Blog post -

Child Benefit changes on the way

Mary Aiston, HM Revenue & Customs’ Director of Personal Tax, explains the changes to Child Benefit from January and where to go for help.

At the moment, if you are responsible for a child you will receive Child Benefit of £20.30 a week for your eldest child and £13.40 a week for each of your other children.

But from 7 January, you will have to pay the charge if you, or your partner, are entitled to receive Child Benefit and one of you has an income of more than £50,000. If you and your partner both have income over £50,000 each, the person with the higher income will have to pay the charge.

If you or your partner’s income is more than £60,000, the charge is 100 per cent of the amount of Child Benefit. If your income is between £50,000 and £60,000, the charge is gradually increased to 100 per cent of the Child Benefit.

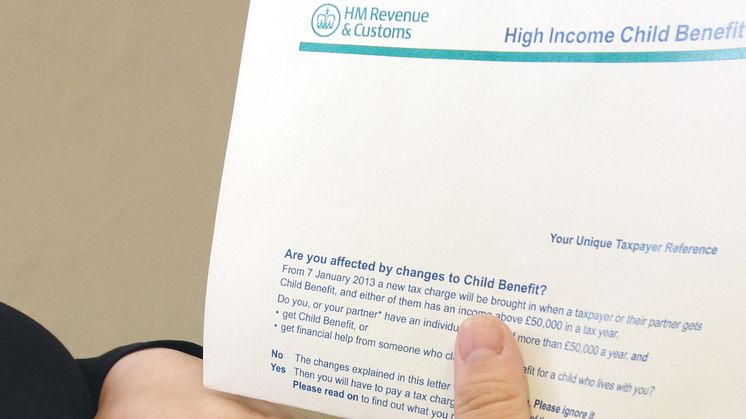

HMRC has written to more than 1 million families affected by the changes, explaining what steps they should take next. But if you know you are affected by the charge and haven’t received a letter or have lost it, HMRC’s website has all the information you need.

If these changes apply to you or you partner, you will need to decide whether to stop getting Child Benefit and avoid paying the new charge or to keep getting Child Benefit and declare payments for income tax purposes through Self Assessment. If your income is less than £60,000, the tax charge will always be less than the amount of Child Benefit and you could lose money to which you are entitled if you stop getting Child Benefit.

To find out if your income is over £50,000, and examples of how much you are likely to pay, visit HMRC’s website.

If you want to stop getting Child Benefit, you or your partner should tell HMRC before 7 January 2013. You can still stop the payments after 7 January, but there will be a charge.

If you or your partner want to keep receiving Child Benefit, you should register for Self Assessment if you have not already done so.

For further information visit www.hmrc.gov.uk/childbenefitcharge