Pressmeddelande -

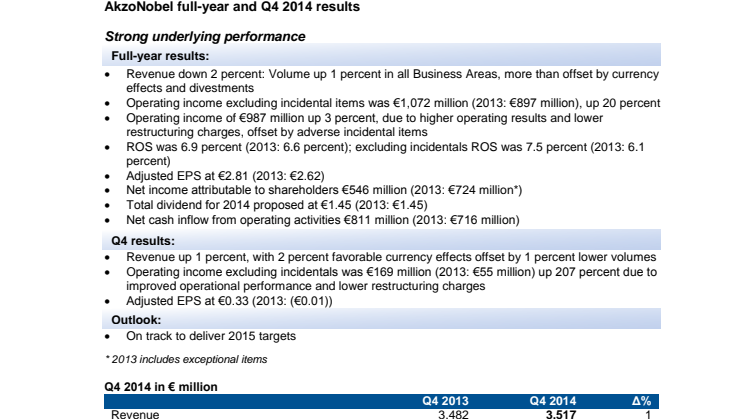

AkzoNobel full-year and Q4 2014 results

Please see pdf version of the press release for graphs and tables!

AkzoNobel full-year and Q4 2014 results

Strong underlying performance

Full-year results:

- Revenue down 2 percent: Volume up 1 percent in all Business Areas, more than offset by currency effects and divestments

- Operating income excluding incidental items was €1,072 million (2013: €897 million), up 20 percent

- Operating income of €987 million up 3 percent, due to higher operating results and lower

restructuring charges, offset by adverse incidental items - ROS was 6.9 percent (2013: 6.6 percent); excluding incidentals ROS was 7.5 percent (2013: 6.1 percent)

- Adjusted EPS at €2.81 (2013: €2.62)

- Net income attributable to shareholders €546 million (2013: €724 million*)

- Total dividend for 2014 proposed at €1.45 (2013: €1.45)

- Net cash inflow from operating activities €811 million (2013: €716 million)

Q4 results:

- Revenue up 1 percent, with 2 percent favorable currency effects offset by 1 percent lower volumes

- Operating income excluding incidentals was €169 million (2013: €55 million) up 207 percent due to improved operational performance and lower restructuring charges

- Adjusted EPS at €0.33 (2013: (€0.01))

Outlook:

- On track to deliver 2015 targets

* 2013 includes exceptional items

Akzo Nobel N.V. (AkzoNobel) today reported positive volume growth and an improvement in return on sales (ROS) for the full-year 2014. Excluding incidentals, ROS was 7.5 percent (2013: 6.1 percent).

CEO Ton Büchner

“For the full year we achieved further improvements in our operational performance, visible in our return on sales and return on investment levels. The introduction of several commercial excellence initiatives will help us drive organic growth going forward.

“2014 was challenging, evidenced by negative currency effects, a continued lack of growth in Europe and a slowdown in some of the Asian and Latin American economies. During the year, we continued to build a solid foundation and remain on track to deliver on our 2015 targets.

“The year was also notable for several key achievements. A major highlight for us in 2014 was the launch of our Human Cities initiative and our partnership with 100 Resilient Cities. We introduced the first carbon credit methodology for the international shipping industry, which allows ships to generate income in the form of carbon credits by reducing CO2 emissions. We were also especially pleased to be ranked first on the Dow Jones Sustainability Index (in the Materials industry group) for the third year in a row.”

Decorative Paints successfully implemented a new operating model in Europe. Volumes for the full year were up 1 percent with a positive volume development in Asia. Revenue declined 6 percent compared with 2013 due to divestments, adverse currency effects and an adverse price/mix effect. Q4 revenue was down 1 percent, mainly driven by the sale of the German stores, which offset 3 percent revenue growth in Asia and 6 percent revenue growth in Latin America. Operational results clearly improved.

Performance Coatings continued to profit from operational improvements and successfully introduced a new organizational structure with fewer management layers. Volumes for the full year were up 1 percent, mainly from growth in Marine and Protective Coatings and Powder Coatings. Revenue was flat compared with the previous year due to adverse currencies. Q4 revenue was up 4 percent on 2013 due to favorable currencies and price/mix, with 4 percent revenue growth in Powder Coatings and 8 percent revenue growth in Marine and Protective Coatings.

Specialty Chemicals showed increased volumes andincreased its profitability in 2014, the latter due to significant savings from restructuring programs. Volumes for the full year were up 1 percent. Revenue was 1 percent lower due to headwinds such as price pressure in caustic, unfavorable currency developments during the first half of the year and interruptions in supply chain and manufacturing. Q4 volume was 1 percent down, due to production interruptions in Rotterdam and market reactions following the large oil price reduction, leading to destocking. Q4 revenue was in line with the previous year, with the adverse impact of volumes and divestments being offset by a favorable currency effect.

Outlook

We anticipate that significant developments in raw material prices, combined with relevant exchange rate movements and lower growth rates in high growth economies, will principally determine the dynamics of 2015. The preparations made during 2013 and 2014 will form a sound basis for further improvements in 2015. AkzoNobel remains on track to achieve its targets for 2015.

The report for the full year and Q4 2014 can be downloaded via the AkzoNobel Report iPad app http://bit.ly/obljrf or read online at www.akzonobel.com/quarterlyresults.

---

Not for publication – for more information

Corporate Media Relations

T +31 (0)20 – 502 7833

Contact: Diana Abraham

Corporate Investor Relations

T +31 (0)20 – 502 7854

Contact: Lloyd Midwinter

Ämnen

- Företagsinformation

Kategorier

- delårsrapport

- q4

- helårsrapport

- kvartals rapport

- akzonobel

- akzo nobel

Om AkzoNobel

AkzoNobel är ett ledande globalt färgföretag och en stor producent av specialkemikalier och limsystem. Med expertis utvecklad under århundraden förser vi företag och konsumenter världen över med innovativa produkter skapade för att möta ökande krav i en snabbt föränderlig värld.

Vi är 48 000 medarbetare, verksamma i cirka 80 länder och har vårt huvudkontor i Amsterdam, Nederländerna. Bland våra välkända varumärken finns Eka, International, Nordsjö och Sikkens. Vi rankas återkommande som ledande inom hållbar utveckling och drivs av att förbättra människors livskvalitet och skapa levande städer.

I Sverige har AkzoNobel ca 3200 anställda på ett 15-tal platser.