News -

Cubera ranked European #1 in independent fund-of-funds assessment

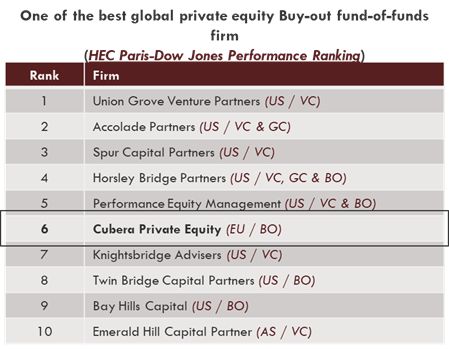

Cubera Private Equity has been recognized as a global leader and the standout European performer at sixth place in the HEC Paris-Dow Jones Performance Ranking of Private Equity Fund-of-Funds.

The ranking lists the world’s Top Fund of Funds in terms of aggregate performance and answers the question: “Which private equity fund of funds generated the best performance for their investors, over the past years?”

Cubera Private Equity is the only European private equity fund-of-funds manager among the top ten and one of best buyout fund-of funds manager globally as the top five spots are taken up by US growth/venture capital focused fund-of-funds managers.

In total, HEC Paris analyzed performance data, considering both relative and absolute returns, from 109 private fund-of-funds firms - including Cubera's International funds data - and the 733 funds with an aggregate equity volume of $223bn they raised between 2008 and 2017.

Since 2009, HEC Paris and Dow Jones have joined forces to publish regular rankings of private equity firms, based on their historic performance and expected future competitiveness.

"There is a lot of evidence that good fund-of-funds are adding meaningful amounts of added value", says Oliver Gottschalg, Professor of Strategy and Business Policy, HEC School of Management, Paris.

"With our Nordic mindset we have had a long-term approach to create superior value when investing in US, European and Asian private equity funds. We are proud of this recognition. It reflects the distinguished selection methodology refined by the Cubera team over many years. We are committed to continuing to raise the bar to deliver best-in-class results for our investors", says Thomas Wold, Senior Partner and Head of Primaries at Cubera.

Cubera Private Equity is a leading specialized investment firm in the Nordic private equity market, providing investors complete exposure to Nordic and International private equity. Serving a client base of European and U.S- based institutional investors, the firm has approximately EUR 4.5 billion in assets under management. For more than two decades, the Cubera team has successfully built four distinct fund-of-funds strategies: International primary, Nordic primary, Impact primary and Nordic secondary.

Operating from offices in Oslo and Stockholm, Cubera is part of Storebrand Asset Management, a leading Nordic asset manager and pioneer in sustainable investments.