Pressmeddelande -

AkzoNobel announces Q3 results

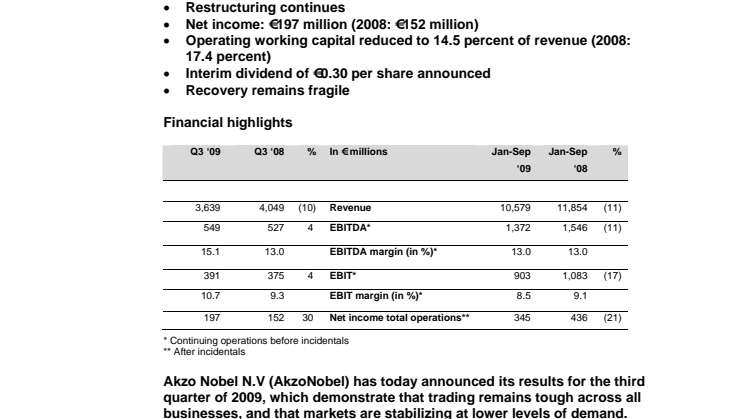

- Revenue declined 10 percent to €3,639 million

- EBITDA* of €549 million, EBITDA margin at 15.1 percent

- Restructuring continues

- Net income: €197 million (2008: €152 million)

- Operating working capital reduced to 14.5 percent of revenue (2008:17.4 percent)

- Interim dividend of €0.30 per share announced

- Recovery remains fragile

Akzo Nobel N.V (AkzoNobel) has today announced its results for the third quarter of 2009, which demonstrate that trading remains tough across all businesses, and that markets are stabilizing at lower levels of demand.

"We have seen some signs of an improvement in emerging markets, but overall we don't foresee a quick recovery," said AkzoNobel CEO Hans Wijers. "The business environment continues to be tough, so it's pleasing to see that our focus on customers, costs and cash is proving to be effective. We remain committed to implementing our restructuring and integration programs and we are on track to deliver on our previously stated EBITDA margin target of 14 percent by the end of 2011."

Please read the pdf version of this press release to view Financial highlights and development of the Revenue growth for Q3 2009.

Management focus

EBITDA from continuing operations before incidentals was 4 percent higher at €549 million, due to continued margin management and cost reduction programs. Decorative Paints is undertaking a major restructuring of the European supply chain, while all businesses in Performance Coatings benefited from margin management and cost reduction programs leading to an EBITDA of €166 million, 12 percent higher than 2008. Focus on cost and cash reduced the Specialty Chemicals cost base and partially offset the volume shortfall.

Balance sheet and dividend

The balance sheet remains robust with a reduction of net debt to €2.0 billion andreduced operating working capital to 14.5 percent of revenue, down from 16.3 percent in Q2.

The company's dividend policy is based on an annual pay-out ratio of at least 45 percent of net income before incidentals and fair value adjustments for the ICI acquisition. The interim dividend has been set at €0.30 per share (2008: €0.40 per share). The final dividend will be proposed to the Annual General Meeting of Shareholders on April 28, 2010.

Restructuring costs

Major restructuring projects in Decorative Paints were related to further supply chain and integration projects in Continental Europe and to rightsizing capacity and store closures in the US. In Performance Coatings, the company incurred costs for headcount reduction programs in Industrial Activities and Car Refinishes. In Specialty Chemicals, the closure of the Skoghall site in Sweden was announced and €49 million was recognized as restructuring costs. The process for an intended 20 percent reduction of staff working at the Amsterdam head office and Arnhem shared service center in the Netherlands is on track.

Decorative Paints

- Revenue down 6 percent (Q2, 2009: 5 percent)

- Volume decline of 9 percent (Q2, 2009: 10 percent)

- EBITDA at €198 million (2008: €207 million)

- EBITDA margin at 15.2 percent (2008: 15.0 percent)

- Trade market remains weak

- Margins positively impacted by continued restructuring, mix improvements and new product launches

- US market still depressed

- Strong performance in Europe on the back of mix and restructuring initiatives

Revenue was 6 percent down. The EBITDA margin was 15.2 percent (2008:15.0 percent). In Europe, volumes were down compared with last year, but price increases mitigated the revenue decline. EBITDA margin improved on 2008 despite the weakness of the pound sterling. The US market was still depressed and US stores had a challenging quarter as the commercial market remained soft. Restructuring activities are continuing with the closure of 48 stores in the quarter. The relaunch of Glidden is gaining momentum. China experienced growth fueled by advertising and new product launches.

Performance Coatings

- Revenue decreased by 12 percent

- Volumes down 11 percent (Q2, 2009: 19 percent down)

- EBITDA up 12 percent at €166 million (2008: €148 million); EBITDA margin at 16.1 percent

- Cost levels decreased as restructuring programs continue

- Improving performance in Industrial Activities

Revenue in Performance Coatings declined 12 percent as a result of lower demand across all businesses. Volume decreased 11 percent (Q2, 2009: 19 percent down).Volumes are still below prior year level. With the exception of the late cycle Marine and Protective Coatings business, some recovery in volume is visible.

The emerging markets showed the most visible signs of recovery. All businesses clearly benefited from margin management and cost reduction programs, leading to an EBITDA of €166 million, 12 percent higher than in 2008. The EBITDA margin was 16.1 percent, 3.4 percent ahead of the previous year. There is an ongoing focus on capital expenditure and the increased focus on operating working capital is delivering results.

Specialty Chemicals

- Revenue decreased by 8 percent

- Volumes down 6 percent (Q2, 2009: 18 percent)

- Cost and cash saving initiatives gathered momentum, with programs in all businesses

- EBITDA at €220 million (2008: €242 million) with margin at 16.7 percent (2008:16.8 percent)

- Resilient performance at Functional Chemicals, Surface Chemistry and Pulp and Paper Chemicals

- Industrial Chemicals results under pressure

Specialty Chemicals experienced lower demand across most businesses. Market conditions remained challenging as overall demand has leveled off below 2008 and the pressure on margins has intensified accordingly.

Demand strengthened in the quarter, largely in the markets that were severely impacted early in the cycle. As a result, volumes in the quarter were 6 percent below last year. The prolonged volume shortfall has resulted in pressure on prices (5 percent), this was partially offset by acquisitions (3 percent), resulting in a revenue decline of 8 percent. The focus on cost and cash favorably impacted our cost base and partially compensated for the volume shortfall. EBITDA margin was just below 17 percent, in spite of the challenges created by weak demand and uncertain markets. EBITDA amounted to €220 million, 9 percent below 2008.

Outlook and medium-term targets reiterated

Focus continues to be given to customers, cost reduction and cash generating actions so that the company is well positioned to meet the current challenges and, as a result, will be in good shape to take advantage of the recovery when it comes. However, the economic recovery remains fragile and it continues to be difficult to predict customer demand.

The company remains committed to improving operational efficiency through further restructuring and cost control and to achieving its medium-term target of an EBITDA margin of 14 percent by the end of 2011.

The report for the 3rd quarter can be read on www.akzonobel.com/quarterlyresults.

------

Note to editors - not for publicationAkzoNobel is proud to be one of the world's leading industrial companies. Based in Amsterdam, the Netherlands, we make and supply a wide range of paints, coatings and specialty chemicals - 2008 revenue totaled €15.4 billion. In fact, we are the largest global paints and coatings company. As a major producer of specialty chemicals we supply industries worldwide with quality ingredients for life's essentials. We think about the future, but act in the present. We're passionate about introducing new ideas and developing sustainable answers for our customers. That's why our 58,000 employees - who are based in more than 80 countries - are committed to excellence and delivering Tomorrow's Answers TodayTM.

Not for publication - for more information

Corporate Media Relations, tel. +31 20 502 7833

Contact: Tim van der Zanden

Corporate Investor Relations, tel. +31 20 502 7854

Contacts: Huib Wurfbain and Ivar Smits

Safe Harbor Statement

This press release contains statements which address such key issues as AkzoNobel's growth strategy, future financial results, market positions, product development, products in the pipeline, and product approvals. Such statements should be carefully considered, and it should be understood that many factors could cause forecasted and actual results to differ from these statements. These factors include, but are not limited to, price fluctuations, currency fluctuations, developments in raw material and personnel costs, pensions, physical and environmental risks, legal issues, and legislative, fiscal, and other regulatory measures. Stated competitive positions are based on management estimates supported by information provided by specialized external agencies. For a more comprehensive discussion of the risk factors affecting our business please see our latest Annual Report, a copy of which can be found on the company's corporate website www.akzonobel.com.

Ämnen

- Ekonomi, finans

Kategorier

- akzo nobel

- akzonobel

- financial

- highlights

- results

- third

- quarter

- 2009

- q3

- hans wijers

- decorative paints

- performance coatings

- specialty chemicals