Press release -

AXEL JOHNSON'S YEAR-END REPORT FOR 2021 - Record results, rapid renewal and decisive acquisitions

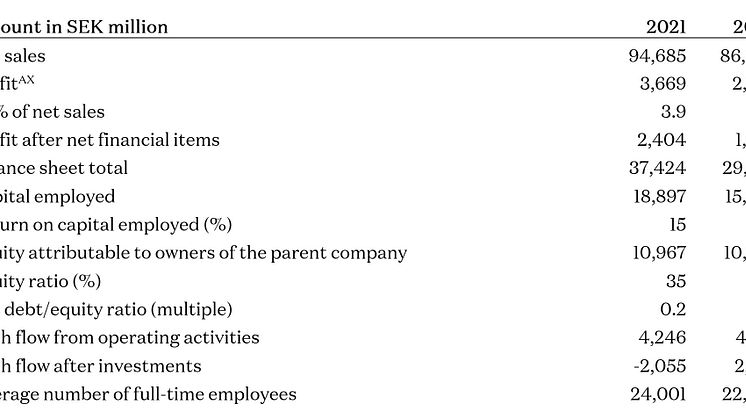

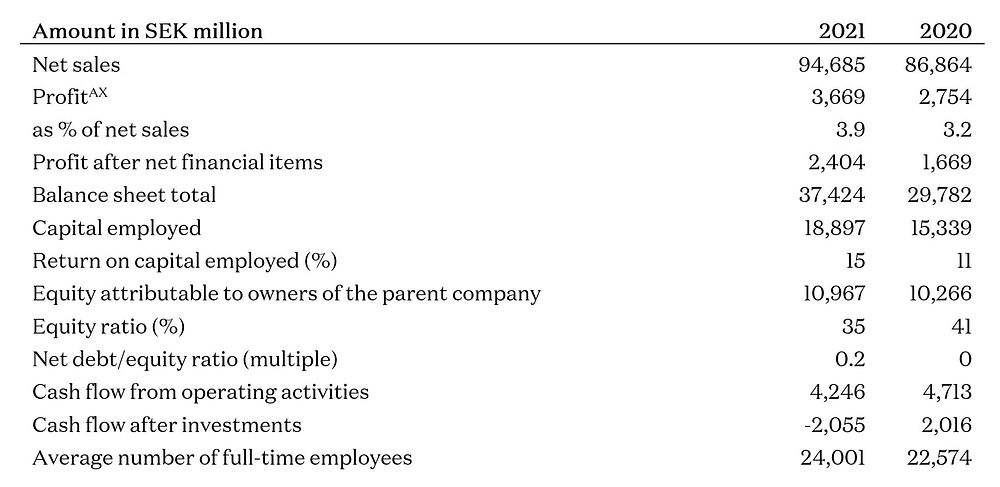

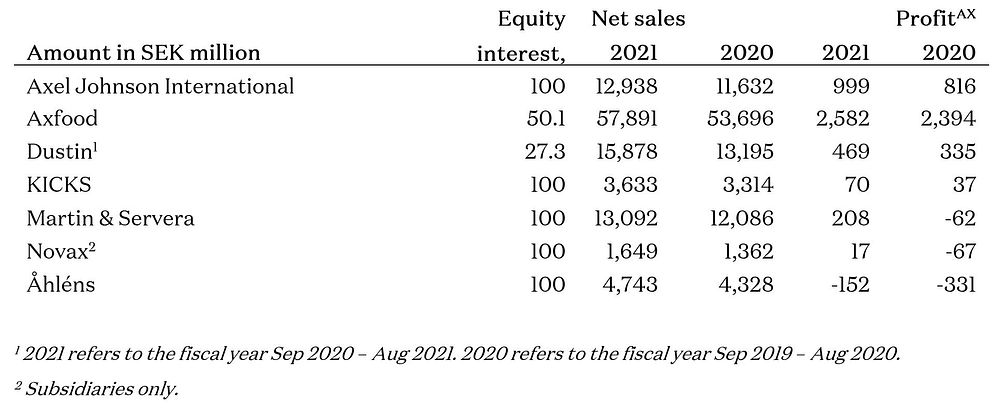

2021 was the strongest year in Axel Johnson’s history. The industrial group Axel Johnson International and Axfood recorded record results, and major investments were made in the form of both acquisitions and physical infrastructure, particularly in highly automated warehouses. Axel Johnson’s turnover amounted to SEK 94.7 billion (86.9) and our profitAX to SEK 3,669 million (2,754).

Mia Brunell Livfors, President and CEO of Axel Johnson, says,

“We achieved Axel Johnson’s best result ever in 2021. We also continued to progress at the high pace required to reach our 10/50 renewal target, despite the fact that the year began and ended overshadowed by the pandemic. It is a powerful signal, pointing to great opportunities ahead.

In 2021, our Group companies improved results across the board. The industrial group Axel Johnson International in particular had another strong year, approaching SEK 1 billion in profits. Even more important than the results of this individual year is the fact that we managed to keep up with our renewal pace. We continued to invest in the digital customer experience, as well as in increased technical skills and capabilities throughout 2021. The biggest investments in our existing operations are in automation and the development of progressively more modern and sustainable logistics.

Axel Johnson and our Group companies made a total of 26 investments in new businesses during the year. This year’s two largest acquisitions – Axfood’s acquisition of Bergendahls Food, and Dustin’s acquisition of Dutch Centralpoint – make Axfood and Dustin even better positioned for continued growth. We also continued to invest in our newer focus areas, such as the Food of the Future, Health and Solar Energy, and signed agreements to build Sweden’s two largest solar parks.

The fact that we were able to maintain a high tempo is also reflected in our figures. When we measure our progress toward our 10/50 goal – which states that in ten years’ time, half of our revenue should be from things we don’t do today – we see that seven years into the first measurement period, we are comfortably on track to meet the target.

In March 2022, we are once again forced to acknowledge how quickly markets and society can radically change. An independent European country is subjected to a brutal and unilateral attack, with incalculable humanitarian repercussions. It is a tragic event in our contemporary history where we as a company should of course contribute to the unity our society needs, both by complying with sanctions, and by helping to alleviate acute distress.

No one knows what the next year, or even the next week, will look like. But Axel Johnson is well equipped to deal with uncertainty successfully. We have a solid financial foundation, strong market positions, a high pace of change and a proven ability to adapt, plus the added strength of the long-term perspective provided by our family ownership.”

ProfitAX is EBT according to IFRS for the listed companies, and EBT excluding goodwill amortization, adjustments of contingent consideration, items affecting comparability and discontinued operations for the non-listed companies. ProfitAXis used to facilitate comparability between Group companies and other listed companies outside the Group, and comparisons between years.

Our Group Companies

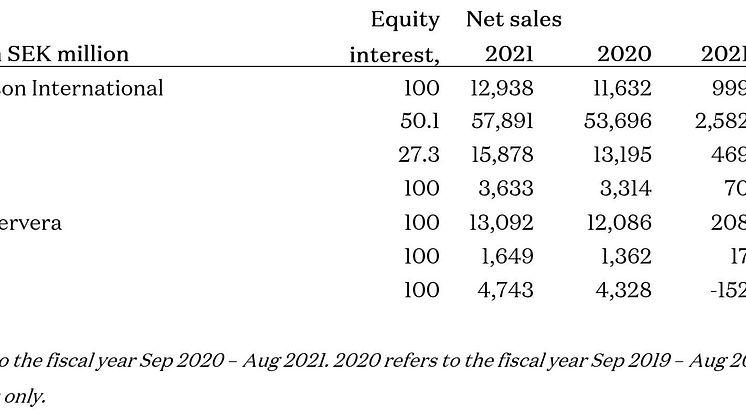

Our industry group Axel Johnson International reports record profits of SEK 999 million (816). To do this in a challenging year – with industry shutdowns in many parts of Europe during the spring and disruptions in supply chains – is a remarkable achievement. Over the past five years, AxInter has almost doubled its turnover, and more than doubled its profits.

Axfood reports very strong profits of SEK 2,582 million (2,394), and is once again growing faster than the market, both in-store and online. In addition, the decisive acquisition of Bergendahls Food, including 9.9 percent in City Gross, was completed. An agreement was signed in December that made Axfood the second largest owner of Mathem after the end of the year through the divestment of Mat.se. Willys reached a milestone during the year as e-commerce broke even.

Dustin1 had an organic sales growth of 9.6 percent, and profit totaled SEK 469 million (335). The acquisition of Centralpoint makes the company a leading player in both the Nordic and Benelux markets, which opens up good opportunities for long-term profitable growth in these markets, and in the long term creates opportunities for further expansion in Europe.

Kicks demonstrated a good ability to track customer movement between channels in a year where demand fluctuated between physical stores and e-commerce. Kicks’ investments in technological development and skills, and in improving both its digital and physical customer experience, are paying off. Sales increased by 10 percent, and profit also improved significantly to SEK 70 million (37).

Martin & Servera took important steps in the right direction during the year as Sweden’s leading restaurant wholesaler. After a tough spring with heavy restrictions, sales took off as people filled restaurants across Sweden during the summer and autumn. Profit amounted to SEK 208 million (-62) and sales in the second half of the year indicate that the underlying demand is well in line with pre-pandemic levels.

Åhléns increased its profit to SEK -152 million (-331). The spring of 2021 was marked by tough restrictions in physical stores, but both sales and profitability improved significantly in the autumn. At the same time, e-commerce continued to grow, and sales in Åhléns’ outlet stores also performed strongly. In 2021, Åhléns invested in a number of priority areas for the future. These include digital customer experience and personalization, as well as the establishment of the automated warehouse that will be operational in summer 2022 and will streamline and improve deliveries and e-commerce offerings.

Our investment business Novaxhas continued to develop and invest in its core areas of Health & Wellness, the Food of the Future, Technical Security and Retail Technology – areas that have the potential to become significant future parts of Axel Johnson. In terms of Health, fitness chain STC acquired fellow industry player Puls & Träning, making STC Sweden’s second largest chain in terms of number of facilities. In terms of Food, Novax invested in the British ingredients company Ulrick & Short, which supplies plant-based, natural ingredients to the food industry.

AxSol invested in two new solar energy companies during the year: EnergiEngagemang and Epishine. EnergiEngagemang is a leading provider of solar solutions for commercial and large-scale installations, while Epishine is a research-based producer of flexible, printed solar cells for indoor use. The market showed good demand and we see great opportunities for continued European expansion in several of AxSol’s six companies and for strong growth in the Swedish market, especially in large-scale solar parks.

Axel Johnson’s 2021 results

Group companies

Translated from the original Swedish. In case of discrepancies, the Swedish original text prevails.

For more information, please contact David Salsbäck, Director of Sustainability and Communications, Axel Johnson, +46 (0)8-701 61 05, david.salsback@axeljohnson.se

Related links

Topics

Categories

Axel Johnson is one of the Nordic region’s leading trading groups which builds and develops businesses within trade and services in the European market, with main focus on the Nordic region. Group companies currently comprise Axel Johnson International, KICKS, Martin & Servera, Novax, Åhléns and the partly owned listed companies Axfood (equity stake 50.1 %) and Dustin (equity stake 27.3 %). Axel Johnson’s consolidated annual sales amounts to SEK 94.7 billion (2021) and the wholly and partly owned companies have about 25,000 employees. Axel Johnson is a family-owned company in the fourth and fifth generation and is owned by Antonia Ax:son Johnson and her family.