Press release -

GOOD FY14/15 BUSINESS PERFORMANCE: +2% ORGANIC SALES GROWTH (+8% REPORTED), IN AN ENVIRONMENT THAT REMAINS CHALLENGING

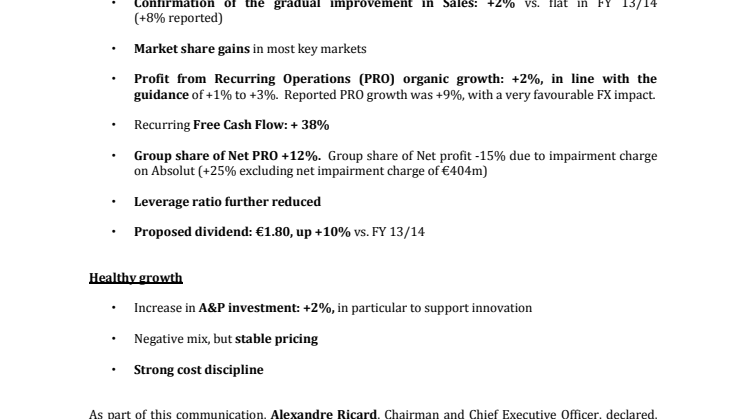

GOOD FY14/15 BUSINESS PERFORMANCE: +2% ORGANIC SALES GROWTH (+8% REPORTED), IN AN ENVIRONMENT THAT REMAINS CHALLENGING. ORGANIC PROFIT FROM RECURRING OPERATIONS IN LINE WITH GUIDANCE: +2% (+9% REPORTED PRO GROWTH).

SALES

Sales for the full year 2014/15 totalled €8,558m. Organic Sales growth was +2%.Reported Sales

growth was +8% with a very favourable FX impact.

This gradual improvement was driven by:

- Asia-Rest of the World: +4% return to growth thanks to improving Sales in China

(-2% vs. -23% in FY13/14) and continued very strong dynamism in India (+18%);

- Americas: +2% with USA stable for full year (improving in H2) and growth in rest of region;

- Europe: stability with a return to growth in Spain +2% but difficulties in Eastern Europe

and Travel Retail.

In terms of categories, growth was driven by whiskies (continued strong performance of Jameson, The Glenlivet, Ballantine’s and Indian whiskies) and also of champagnes Mumm and Perrier-Jouët, both in high single digit growth. Martell returned to growth, despite negative mix (China). Absolut was impacted by a challenging USA market but grew outside the USA.

The Top 14 returned to growth: +2% (vs. -2% in FY13/14), with a performance improvement driven by Ballantine’s and Martell and continued strong growth of Jameson and The Glenlivet.

Key Local Brands performed well: +5% driven by Indian whiskies and standard Scotch brands, despite the decline of Imperial in Korea.

Priority Premium Wines were stable with the growth of Campo Viejo offsetting Jacob’s Creek. There were market share gains in most key markets.

Q4 Organic Sales growth was +3%, with a favourable basis of comparison (destocking in Q4 13/14.) Reported Q4 Sales were up +15%, due to a stronger USD.

RESULTS

Full year PRO increased +9% (+2% organically) to € 2,238m and the PRO margin to 26.2% thanks to a favourable FX impact. Key organic margin drivers were:

- Decrease in Gross Margin ratio: -105bps, with stable pricing in a challenging and competitive environment, negative mix due to geographic mix and quality mix (Martell) yet good cost control

- Increase in A&P: +2%, overall in line with top line, with a focus on Top 14 and new business opportunities and double-digit increase in support for key innovation projects, partly financed by €25m reinvestment from Allegro, as expected

- Strong decrease in structure costs driven by Allegro: -3%, better than initially planned due to vacancies linked to implementation of new organisation.

FX impact on reported PRO was +€155m, mainly driven by USD.The cost of debt was lowered to 4.4% and is expected to be close to 4.2% for FY15/16. The corporate income tax rate on recurring items slightly decreased to 24.4%.

Reported group share of Net PRO was up +12%. Reported Group share of Net profit was down -15%,due to an impairment charge on Absolut (+25% excluding the impairment charge.) The latter was driven by lower growth in the USA, but has no cash or business impact. Group mid- to long-term prospects presented during the Capital Market Day in June are unchanged.

FREE CASH FLOW AND DEBT

Reported Free Cash Flow from recurring operations improved significantly, close to historically high levels (€1,154m, +38%) due in particular to tight working capital management. EBIT cash conversion was excellent at 88%, +6pts vs FY13/14, while the Group continued to invest in the long-term.

Free Cash Flow increased +€53m to €808m, impacted by non-recurring items of -€346m, mainly relating to the settlement of accrued tax and restructuring liabilities.

Net debt increased by +€668m to €9,021m mainly driven by a mechanical FX impact (+€964m due to variation of €/USD parity between 30 June 2014 at 1.37 and 30 June 2015 at 1.12.)The leverage ratio at average rates was reduced to below 3.5 from 3.6 for FY13/14 (with €/USD parity at 1.36 in FY13/14 vs. 1.20 in FY14/15.)

PROPOSED DIVIDEND

A dividend of €1.80 is proposed for the AGM, +10% vs FY13/14, corresponding to a pay-out ratio of 36%, in line with the customary policy of cash distribution of approximately one-third of Group net profit from recurring operations.

For more information visit. www.pernod-ricard.com

Related links

Categories

- pernod ricard

- financial report

The Absolut Company has the worldwide responsibility for the production, innovation and strategic marketing of Absolut Vodka, Malibu, Kahlúa, Wyborowa, Luksusowa och Frïs. Absolut Vodka is the world’s fourth largest premium spirits brand. Every bottle of Absolut Vodka is produced in Åhus, southern Sweden. Malibu is the number one rum-based coconut spirit in the world, sold in more than 150 countries. Kahlúa coffee liqueur is the world leader in its category. The head office is located in Stockholm, Sweden. The Absolut Company is a part of Pernod Ricard, which holds one of the most prestigious brand portfolios in the sector.