Self Assessment newcomers urged to register now for online services

HM Revenue and Customs (HMRC) is urging first-time Self Assessment (SA) filers who haven’t sent in their returns to register for its online services now.

HM Revenue and Customs (HMRC) is urging first-time Self Assessment (SA) filers who haven’t sent in their returns to register for its online services now.

HM Revenue and Customs (HMRC) has published additional guidance [hyperlink] for UK micro and small businesses who supply digital services to consumers in other EU Member States.

HM Revenue and Customs (HMRC) has re-launched Supporting Small Business, which lays out how the department is making tax easier, quicker and simpler.

Solicitors are being given the chance by HM Revenue and Customs (HMRC) to bring their tax affairs up to date or face tougher penalties, as part of a new tax campaign.

From today, businesses that offer gambling to UK customers from overseas will have to pay Remote Gaming Duty (RGD), General Betting Duty (GBD) and Pool Betting Duty (PBD), HM Revenue and Customs (HMRC) has confirmed.

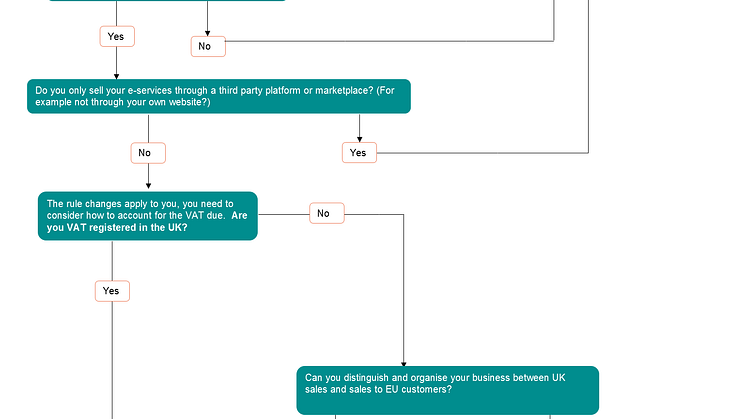

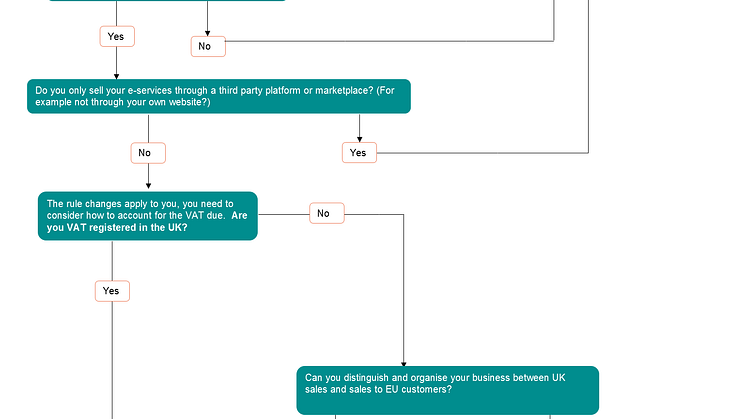

VAT place of supply of services rules changes from 1 January 2015. HM Revenue and Customs (HMRC) held a Twitter Q & A on 27 November 2014. Here we list some of the main questions to come out of that.

Christmas shoppers looking for bargains overseas have been warned by HM Revenue and Customs (HMRC) not to get hit by unexpected charges.

The inaugural meeting of HM Revenue and Customs’ (HMRC) new stakeholder group, the Employment and Payroll Group (EPG), will be held on 4 December, it was announced today.

VAT place of supply of services rule changes from 1 January 2015. Here are HM Revenue and Customs’ top tips for businesses preparing for the changes:

Plans to recover tax and tax credit debts directly from the bank accounts of people and businesses who refuse to pay what they owe will include strong safeguards to protect vulnerable taxpayers, the government announced today.

HM Revenue and Customs (HMRC) has clocked up another three major legal victories over corporate tax avoidance schemes, protecting over £100 million of tax.

A Fermanagh farmer, who was jailed for stealing nearly £500,000 in fraudulent VAT repayments, has been ordered to repay £60,000 or serve a further two years in prison.