Blog post -

Will Alibaba blow away Amazon and eBay?

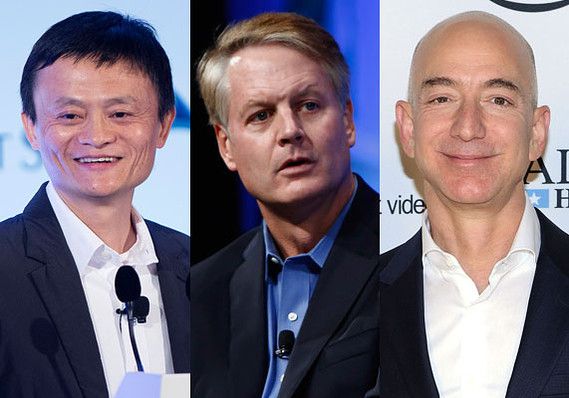

Founded in 1999 in the garage of Jack Ma, a former English schoolteacher, Alibaba is the largest e-commerce company of the world. Here are some facts that highlight the company’s extraordinary position and potential to grow.

The company generated an overall Gross Merchandise Volume (GMV) – total sales volumes in dollar value for merchandise sold through a marketplace for a given period of time – of $248 billion in 2013; more than the combination of both Amazon and eBay.

Across its China retail marketplaces, Alibaba’s GMV grew by 49% year-over-year, driven by strength in both Taobao and Tmall.com. Taobao is the online marketplace for Chinese consumers looking for choice, value, and convenience. It features hundreds of millions of product and service listings.

Contrary, eBay’s GMV declined in the fourth quarter of 2014 due to a decline in new buyers.

Among all listed Internet companies, the capitalization of the company was second only to Google, reaching $212 billion in January 2014. While Amazon was still struggling to break even, Alibaba enjoyed growing profits of $5.6 billion in 2014, and for the full financial year 2015 its net income reached $11.08 billion. Doing so, it resisted a broader trend of slowing economic growth in the world's second-largest economy.

What makes the figures more interesting is that the company was not even an e-commerce first comer in China. eBay had entered China first through a joint venture with EachNet. At that time, Alibaba was only a Business-to-Business (B2B) company that helped small- and medium-sized Chinese enterprises land deals with western importers. Soon, Alibaba established Taobao and ten years later is dominating the market as a conglomerate. It has set foot in Consumer-to-Consumer (C2C), Business-to-Consumer (B2C) and Business-to-Business (B2B), group buying, online payment, logistics, online advertisement and cloud computing. In a nutshell, it covers the business of Amazon, eBay, Groupon, PayPal, Li&Fung as well as Google AdSense.

But why is Jack Ma’s company so successful? Alibaba’s success seems to lie in its ability to adapt its business model to the Chinese reality.

1. The customer base is gigantic. There are 1.4 billion people in China. In the United States there are 327 million. For the record, the United States is the third largest country in the world; India is second with a population of 1.2 billion. Alibaba claims to have 300 million customers and it employs over 25,000 workers to service its clientele.

2. The Chinese retail market is highly diversified and fragmented. The Chinese economy is extremely unbalanced among regions and, based on the short history of retailing, there’s no national retail chain in China.

3. Charging no service fee at all, gave Taobao the largest advantage over its major rival at that time, eBay. With Alibaba as a cost-free alternative, buyers and sellers had no good reason to accept eBay’s fee structure.

4. As the factory of the world, China has millions of small manufacturing companies. Before the dawn of e-commerce, they had no way to reach customers on the domestic market. Taobao managed to link these small businesses with numerous buyers around the country.

5. Fraud is a serious issue in online retail. Buyers are not very comfortable with handing out money before receiving the goods. That’s why Taobao’s website, in order to meet its customers’ needs, ‘holds’ the buyers’ money until the delivery is confirmed. Moreover, Alibaba has launched AliPay, an integrated payment system, which provides the buyers and sellers a unified platform to handle the money easily.

6. Browsing the home page of Taobao is more like window-shopping. Hundreds of different items and categories are displayed on just one single page. Although it may look rather busy for western consumers, it successfully lures local customers into exploring new products.

7. Alibaba is currently working on establishing financial services and banking relationships. Soon customers will be able to invest as well as buy insurances with the Alibaba credit card.

8. Recent estimates put Alibaba's value somewhere between $150 billion and $200 billion. This implies that its Initial Public Offering (IPO – the process by which a private company can go public by sale of its stocks to general public) is around $17 billion, about $1 billion higher than the Facebook one.

Alibaba represents now the first chance for western investors to see the dragon up close, along with other companies like Tencent (which owns WeChat, China’s leading social network) and Baidu (China’s market leading search engine in a Google-free market) which are set to challenge the nature of global branding.

The current key question is who is going to win in the next market transformation: mobile commerce for China’s 1.4 billion consumers. For now, the money and the momentum are on Alibaba’s side but who knows what is going to happen next. One winner in this battle of titans will be definitely the e-commerce consumer.

Sources:

http://www.nasdaq.com/article/alibaba-vs-amazon-a-clash-of-e-commerce-titans-cm481908

Read more Swedbrand blog posts at

swedbrand.com/blog, or visit our website at swedbrand.com.

Written by

Alessandra Ruggeri

Topics

- Packaging, packing

Categories

- global markets

- competition

- ebay

- amazon

- alibaba