Pressmeddelande -

AkzoNobel publishes Q1 2013 results

Please see pdf version of the press release for graphs and tables!

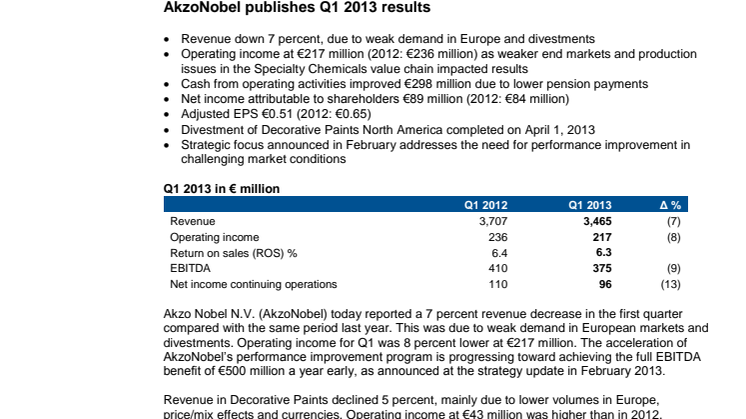

- Revenue down 7 percent, due to weak demand in Europe and divestments

- Operating income at €217 million (2012: €236 million) as weaker end markets and production issues in the Specialty Chemicals value chain impacted results

- Cash from operating activities improved €298 million due to lower pension payments

- Net income attributable to shareholders €89 million (2012: €84 million)

- Adjusted EPS €0.51 (2012: €0.65)

- Divestment of Decorative Paints North America completed on April 1, 2013

- Strategic focus announced in February addresses the need for performance improvement in challenging market conditions

Akzo Nobel N.V. (AkzoNobel) today reported a 7 percent revenue decrease in the first quarter compared with the same period last year. This was due to weak demand in European markets and divestments. Operating income for Q1 was 8 percent lower at €217 million. The acceleration of AkzoNobel’s performance improvement program is progressing toward achieving the full EBITDA benefit of €500 million a year early, as announced at the strategy update in February 2013.

Revenue in Decorative Paints declined 5 percent, mainly due to lower volumes in Europe, price/mix effects and currencies. Operating income at €43 million was higher than in 2012, reflecting lower restructuring charges and lower costs in mature markets.

Revenue in Performance Coatings declined 3 percent compared with the previous year. The slowdown in Europe impacted all businesses. Operating income was up 2 percent and margins improved due to a combination of margin management activities and ongoing cost control.

Revenue in Specialty Chemicals was 11 percent lower due to divestments and lower volumes, mainly in construction related products and the pulp bleaching and plastics industries. The cold weather affected seasonal segments such as agriculture and the exit from the merchant fatty acids business in China also contributed to the volume decline. Profitability was impacted by the lower volumes and productions stops.

Divestments

In December 2012, AkzoNobel completed the divestment of Chemicals Pakistan, which accounts for the divestment impact in revenue.

The divestment of Decorative Paints North America was completed on April 2013 and is reported in discontinued operations. The cash inflows and the deal result will be reported in Q2.

CFO Keith Nichols

“The economic environment remains challenging and we do not expect an early improvement in the trends that we see in our businesses. The acceleration of our performance improvement program and the strategic priorities announced in February are the right focus to have in these markets.”

The 2013 Q1 report can be downloaded via the AkzoNobel Report iPad app http://bit.ly/obljrf or read online at www.akzonobel.com/quarterlyresults

---

Not for publication – for more information

Corporate Media Relations, tel. +31 20 502 7833

Contacts: Paul Thomas, Jeroen Pul

Corporate Investor Relations, tel. +31 20 502 7854

Contact: Jonathan Atack, Sheryl Stokes

Relaterade länkar

Ämnen

- Ekonomi, finans

Kategorier

- akzo nobel

- akzonobel

- q1

- kvartalsrapport

Om AkzoNobel

AkzoNobel är världens största färgföretag och en ledande producent av specialkemikalier, bygglim och limsystem. Vi förser företag och konsumenter världen över med innovativa produkter och brinner för att utveckla hållbara lösningar för våra kunder. Bland våra välkända varumärken finns Eka, International, Dulux och Sikkens. Vi rankas återkommande som ett av de ledande företagen inom hållbar utveckling. Med huvudkontor i Amsterdam, Nederländerna, är vi verksamma i fler än 80 länder, där våra 55 000 engagerade medarbetare levererar Tomorrow's Answers Today™.