Nyhet -

Letter from the CEO THiS Group March 2022

We are currently in an expansive phase where several of us work in principle 24/7 to accelerate growth and at the same time prepare ourselves with everything legal before the IPO. Every day I get calls from investors who are interested in our business and our future. Talking about our vision with you, which means being a collective pioneer in market-based and value-adding business in health and lifestyle with a focus on global sustainability, is something I am driven by and find extra fun. Committed shareholders are important for us to achieve stable and sustainable growth together.

New management team and strategic advisors begin the rollout phase of the M&A model (Merger & Alliance)

During the first quarter, the management team was strengthened with great knowledge and competence. Ali Farmandeh has joined the group as Deputy CEO and at the same time my right hand. Ali has over 20 years of experience in leading positions in various companies where he mainly worked with organizational and business development. In addition to Ali, we have also strengthened the management team with Eleonor Åslund who has over 25 years of experience in HR and until 2021 she was HR manager for Marginalen Bank and was a part of the management team. In addition, Marco Gentilli has been appointed to the management team. Marco has extensive experience from organizational and business development and will play a significant role in future acquisitions. We have also added additional expertise in the form of more strategic advisors. Neil Shen, one of the world's leading tech investors, has been added and also # 2 on Forbes' list "The Midas List: Top Tech Investors". Bob Xioping Xu has also been appointed, one of China's foremost angel investors and co-founder of the VC company ZhenFund. Finally, Peter Olofsson has also been appointed with extensive experience in innovation and organizational and business development.

The new management team and the new advisers are now beginning the roll-out phase of the M&A model. I am pleased that all these competencies are behind our innovative business model with a butterfly effect.

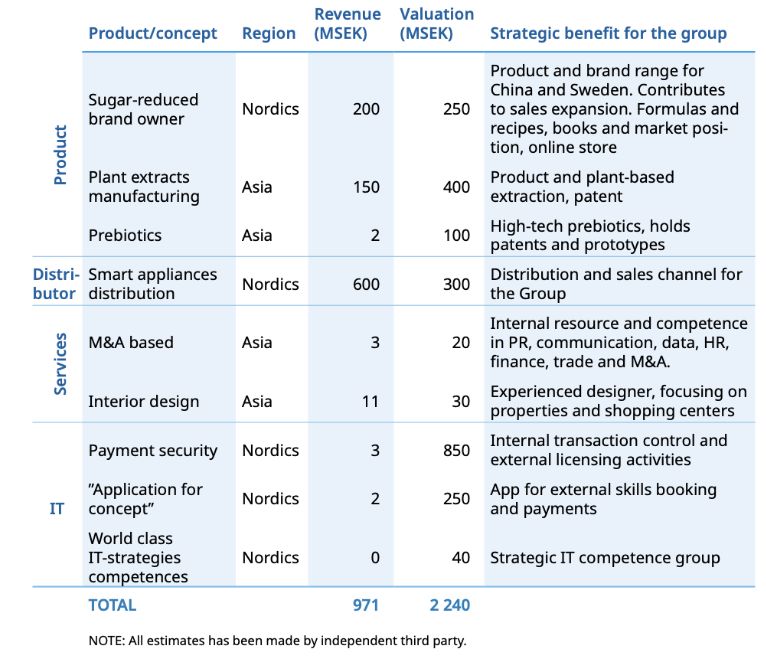

As previously mentioned, we also have a prepared pipeline with intended acquisitions of brand owners, distributors and high-tech and innovative ideas where we have well-established discussions. The picture below reflects the intended acquisitions in their entirety together with current revenues and valuation.

Visit to Bulgaria

Last month I went down to Bulgaria to discuss potential collaborations with several interesting people with whom I had previously built a network during my time at Bayn Europe who are positive to THiS. Among other things, we discussed brand building and ideas to create a stronger bond between Europe and Asia in a better way. Many rewarding meetings that can result in potential business partnerships in the future.

Karuu´s e-commerce platform is now in place

Karuu´s advanced e-commerce platform is now finally in place after a long period of development. The payment system is also in place, which means that Asian consumers now have the opportunity to buy Nordic goods directly through Karuu´'s e-commerce platform. During the month of April, approximately 150 products will initially appear on Karuu´s platform, all from our partners, e.g. Enlund Nutrition and the Danish health company Easis. THiS is created for the entrepreneurs who have unique products in health, well-being and lifestyle. Through the e-commerce platform, we help them reach out to the Asian market and the Asian consumers - Win-win!

THiS Ecosystem

The development of the internal ecosystem has begun. A platform for this is currently being developed and will enable entrepreneurs to be able to interact with consumers directly without any intermediary and for consumers themselves to be able to interact with each other. The ecosystem will further clarify the business model. The goal is to create a sense of belonging among all parties, which includes both entrepreneurs and end consumers.

Dialogue with stakeholders in Hong Kong

We have begun intensive discussions with stakeholders in Hong Kong to set up the digital infrastructure for transactions and business between Asia and Europe. This is an essential part of the business model for us to create growth and synergies between the subsidiaries among themselves. The market is huge and it is therefore necessary that we have the digital infrastructure in place before we can start executing on it.

The Board has approved a private placement

The Board has approved that we raise capital of a maximum of 60 million SEK, which will primarily go to strengthening e-commerce, preparations for IPO, digitization and brand building. The capital raising process runs from 1 April to 30 June and we have begun initial dialogues with potential investors. As part of this, we have developed a Pitch Deck which can be found on our website. Both for you who may be interested in investing or gain a better understanding of THiS group as a whole. You can read the Pitch Deck in both Swedish and English format.

In the upcoming month, I will spend a lot of time finding investors and, above all, gaining a stronger ownership base. We feel confident that our "butterfly share" can create a butterfly effect to benefit both health and wealth.

Lucy Dahlgren,

CEO, THiS Less-is-more Group AB (publ)

Ämnen

- Företagande