Standout News #4 - Nordic Tech, Deals and Trends

Standout News #4 - The Newsletter from Standout Capital. Follow Nordic tech, trends and deals.

Standout News #4 - The Newsletter from Standout Capital. Follow Nordic tech, trends and deals.

Private growth companies stay private longer, and it makes sense for stock exchanges like Nasdaq to help these fast-growers earlier, before they even start thinking about an IPO. In 2014 Nasdaq Private Market launched, now it’s coming to Europe and we were interested to learn more.

Swedish business daily Dagens Industri and their tech news channel Di Digital is launching an initiative to make the Nordic digital ecosystem more transparent. Standout Capital, since long an advocate for quantifying the new business landscape, is a partner toNordic Tech List and supplying company information from our database.

We invest in tech companies, but even more so in the digital transformation of business and society. We look broadly at companies and industry sectors undergoing digital change. There are three themes that we think are especially interesting long term; private transportation, consumer finance and education. Let us tell you why.

Each year consulting group Deloitte highlights the 50 fastest growing technology companies in Sweden, Finland and Norway. The award, that ranks companies based on their revenue growth, is now over 10 years old in the Nordics and a top recognition of entrepreneurship.

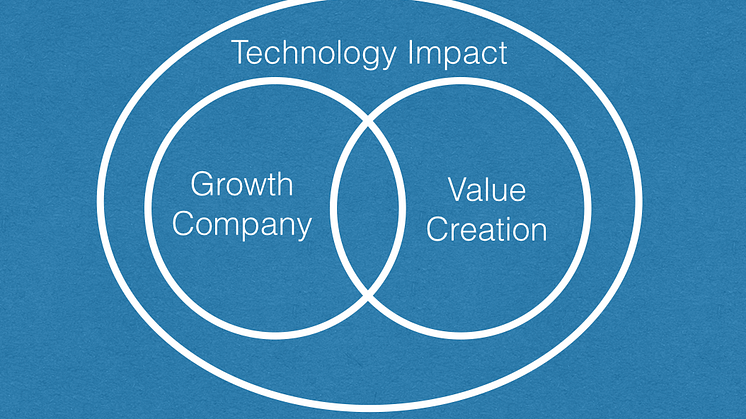

In an earlier post, we explored five must-have success factors that we think are essential for a modern tech investor that wants to thrive in today’s dynamic global market. Now we would like to turn to the actual investments. What is an outstanding investment? Also, we’re introducing the Technology Impact concept, a three-step investment philosophy.

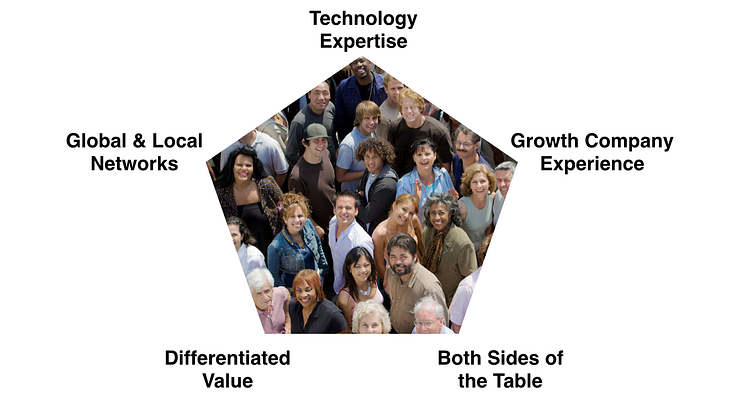

The rapid technology market is raising the demands on tech investors. We have been thinking about what makes a great growth capital investor today, and believe that there are 5 “must-have” success factors to thrive as a modern investment company operating locally in a global technology context.

The Nordic region is famous for global tech successes, exciting new companies and vibrant tech hubs with conferences attracting global crowds.But it’s not only about startups. Research from Standout shows that there are also over 4,000 tech-enabled, established and mostly profitable growth companies in the Nordics. And an underserved local growth capital market.

Standout News #1 - The Newsletter from Standout Capital. Follow Nordic tech, trends and deals.

This is the question that founders, CEOs, entrepreneurs, owners or anyone responsible for a business is asking all the time: “Do we have the right strategy?”

We have changed our name to Standout Capital, and just wanted to write a short blog post to explain why, in case anyone is wondering.

Investments to maximize short-term return on capital will not create long-term growth and jobs – and not even return on capital. This is a dilemma, but today’s super-dynamic tech industry might offer the unique combination of both fast capital returns, and simultaneous rapid new market creations from innovations.

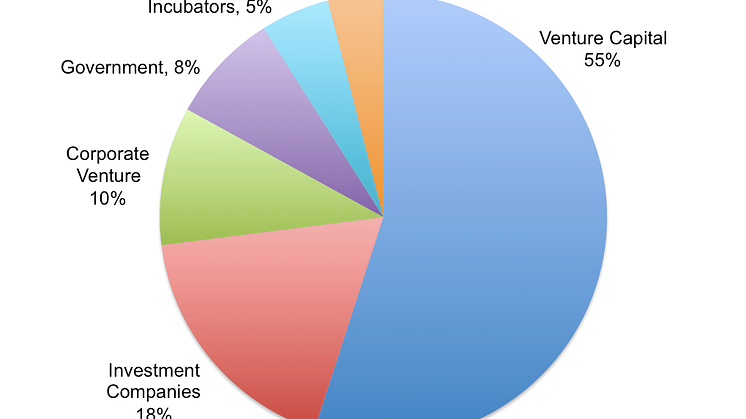

There are at least 120 tech investors active in the Nordics. What does this diverse landscape really look like? Here are some of the findings.

In 2014 we wrote a series of blog posts about the startup boom and changing face of VC in Stockholm and the Nordics. But who are actually the players investing in the Nordic tech boom? Venture Capital firms, investment companies, incubators, angel networks, corporate venture and government agencies. Our team made some research and created the Nordic 100 Tech Investor list.

Maybe it’s not a Stockholm syndrome, but a European dilemma. According to a recent article in The Economist about venture capital in Europe, “the rule of thumb is that young American firms raise twice as much money in each round of financing as European ones – and twice as fast.

At the beginning of 2000, venture capital skyrocketed in Sweden and all over the Western world, then dropped in the first years of the new decade. Most VC markets then stabilized although they keep on struggling.

Around Stockholm, startup hubs, activities, spaces and incubators are now emerging, driven by need for access to office space, networks and getting together with other talents to build amazing new things.

There is a Silicon Alley in New York, a Silicon Beach in Los Angeles and a Silicon Roundabout in London. There is no Silicon Archipelago here, but a hashtag and a movement that has grown from the grassroots of Stockholm’s startup community: #sthlmtech.

Venture Capital is a new software industry. I do not only mean that it’s a new market for smart tools like Visible for running VC funds, but that VC companies themselves are becoming tech startups. Please let me highlight five points why.