Blog post -

Profiling the Nordic Tech Investor Landscape

There are at least 120 tech investors active in the Nordics. What does this diverse landscape really look like? Here are some of the findings.

There are 6 main categories of investors:

- Venture Capital (funds of capital from external investors)

- Investment Companies (investing their own capital)

- Corporate Ventures (strategic investors with a parent)

- Business Angels (often organised as networks, investing regionally)

- Governments (funds and agencies, usually co-investing with private)

- Incubators (related to universities and other hubs, seed investing)

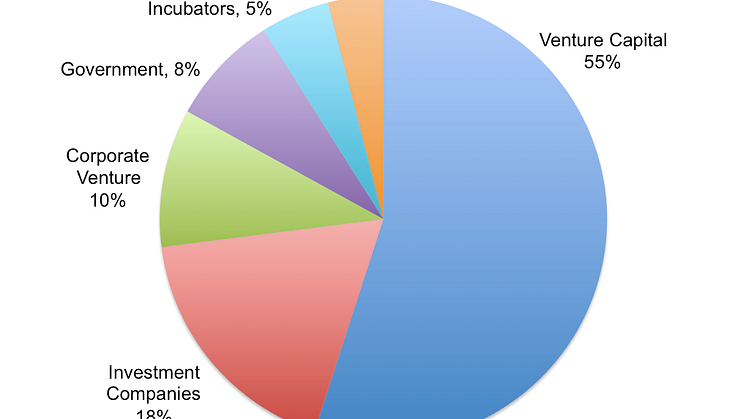

In terms of the number of companies, funds and organisations (not the capital size), over 80% of the players are VC, Investment companies and corporates.

- Venture Capital, 55%

- Investment Companies, 18%

- Corporate Ventures, 10%

- Government, 8%

- Incubators, 5%

- Business Angels, 4%

So counting investing entities, the main force in Nordic tech investing is venture capital; professionally managed funds of capital from private and public investors.

Looking closer at the VCs, they can be divided in three sizes, Large, Medium and Small. About 13% can be considered large (fund size above $1 billion) and mostly from the US. These players have typically only invested at larger stages across the Atlantic, but are now moving towards increasingly earlier investments in the Nordics.

The bulk of European VC is the mid-size fund, normally around €70-200 million Euro. Around 55% of the VCs investing in the Nordics are this Medium fund size, typically with institutional investors and traditional set-up. They are considered too small to compete with their US west coast colleagues, yet too big to be active in the growing seed market. However, they fill an important role for local expansion and growth capital.

The changing startup eco-system (cheap software, hosting and distribution) has lowered costs for launching new companies, and correspondingly decreased the need for capital. This is the background for a new type of VC, sometimes called a “micro-VC”. This Small size VC raises $10-50 million funds and invest in early and seed stages. In the US the trend is significant. During the last three years, the number of VC funds raising capital has grown from 92 to 163 funds, while the total capital raised has shrunk from $25 billion to $17 billion. That means that the average VC fund size has decreased from around $280 million to $100 million. Not counting the few Large funds, 60% of new funds are below $50 million, according to data from PitchBook. We are likely to see this trend in Europe as well.

Investment Companies are normally investors investing their own money, typically capital from other businesses. With more successful exits the number of investment companies and family offices is likely to grow. Corporate venture is also growing, and in our study they mainly come from media industry. This category is also likely to grow, as traditional business needs to add both new revenue and innovations.

Expect to see more government initiatives, with global competition putting pressure on politicians for growth and jobs. Incubators and accelerators (both private, academic and public) will continue to be fashionable and play an important role in the “experimental” phase of startups. Business angels in Europe will probably continue to develop too as an investor collective, even though there is a long way to reach US levels, where angels invest just as much as VC funds, about $25-30 billion annually.

Now, where do all the investors come from? To summarise, 92% of the investors are from about 7 countries:

- Sweden, 28%

- Finland, 18%

- UK ,16%

- Germany, 11%

- US, 8%,

- Denmark, 7%

- Norway, 4%

There is strong startup and VC activity in Sweden and Finland today, with Denmark following. Especially Finland is on the rise with a number of new exciting companies, investors, incubators and conferences, maybe filling the void after Nokia’s fall. Norway seems to be the least dynamic tech startup nation in the Nordics, probably because the economy is dominated by the strong energy sector.

US and UK are present by sheer force of Silicon Valley, New York and London spreading out their networks to tech hotspots in Stockholm, Helsinki and Copenhagen. Germany has a long history of strong corporate ventures, and with Berlin as a new VC and startup hub, the short step over the Balitic sea to the Nordics is quite natural. There are already increasing dynamics between Stockholm, Helsinki and Berlin.

There are really two categories of tech investors that could be added to the list – private equity funds (buyout) and crowdfunding platforms.

We have not looked at private equity and buyout investors in this study. These firms are normally structured as funds with Limited Partner investor, like VC funds, but they differ in several aspects. They usually have majority control of their portfolio companies, they use debt to leverage equity, they invest in later stages – and most importantly, they have not so far been typical tech investors. Why? There are two main reasons. First, buyout funds need portfolio companies with steady cash flow to pay the debt (not always the case with tech companies, especially if they’re early stage). Second, tech investing requires sector expertise and skills, and buyout firms are usually generalists.

Having said this, there are since long leading buyout firms active in the tech sector, like the US firm and tech specialist Silverlake. There are signs that major generalist buyout firms like General Atlantic, TPG, KKR, and Blackstone are looking at setting up technology funds. The reasons are that 1) there is growth, cash flow and substantial value in tech companies, and – 2) the tech sector is disrupting the existing portfolio of companies, and by investing you get access to this disruptive force.

And finally, what about crowdfunding? It is certainly a new force in the capital market, but unless they set up their own funds or syndicates (as some now do) they cannot yet be defined as investors. Crowdfunding platforms are per definitions brokers of capital between individual angel investors and startups. As an advisor, and like an investment bank, they typically make money on transaction fees from raising money for companies. Expect this online model, matching capital supply and demand in efficient ways, to continue to change and disrupt financial markets.

In all, the tech investing landscape will get even more exciting.

Originally published on Standout Capital.