Blog post -

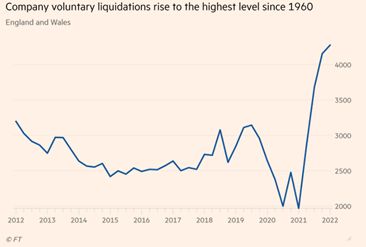

Business bankruptcies in England and Wales rise to highest level since 1960

Businesses in England and Wales have voluntarily filed for insolvency due to supply chain disruption and price pressures from commodities and energy.

In the first quarter of 2022, about 4,900 companies went bankrupt, a 117% increase from the same period last year, and a level not seen since the survey began in 1960, according to the Insolvency Service.

Samantha Keen, UK turnround and restructuring strategy partner at EY-Parthenon said that small businesses were already facing tough times since the Covid-19 related government support measures were rolled back and they now “face a perfect storm.”

Small businesses are also unable to recruit staff due to rising wage pressure. A survey of 5,500 businesses by the British Chambers of Commerce shows that about 80% of the businesses, especially SMEs, were facing tighter labour market.

According to accounting software platform Xero, there are still 7.4% fewer people working in small businesses than there were in February 2020.

Alexander von Schirmeister, UK managing director at Xero, told the Times that “small businesses are very worried about finding people, whether that’s a delivery driver, someone to do the stocking or the inventory or front-of-office staff or, in a restaurant, service staff or kitchen staff.”

However, on a brighter note, small businesses’ revenue rose 13.5% in March but remain behind pre-pandemic levels and mask weak job creation, according to Xero.

While it is estimated that about 440,000 or 8% of the small businesses in the United Kingdom face insolvency from cash flow problems arising from higher operating costs and difficulties in getting invoices paid on time, large companies are making efforts to pay their suppliers on time to ease pressure.

UK Small Business Commissioner, Liz Barclay, says that the prompt payment code introduced by the UK government to encourage large companies to commit to good payment practices has resulted in improving payment days, but lack of negotiation skills and invoicing errors by SMEs can sometimes act as a hurdle to get paid on time.

Want to know more about this topic? Listen to UK Small Business Commissioner Liz Barclay and RIABU's Mark Laudi discuss this issue on our podcast, Be First In Line To Get Paid:

Get more tips on effective cash flow management from our book, Let The Cash Flow. To find out more about how RIABU helps small businesses get paid on time, visit RIABU.com

Topics

- Business enterprise, General

Categories

- late payments

- prompt payment code

- cash flow

- smes

- business owners

- risk

- accounts receivable

- xero

- sme