Sajtóközlemény -

Ford Credit to use new approach in car financing In Hungary

BUDAPEST, Hungary, 28. February. 2019 – Ford Credit, the financial services arm of Ford Motor Company, has just launched a new Ford Options product. This allows more frequent replacement of vehicles and shorter-term financing to be used, thus making car financing more predictable and projectable for customers.

Sales of new passenger vehicles and small commercial vehicles were up by nearly 17 % in 2018 in Hungary, surpassing 166 000 units in total.*

The growth seen in the Hungarian vehicle market in recent years was due primarily to the strengthening of retail vehicle purchases. 35% of the growth seen since 2017 came from retail purchases. Finance programmes supporting retail vehicle sales have been a contributory factor to this increase.

After the years of crisis in 2008 and 2009, dynamic growth began in the financing market in 2014 – as seen from official data published by the Hungarian Leasing Association. Since 2014, the volume of financing granted in the retail passenger, and small commercial vehicle segments has expanded by more than 150 %, surpassing HUF 180 billion in total, according to data from the first three-quarters of 2018.**

The growth of the retail market has an effect on the retail vehicle leasing market as well. While retail customers accounted for 22 % of the total financing granted in the first three quarters of 2016, this percentage was 31 % in the first three quarters of 2017 and 33 % in the first three quarters of 2018.

This is the segment where Ford Credit is offering a brand new product – Ford Options.

Ford Credit is a financial service provider owned by the Ford Motor Company. This year, Ford Credit Hungary is launching a retail-financing product, which has a long history and has become a very popular method of financing vehicles in Western Europe.

Ford Options was launched in the UK, Ford’s largest European market, in 1992, and other financing companies soon launched similar products, called Personal Contract Purchases (PCP). In 2018, it was estimated that 83 percent of newly registered cars in the UK were financed on PCPs.

Experience across the UK car industry shows that PCP financing has resulted in customers driving a new car more often than with a conventional loan agreement and that some customers remain in a PCP programme to drive multiple new vehicles over time.

„Actually, Ford Options represents a new approach to financing for Ford in Hungary” – said Tamás Gyureskó, head of operations from Ford Credit. „This product has proven to be so successful in other European markets because it turns the vehicle financing cost of ownership into a predictable cost with lower monthly payments and shorter trading cycles. This allows customers to replace their vehicles, after the expiry of the financing contract, with another new Ford, which will have the latest safety, technology and design features available, without having a substantial increase in the monthly cost of financing or having to invest energy into selling their old vehicle. ”- added Mr. Gyureskó.

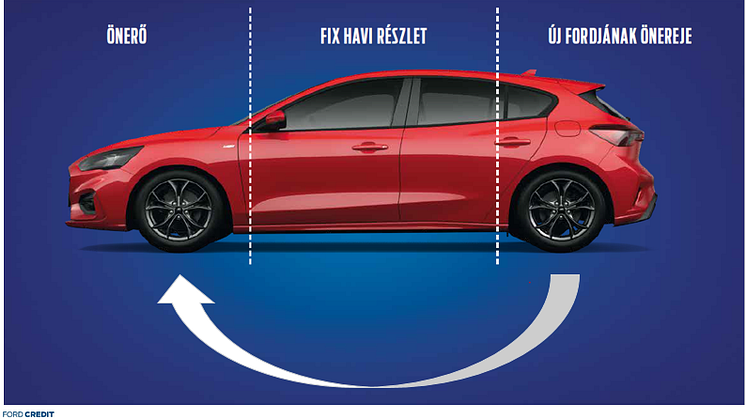

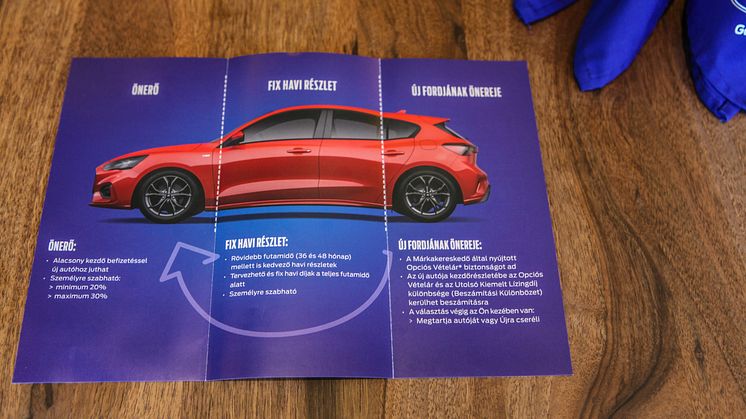

So, how does Ford Options work?

- 1. The customer chooses their new Ford, how long they wish their agreement to run for (XX or YY months), their anticipated annual mileage and their deposit amount (maximum deposit of MM percent).

- 2. Ford Credit states fixed monthly payments for the duration of the agreement and the optional final payment, which is the anticipated future value of the vehicle assuming its mileage and condition are as agreed with the customer.

- 3. At the end of the agreement, the customer has three options: renew, return or retain.

- Renew: The customer can drive another new Ford by trading in their car in or selling it privately. Once the customer has fully settled their Options account, including the optional final payment, any money left may be used as the deposit for a new Ford car.

- Return: Assuming all monthly payments have been made, the customer has nothing further to pay, providing the car is in good condition and within the agreed mileage.

- Retain: If the customer decides to keep the car, assuming all monthly payments have been made, they just need to make the optional final payment plus the purchase fee, and it’s theirs to drive away.

In 2018, almost half of the retail financing contracts of Ford Credit were Trade Cycle Financing products like Ford Options in Europe. With experience showing that the use of trade cycle financing has resulted in the period of use for cars decreasing to between 3 and 4 years, with customers having their fourth, fifth or sixth Ford car financed under similar conditions. Ford Credit, as the financing provider for the market-leading brand in Hungary, is working on changing the prevailing approach to financing and the financial education of vehicle buyers. Ford Options is offered solely by Ford dealers, where fully trained dealership staff will help customers become familiar with the opportunities provided by this new product.

* Based on data from Datahouse

** www.lizingszovetseg.hu/hasznos/elemzesek

Erőforrás linkek

Témakörök

Címkék

A Ford Motor Company

A Ford Motor Company globális vállalat, amelynek központja a Michigan állambeli Dearborn. A vállalat tevékenységi köre a Ford személyautók, haszongépjárművek, városi terepjárók (SUV) és elektromos hajtású autók, valamint a Lincoln luxusautók tervezése, gyártása, értékesítése, szervizelése és a velük kapcsolatos szolgáltatások biztosítása. A vállalat a Ford Motor Credit Company révén pénzügyi szolgáltatásokat is nyújt. A Ford vezető szerepre törekszik az elektromos autók, az önvezető járművek és a mobilitás területén. A Ford mintegy 199.000 embert foglalkoztat világszerte. Amennyiben több információra van szüksége a Fordról, termékeiről vagy a Ford Motor Credit Company vállalatról, kérjük, keresse fel a www.corporate.ford.com vagy a www.ford.hu honlapot.

A saját tulajdonú vállalatokban körülbelül 53.000 alkalmazottat, az összevont, illetve nem összevont közös vállalkozásokkal együtt pedig mintegy 67.000 embert foglalkoztató Ford Európa felel a Ford márkához tartozó autók gyártásáért, értékesítéséért és karbantartásáért Európa 50 piacán. A Ford Motor Credit Company mellett a Ford Európa üzleti tevékenysége magában foglalja a Ford Ügyfélszolgálat és 24 gyártóüzem (16 saját tulajdonú vagy összevont közös vállalat és 8 nem összevont közös vállalkozás) működtetését. Az első Ford autókat 1903-ban szállították Európába – ugyanabban az évben, amikor a Ford Motor Companyt alapították. Az európai gyártás 1911-ben indult meg.