, the sole distributor of Pyramis’ institutional investment products outside North America.

Market Volatility Expectations

Outside the U.S. and Canada, volatility expectations over the long term are quite low with a decrease in the frequency of boom/bust cycles expected in Asia (91%) and Europe (79%). Only seven percent of U.S. institutions expect volatility to decrease, while 42 percent expect an increase in volatility. This trend continues across North America with only 10 percent of Canadian plans expecting a decrease in volatility, while 60 percent foresee an increase.

While market volatility remains a top concern in Europe and Asia, U.S. institutions are expressing less worry about capital markets than years past. Europe also remains concerned about a low return environment, while Asia is focused on regulatory and accounting changes and Canada is focused on risk management. The top concern for U.S. plans is current funded status (28%), with a majority of pensions intending to improve it.

While the use of alternative investments is still rising rapidly in the rest of the world, use of liquid and illiquid alternatives appears to be slowing among U.S. institutions.

Among respondents planning an allocation increase to illiquid alternatives over the next one to two years, Asia leads the way with 79 percent, followed by Europe (57%) and the U.S. (22%).

When asked which investment approaches are most likely to underperform over the long term, 31 percent of U.S. respondents cite hedge funds as least likely to meet expectations. Risk factor investing is expected to be the biggest disappointment among Canadian, European and Asian plans.

When asked specifically about the fees associated with alternative investments, only 19 percent of U.S. plans surveyed say hedge funds and private equity are worth the fees, as compared to 91 percent in Asia and 72 percent in Europe.

“U.S. plans are currently re-evaluating the complexity, risks and fees associated with hedge funds,” said Derek Young, vice chairman of Pyramis Global Advisors. “Our survey suggests that U.S. institutions are preparing to move back to a more traditional, back-to-basics portfolio.”

Investment Objectives

On average, primary investment objectives among global institutions lean toward growth, but results vary considerably by geography. Asian institutions are overwhelmingly focused on growth, with 64 percent listing capital growth as the primary investment objective. For plans in the U.S., funded status growth is the primary investment objective, but levels differ among public plans (62%) and corporates (37%). Plans in Europe are primarily focused on preservation, while Canadian institutions are equally focused on preserving and growing their funded status.

Investment Opportunities

A global view of the survey results shows plans are seeking investment opportunities over the medium term predominantly in emerging Asia. However, a regional breakdown reveals a geographic tilt. Seventy-one percent of plans in Asia cite emerging Asia as the top medium-term growth prospect. U.S. and Canadian plans favour North America (34%) and emerging Asia (32%). European plans favour North America (33%), emerging Asia (21%) and developed Europe (19%).

For additional materials on the Pyramis survey, go to www.pyramis.com/survey.

About the Survey

Pyramis Global Advisors conducted its survey of institutional investors in the summer of 2014, including 811 investors in 22 countries (191 U.S. corporate pension plans, 71 U.S. government pension plans, 48 non-profits and other U.S. institutions, 90 Canadian pension plans, 283 European and 128 Asian institutions including pensions, insurance companies and financial institutions). Assets under management represented by respondents totalled more than USD$9 trillion. The surveys were executed in association with Asset International, Inc., in North America, and the Financial Times in Europe and Asia. CEOs, COOs, CFOs, and CIOs responded to an online questionnaire or telephone inquiry.

About Pyramis Global Advisors

Pyramis Global Advisors, a Fidelity Investments company, delivers asset management products and services designed to meet the needs of institutional investors around the world. Pyramis is a multi-asset class manager with extensive experience managing investments for, and serving the needs of, some of the world’s largest corporate and public defined benefit and defined contribution plans, endowments and foundations, insurance companies, and financial institutions. The firm offers traditional long-only and alternative equity, as well as fixed income and real estate debt and REIT investment strategies. As of June 30, 2014, assets under management totalled nearly $215 billion USD. Headquartered in Smithfield, RI, USA, Pyramis offices are located in Boston, Toronto, Montreal, London, and Hong Kong. Outside of North America, Fidelity Worldwide Investment is the sole distributor of Pyramis’ institutional investment products.

About Fidelity Worldwide Investment

Fidelity Worldwide Investment is an asset manager serving retail, wholesale and institutional investors in 25 countries globally outside North America. With USD $290.1 billion assets under management as of June 30, 2014, Fidelity Worldwide Investment is one of the world’s largest providers of active investment strategies and retirement solutions. Institutional clients benefit from the breadth of our investment platform, which combines our own product range and through a sub advisory agreement, the capabilities of Pyramis Global Advisors.

Pyramis, Pyramis Global Advisors and the Pyramis Global Advisors A Fidelity Investments Company logo are registered service marks of FMR LLC.

703332.1.0 © 2014 FMR LLC.

All rights reserved.

For further information, please contact:

Emma Lehtovaara

Fidelity Worldwide Investment

Tel. +46 (0)8 505 257 02

This material is for investment professionals only and should not be relied upon by private investors. Fidelity, Fidelity Worldwide Investment, the Fidelity Worldwide Investment logo and F symbol are trademarks of FIL Limited.

SSL1410N10/0415

Ämnen

- Finans

About Fidelity Worldwide Investment

Fidelity Worldwide Investment is one of the largest independent mutual fund managers. We have offices in 25 countries around the world and manage investments worth more than US$215 bn.

Fidelity was founded in 1969 and has over over 5 500 employees. We have over 7 million cients - both institutions and larger companies, but also private clients. Since 1996 we have had a presence and supported clients in the Nordic region.

We manage more than 740 funds and with more than 280 analysts and portfolio managers across the globe, we have a unique loval presence but also global expertise. Fidelity is a privately owned company.