Blog post -

Rolling Forecasts: is it time to abandon the traditional budget? (Part 1)

The traditional budget has been the mainstay of business finance for as long as we can remember but, with the arrival of cloud technologies and a new generation of finance philosophy, some question the relevance of this antiquated process in today’s increasingly agile and competitive economic landscape.

Increased automation of traditional accounting and finance processes has given way to data-driven, financial planning & analysis (FP&A) and the alternative, rolling forecast. This way-of-working has welcomed and enabled finance to take a more strategic role within the business and for many, has become an essential tool to radically transform the traditional budgeting process. If implemented properly, a rolling forecast expands planning horizons, reduces planning cycles and helps support the execution of organisational strategies.

Instead of using the traditional static budget to manage the business, you instead create a rolling forecast which can prove more practical when revisiting and updating budget assumptions throughout the financial year. This method allows organisations to change and adapt plans and resource allocations based on business, economic and industry changes.

What is a rolling forecast and how does it work?

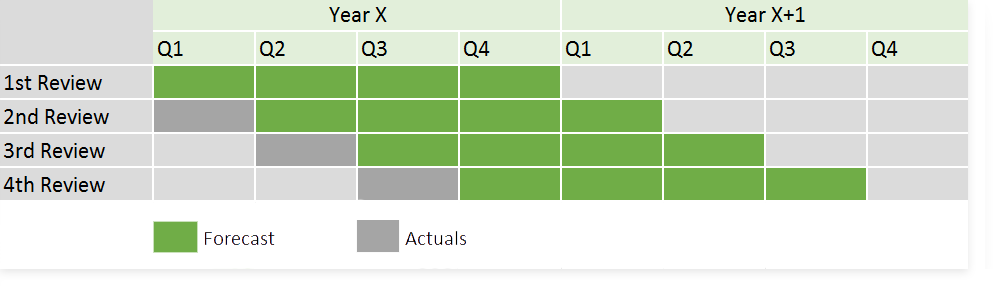

In short, a rolling forecast allows organisations to project future results based on a combination of actual YTD financial outcomes, the original budget, revenue projection fluctuations and cost forecasts for future periods. The future forecast period can be agreed according to business requirements which in some cases includes until fiscal year end, but in most cases, the rolling forecast period typically extends out from four to six trading quarters. See example below.

This method relies heavily on an add/drop approach to forecasting that creates new forecast periods, in the form of a rolling forecast, as you move through the fiscal year. The business establishes a pre-agreed period, such as quarters or months, to update their forecast. When one period closes, a new period is added to the forecast so that the business can regularly change and adapt their financial plan to reflect recent and predicted trends.

This rolling forecast approach provides organisations with the agility to manage and prepare for change in a far more proactive manner than if solely aligned to a static budget. Crafting a new year budget also becomes less of a headache since a great deal of the ‘work’ becomes part of an evolving forecast process where final actuals and future predictions benefit from regular visibility and analysis.

The suggestion of total elimination of the traditional budget, and replacing it with a rolling forecast, may seem a petrifying thought for many, but for some organisation, adopting and executing a rolling forecast process has been a worthwhile transition. The rolling forecast concept and benefits is promoted by the Beyond Budgeting Roundtable, led by industry guru Steve Player.

Getting your forecast frequency right – finding the optimal period

Weekly cash forecasts are used to project a company’s liquidity over the short to medium term, estimating the timing and amounts of cash inflows and outflows. Weekly forecasts allow organisations the visibility to understand detail at a quiet granular level example: for some businesses, cash inflows could be large one week, if in receipt of a high volume of receivables, but considerably less the following week if outflows peak due to salary payments and due rents etc. Using a weekly cash forecast has proven benefits, capturing some of the detail which can otherwise be missed if working to a wider forecasting period such as monthly, quarterly, yearly etc. So why not look at implementing an even shorter forecasting period of say, daily? Dependant on business type, and for many organisations across a range of industry sectors, a daily forecast is counterintuitive as the process can be excessive and provide no more true visibility and accuracy than a weekly or monthly forecast. For a large percentage of organisations, the weekly forecast is just right, providing sufficient granularity without process overkill.

Finding the optimal forecasting period for your business is key to maximising the benefits of a rolling forecast. A standard gauge is approximately thirteen weeks, the average fiscal quarter, but organisations should aim to understand how revenues and costs how and will be incurred within this time frame. Positioning your business to quickly react to liquidity issues is critical, therefore setting a forecast period that allows sufficient time to react, but not too far ahead that it reduces forecast confidence, is the sweet spot.

Why the arguments against weekly forecasts are short-sighted?

Here’s just some of the reasons organisations offer for not doing a forecast:

- “That’s great, but these were all distressed situations. My business is healthy, so this is a waste of time.”

- “I have a small team (or no team) and I don’t have time to put together another forecast”

- “My company is growing well, and there is nothing on the horizon to lead me to believe otherwise”

- “My business is different than the ones you described, so cash forecasting doesn’t apply to my company”

- “My shareholders/lenders/parent company believes in us and has deep pockets. Even if we have a problem, they will fund any cash shortfall we might have”

Whilst understandable, the above perspectives could also be guilty of little short-sightedness. Every business, no matter how strong or cash rich, will inevitably face difficult times - no one was prepared for the current COVID crisis and businesses of all sizes, types, location and industry focus have been negatively affected. We can’t always predict economic challenges, but we can prepare for them and the question remains as to if regular rolling forecasts and liquidity visibility could better equip organisations for bumps in the road and help mitigate the magnitude of damage of and when a crisis may occur. Knowing liquidity limits is the holy grail.

Look out for Part 2 in the series of ‘Rolling Forecasts, is it time to abandon the traditional budget?’ where we’ll further investigate the usefulness of weekly cash flow forecasts, discuss the key disciples around their construction and highlight some of the benefits of scenario modelling.

Author: David Kelin (Managing Director at DNA Treasury Limited)

Contact: email: david@dnatreasury.org

For more information on the key features and benefits of Analyste CashForecast cloud solution,

Topics

- Computers, computer technology, software

Categories

- treasury

- cashforecasting

- analyste

- fx

- cashflowforecasting

- cashmanagement

- payments

- treasurymanagementsystem

- treasurymanagementsoftware

- risk