Press release -

Insurance revenues reach £3.6bn for Allianz in the UK

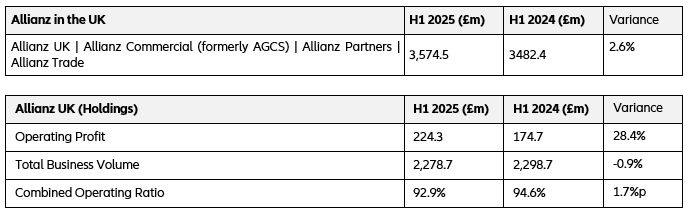

Allianz UK reports 28.4% increase in operating profit to £224.3m

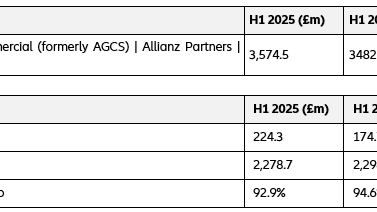

Half-year results for Allianz Group released today reveal that the organisation achieved revenues of £3.6bn across Allianz UK, Allianz Commercial, Allianz Trade and Allianz Partners.

Key highlights for Allianz UK in the first six months of the year include:

- Announcing business wins including VetPartners, Volkswagen Financial Services UK (VWFS) and Sainsbury’s Bank

- Creating one Allianz UK claims function to unite expertise

- Celebrating Allianz Engineering Inspection Services’ 100th anniversary

- Delivering transformation programmes benefitting customers and employees

- Achieving excellent customer feedback including What Car? and Gracechurch

Colm Holmes, Chief Executive Officer, Allianz UK said:

“I am pleased with the performance so far this year. The increase in profitability is an obvious highlight but this just represents the outcome from the extensive investments we have been making in our business over the past two years. Our focus remains on disciplined, profitable growth and through our always advancing technical expertise and pricing capabilities we are seeing the results of that approach.

“Our strategy to expand our distribution in personal and commercial is beginning to deliver tangible benefits to our underlying business and is evidenced in numerous ways including our new partnerships with brands such as VWFS UK and Sainsbury’s Bank. In Commercial we have continued to see impressive growth in our targeted mid-market segments. Our broker community has expanded as we continue to build closer relationships with our broker partners of all sizes. At Allianz we value each and every one of those relationships and will continue to build mutual innovative market solutions in the future.

“Our business transformation programme and investment in simplification and digital trading is beginning to be truly felt across the business as we work to make our interactions with customers and brokers smarter and faster. So far this has included projects that have revolutionised our telephony systems, and the outcomes of our systems thinking programmes including a new approach in Commercial property claims that has led to a 25% reduction in processing times. These are only two examples of many programmes and there is much more to come in the second half of 2025 as we continue to transform to become fit for the future.

“These advancements are being well received and our customers and brokers are offering positive feedback across all metrics. I’m delighted that Allianz Commercial has kept loyalty leader status as part of the global net promoter score results and that Allianz Personal were awarded the Which? Best Buy Car Insurance award 2025. For the second year in a row, Britannia Rescue has been named the Best Breakdown Service by What Car? which demonstrates that our customers understand that we’re there for them when they need us the most. “

Financial Highlights

Allianz's insurance businesses in the UK

Segmental Highlights

Allianz UK Personal

- The trading environment continues to be challenging, with both motor and home markets continuing to soften but profitability has been maintained and actions are being taken to address market conditions.

- Highlights for H1 included new partnerships, product enhancements and Allianz UK’s car and home insurance policies earning a 5-star Defacto rating, the highest possible.

- The business will continue to invest in data and pricing capabilities to drive technical excellence as well as focusing on growing the UK brand.

- The continued focus on disciplined pricing and investment in customer service has strengthened our position and enhanced our strong customer loyalty.

Allianz UK Commercial

- The commercial market is highly competitive but our agility in pricing and trading means that we are on track to achieve our ambitions and drive profitable growth.

- Articulating our risk appetite and continuing to utilise the strength of Allianz Commercial through broker relationships have been key factors behind our success in the first half of the year, alongside digital advancements such as self-service options for digital trading and mid-market brokers.

- During H2 the highly-anticipated new trading platform will launch with implementation initially rolled out for digital products. This will transform the way brokers interact with us and how we process mid-market requests making business easier for colleagues, customers, brokers, and suppliers.

Allianz UK Specialty (Pet)

- Allianz Specialty continues to perform strongly in a competitive and challenging market.

- During H1 product enhancements were made to simplify the customer experience and partnerships were announced with VetPartners and Medivet.

- Focus for H2 is the continuation of transformation projects that will support customers across multiple distribution channels and contribute to Petplan retaining its Most Trusted Pet Insurer status.

Outlook for H2 2025

Colm Holmes continued:

“It’s been a good start to the year and I’ve no doubt that we’ll maintain our momentum as we move into H2. The market remains fiercely competitive, and we are seeing the results of operating in a soft market alongside lingering inflationary factors, but the actions we’ve taken to form and establish Allianz UK are working and will enable us to respond to these customer and market demands in a more agile way.

“We’re working smarter, adapting to shifting customer and market dynamics through strategic partnerships and we’re winning new distribution deals based on our brand, and the digital self-serve capabilities we are building. We’re embracing technology that will make us simpler and easy to do business with whilst continuing to invest in our people to maintain and develop the technical excellence that we’re known for.

“I’d like to thank all my colleagues for their continued dedication and enthusiasm, not only for supporting our customers and broker partners but also for their communities. In the first year of our partnership with Barnardo’s we’ve raised over £350,000 and that money will make a tangible difference to the lives of young people and their families across the UK. I also congratulate my Allianz Engineering Inspection Services colleagues who are celebrating 100 years of business. This is a huge milestone and a credit to their expertise that we maintain our #1 engineering inspection market leader status.

“We will continue to deliver on our transformation and focus on disciplined underwriting. Last year we came together to lift our ambitions as ‘One Allianz’ and are now in delivery mode to give our customers, brokers, and clients a smarter and simpler experience as part of a strong Allianz UK.”

[ENDS]

Notes to editors:

Definition: Total Business Volume is the premium received by the business for both insurance and non-insurance operations.

Topics

Regions

About Allianz Holdings plc

Allianz Holdings plc is the non-regulated holding company which owns the principal insurance operations of Allianz SE in Great Britain including Allianz Insurance.

About Allianz

The Allianz Group is one of the world's leading insurers and asset managers with around 128 million* private and corporate customers in nearly 70 countries. Allianz customers benefit from a broad range of personal and corporate insurance services, ranging from property, life and health insurance to assistance services to credit insurance and global business insurance. Allianz is one of the world’s largest investors, managing around 776 billion euros** on behalf of its insurance customers. Furthermore, our asset managers PIMCO and Allianz Global Investors manage about 1.9 trillion euros** of third-party assets. Thanks to our systematic integration of ecological and social criteria in our business processes and investment decisions, we are among the leaders in the insurance industry in the Dow Jones Sustainability Index. In 2024, over 156,000 employees achieved total business volume of 179.8 billion euros and an operating profit of 16.0 billion euros for the group.

* Including non-consolidated entities with Allianz customers.

** As of December 31, 2024.

Mandatory corporate information: Corporate disclosures

These assessments are, as always, subject to the disclaimer provided below.

Cautionary note regarding forward-looking statements

This document includes forward-looking statements, such as prospects or expectations, that are based on management's current views and assumptions and subject to known and unknown risks and uncertainties. Actual results, performance figures, or events may differ significantly from those expressed or implied in such forward-looking statements.

Deviations may arise due to changes in factors including, but not limited to, the following: (i) the general economic and competitive situation in the Allianz’s core business and core markets, (ii) the performance of financial markets (in particular market volatility, liquidity, and credit events), (iii) adverse publicity, regulatory actions or litigation with respect to the Allianz Group, other well-known companies and the financial services industry generally, (iv) the frequency and severity of insured loss events, including those resulting from natural catastrophes, and the development of loss expenses, (v) mortality and morbidity levels and trends, (vi) persistency levels, (vii) the extent of credit defaults, (viii) interest rate levels, (ix) currency exchange rates, most notably the EUR/USD exchange rate, (x) changes in laws and regulations, including tax regulations, (xi) the impact of acquisitions including related integration issues and reorganization measures, and (xii) the general competitive conditions that, in each individual case, apply at a local, regional, national, and/or global level. Many of these changes can be exacerbated by terrorist activities.

No duty to update

Allianz assumes no obligation to update any information or forward-looking statement contained herein, save for any information we are required to disclose by law.

Privacy Note

Allianz SE is committed to protecting your personal data. Find out more in our privacy statement.