News -

Survey: Annual external costs for impact reporting typically in EUR10-25k range

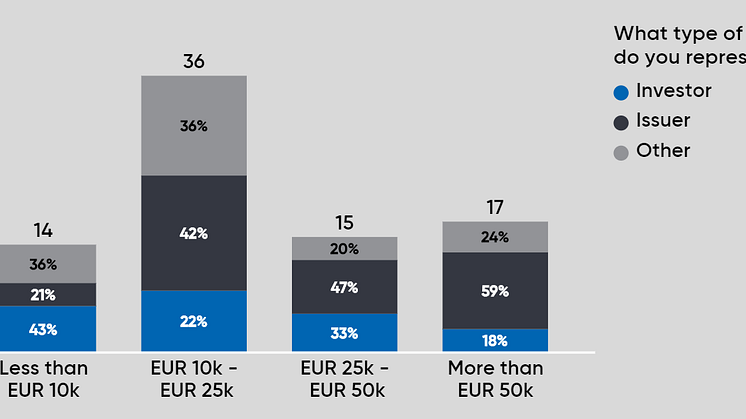

The external costs for impact reporting, to produce as an issuer and review/consolidate as an investor, typically amount to EUR 10k-25k annually, according to a recent survey[1] on impact reporting.

The survey shows that the annual external costs for impact reporting are EUR 10k-25k for 44 % of respondents, EUR 25k-50k for 18 % of respondents, while for 21% of them, the external costs incurred for consultants, third party verification, editing/publishing, etc., exceed EUR 50k, sometimes by a very large margin. In all, 121 respondents participated, of which 43 issuers, 23 investors and 54 “Other”.

The survey was first undertaken at a seminar on impact reporting arranged in Frankfurt on June 14 by a group of international green bond issuers and two banks, with +70 delegates participating. The seminar objective was to encourage a deepened international dialogue and to share knowledge on a topic of high relevance to the green bond market. As the green bond market continues to grow, it is imperative to encourage harmonized, robust and conservative impact reporting. Initiatives from ICMA/the multilateral development bank as well as Nordic public sector issuers pave the way[2].

Perhaps surprisingly, 24 % of the survey respondents are already providing or getting reporting on climate-related physical risk, while 43 % of respondents said they expect to be able to report/collect such data for green bond projects within 2 years.

In terms of time spent internally on impact reporting, to produce as an issuer/to review and consolidate as an investor, the majority of respondents spend at least 15 days per year, with issuers typically spending at least 30 days.

For the vast majority of investors, impact reporting is material in the investment decision making. By a factor of 5:1, investors would either sell the bond or mark it as non-green if they do not get the impact reporting they require.

The UN Sustainable Development Goals (SDGs) seems to have made inroads into impact reports and green bond frameworks. Almost half or respondents provide or expect at least simple alignment to the SDGs, ie. following the ICMA high-level mapping or similar.

Finally, reporting on bond-by-bond approach (impact is reported in relation to each outstanding green bond). seems to be the preferred option for investors, while issuers tend to follow the portfolio approach (where impact is reported for the issuer’s outstanding green bonds portfolio).

In order to mitigate this potential mismatch of preferences, the Nordic public sector issuers recommend issuers to report impact to meet demands both from investors which prefer impact reporting data relevant to the specific bond that they have purchased as well as from investors who prefer an aggregated approach.

The complete survey results are available in the PDF attached to this release.

[1] The poll was undertaken live on two occasions: 1) At an impact reporting seminar arranged on 14 June 2019 in Frankfurt by a group of international green bond issuers (BerlinHyp, EnBW, Iberdrola, Kommunalbanken, Kommuninvest and Munifin) and two banks (Crédit Agricole and SEB); and 2) at the ESG in Fixed Income conference in London, arranged by Environmental Finance, on 17 June 2019. From 17-23 June 2019, the survey was open to online voting.

[2] The Harmonized Framework for Impact Reporting (HFI), originally published in 2015, was republished in 2019 as a Handbook, merging the “Proposal for a harmonized framework for impact reporting” with all subsequent guidance documents developed by the Impact Reporting Working Group under the Green Bond Principles. The Nordic Position Paper on Green Bonds Impact Reporting, which is based on the HFI, provides procedural guidance and impact reporting specifics related to the Nordic situation. Originally published in 2017, an updated version was published in 2019.