Press release -

AXEL JOHNSON’S YEAR-END REPORT FOR 2022

Success in troubled times: Strong results, growth and continued renewal

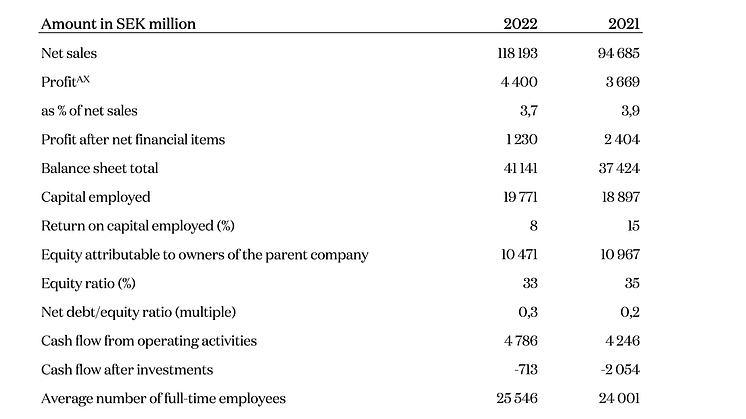

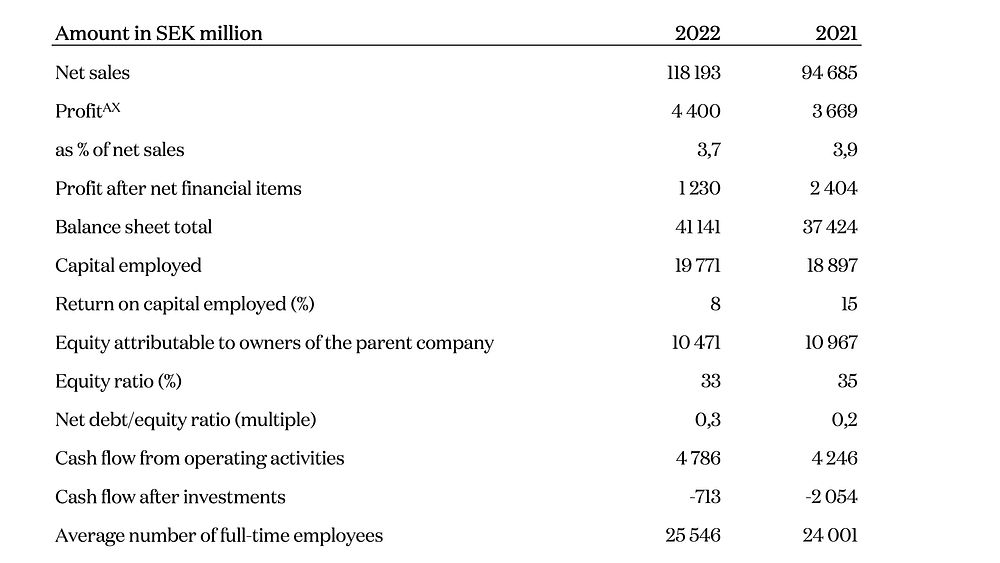

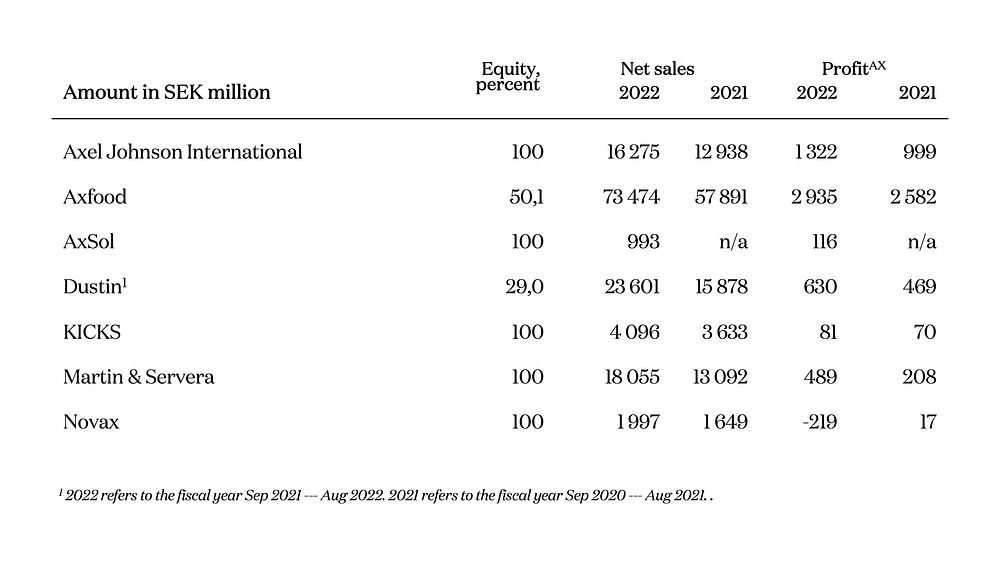

The year 2022 ended as a new record year for Axel Johnson. Axfood, Martin & Servera and the industrial group Axel Johnson International all recorded their best earnings to date. At the same time, large investments were made through acquisitions and investments in physical infrastructure, above all in highly automated warehouses. Axel Johnson’s revenues amounted to SEK 118.2 (94.7) billion and profitAXto SEK 4.4 (3.669) billion.

Axel Johnson CEO Mia Brunell Livfors says:

“We are proud to end with yet another historically strong year marked by growth, record profits and continued growth of our business.

“We once again saw broad improvements in earnings, with the greatest impact being the growth and development of our three largest group companies: In a grocery industry characterized by inflation, volume loss and squeezed margins, more customers than ever have found Willy’s high-quality, low-price offer. Over the past five years, Axel Johnson International has nearly tripled its earnings. Martin & Servera achieved strong improvement in earnings and gained market share as the restaurant industry opened up again.

“As important as the year’s strong results is the fact that we are keeping pace with our transformation, where we are well on our way to achieving our 10/50 goal. We have continued to invest in digital customer experience, in increased technical capacity and automation of our logistics to increase efficiency, and to reduce our climate footprint.

“In addition to the transformation of our existing operations, we have continued to invest and make acquisitions in growth areas such as solar energy, future food and health.

“It is also from the perspective of our transformation that one should understand our divestment of Åhléns, after 34 years as owner. Apart from our strong position in beauty, discretionary B2C retail is generally no longer a focus area of Axel Johnson as we develop going forward.

“In short, Axel Johnson’s 2022 has been very successful. But if we cast our gaze just a bit more widely, it is harder to describe 2022 as positive. In March, we saw a brutal and unilateral attack on a free European country. We have been able to follow with admiration the resistance with which the Ukrainians have met the invasion. It is a resistance that deserves our society’s support.

“The after-effects of the war have contributed to an inflation within the Swedish economy that we have not seen for more than a generation, which has been the cause of Swedish households losing real income. The inflation that we are currently seeing, not least within food, are negative not only for households, but also for businesses and society as a whole.

“These are challenging times for those of us who are fundamentally optimists. But as a business group, part of our role is to contribute constructively with faith in the future and growth. We want to be on the right side of the big issues of our time. Which is why we, for example, want to grow into a significant European player in solar energy, and why we see working for a more sustainable food market as both our responsibility as well as an opportunity.

“In addition to our solid financial base, Axel Johnson has an additional advantage in a turbulent market and social situation: our form of ownership. Axel Johnson has been in business for 150 years and is run by the fifth generation of an owner family that strives to combine business with benefitting society, and impatience with a long-term perspective. It is from a position of strength that Axel Johnson faces the uncertainty and the opportunities that lie ahead.”

ProfitAX is EBT according to IFRS for the listed companies, and EBT excluding goodwill amortization, adjustments of contingent consideration, items affecting comparability and discontinued operations for the non-listed companies. ProfitAX is used to facilitate comparability between Group companies and other listed companies outside the Group, and comparisons between years.

Group Companies

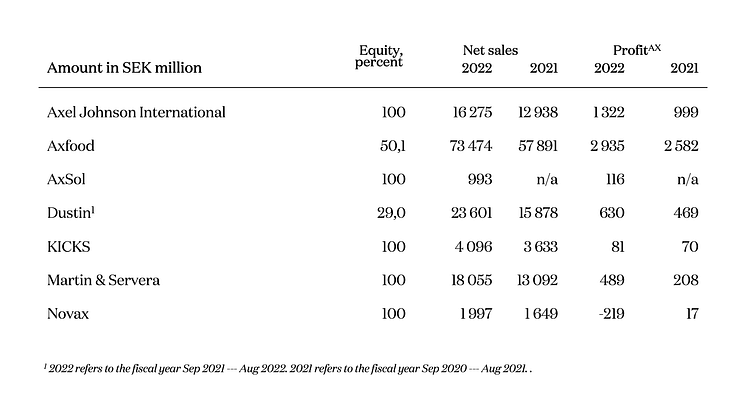

The industrial group Axel Johnson International reported record profits of SEK 1,322 million (999), through a continued combination of organic and acquired growth. Over the past five years, Axel Johnson International has almost doubled its turnover and tripled its profit.

Axfood had very strong profits of SEK 2,935 million (2,582) and is once again growing faster than the market, both in-store and online. During a year of rapidly rising food costs, Willy’s combination of price value and high quality has been particularly successful. Hemköp has also gained market share in relation to comparable competitors.

Dustin1 had organic revenue growth of 11.4 percent, and profits amounted to SEK 630 million (469). During the year, the acquired operations in Benelux were integrated with the Dustin brand. In the short term, there are challenges in the form of more frugal customers among small and medium-sized companies, but the leading position in the Nordics and Benelux establishes good conditions for profitable growth in these markets, and in the long term for further expansion in Europe as well.

Kicks once again showed skill in serving their customers during quick shifts between e-commerce and physical stores. Kick’s investments in technical development and competence, and in the improvement of both the digital and physical customer experience are yielding results. Sales exceeded SEK 4 billion for the first time, and profits improved to SEK 81 (70) million. In late fall, a decision was made to place Kicks and Skincity together in the Kicks Group.

Sweden’s leading restaurant wholesaler Martin & Servera showed good growth and took market share in an industry that bounced back strongly after the pandemic. After a tough start to the year, sales picked up considerably as people again filled restaurants during the spring, summer and fall. Profits landed at SEK 489 (208) million. Martin & Servera continued with the gradual electrification of its transport fleet, and at the beginning of the year was able to benefit from its investment in what was at the time Sweden’s largest solar park.

Our investment business Novax has continued to develop and invest within its core areas of Health & Wellness, Food of the Future, Technical Security and Retail Technology. On the Food side, Novax has created the Ingå Group, with the ambition of building a leading European company group within sustainable functional ingredients for food production. Today, the British company Ulrick & Short and the French company Louis Francois are included in Ingå.

At the beginning of the year, AxSol became the majority shareholder in Solkompaniet, in connection with a new issue of shares. Solkompaniet and EnergiEngagemang, also majority owned, are both leading players in the Swedish large-scale solar energy market. AxSol is also the largest owner of Oslo-based Otovo, a marketplace for solar energy for households, which expanded geographically during 2022 and is now present in 13 markets. Solar energy grew strongly across Europe, and there are great opportunities for rapid growth in the Swedish market, not least in solar parks, which have so far been held back due to long and difficult permit processes.

Axel Johnson's 2022 results

Group companies

Translated from the original Swedish. In case of discrepancies, the Swedish version prevails.

Topics

Categories

Axel Johnson is a leading family-owned business undergoing rapid transformation with a view to the group’s 10/50 goal. The group companies today consist of Axel Johnson International, AxSol, KICKS, Martin & Servera and Novax, as well as the partly owned listed companies Axfood (ownership 50.1%) and Dustin (ownership 29.0%). The group companies have a total of around 25,000 employees. Axel Johnson is a family business now into its fourth and fifth generation and is owned by Antonia Ax:son Johnson and family. Axel Johnson is included as one of four independent groups within the Axel Johnson Group together with the real estate company Axfast, U.S.-based Axel Johnson Inc. and the holding company AltoCumulus.