Tax stealing tiler sentenced

A tax stealing tiler has been sentenced for a £492,000 VAT fraud after ignoring a chance to come clean

A tax stealing tiler has been sentenced for a £492,000 VAT fraud after ignoring a chance to come clean

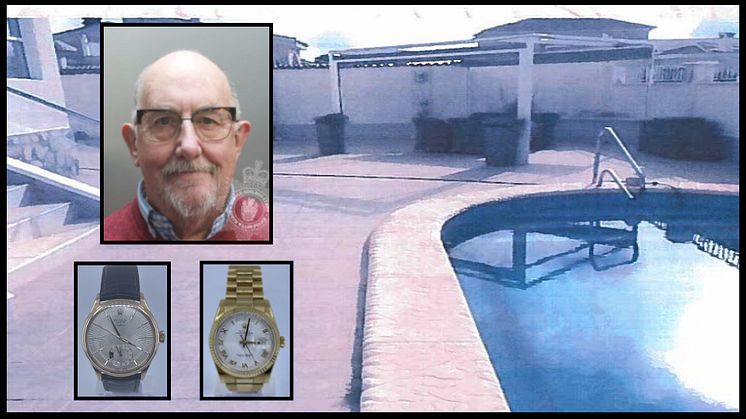

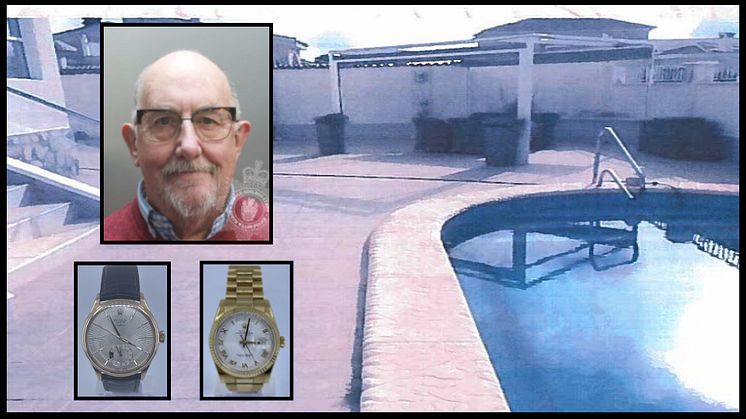

A jailed fraudster who bought three Spanish villas after stealing from the taxpayer must pay £1.2 million back or face another seven years in jail. Graham Drury, 71, formerly of Strathalyn, Rossett, Wrexham, was jailed for five-and-a-half years in 2021 after submitting fraudulent VAT returns to HM Revenue and Customs (HMRC).

Mae’n rhaid i dwyllwr sydd wedi’i garcharu, a brynodd dair fila yn Sbaen ar ôl dwyn mwy na £1.2 miliwn oddi ar drethdalwyr, dalu’r arian yn ôl neu bydd yn wynebu saith mlynedd arall yn y carchar.

Cafodd Graham Drury, 71 oed, gynt o Strathalyn, Yr Orsedd, Wrecsam, ei garcharu am bum mlynedd a hanner yn 2021 ar ôl cyflwyno Ffurflenni TAW twyllodrus i Gyllid a Thollau EF (CThEF).

Mewn gwrandaw

Two fraudsters who spearheaded a Polish beer smuggling scam have been jailed for a total of seven years. Radoslaw Dobron, 36, and Ilona Leszczynska, 37, smuggled 122 lorry loads of non UK-duty paid beer via a North London based alcohol wholesaler. The beer, worth more than £3.1 million in evaded duty, was smuggled to Top Seller Ltd by abusing a commercial importers scheme.

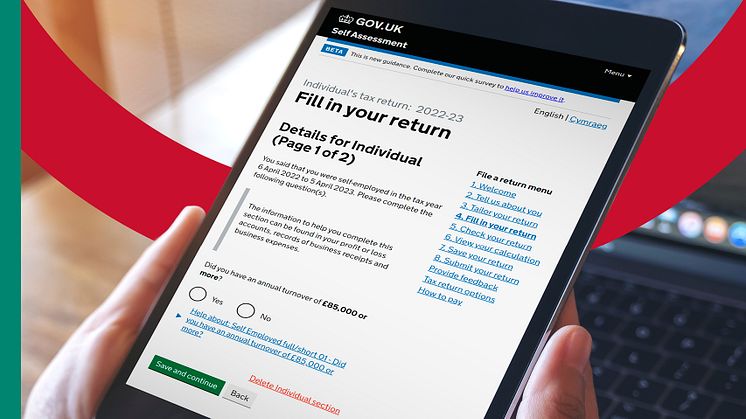

Self Assessment customers could take advantage of four key benefits when filing their tax return early, HM Revenue and Customs (HMRC) has revealed.

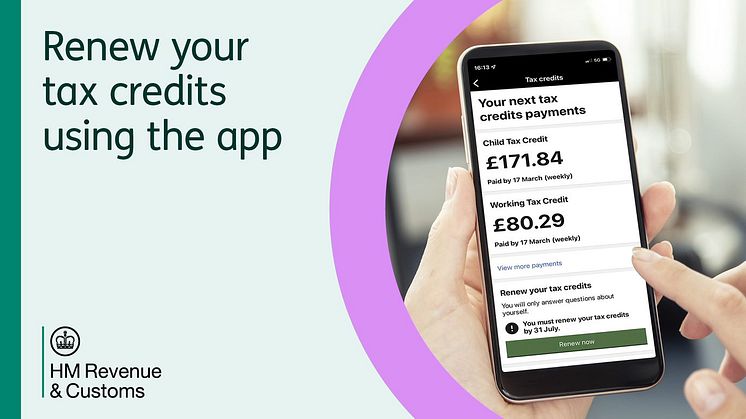

More than 171,350 tax credits customers have until 31 July to renew their annual claim and HM Revenue and Customs (HMRC) is urging them to not miss out.

More than 27 million illicit cigarettes and 7,500kg of hand-rolling tobacco were seized under Operation CeCe in its first two years, HM Revenue and Customs (HMRC) and National Trading Standards have revealed.

HM Revenue and Customs (HMRC) is awarding £5.5 million to organisations within the voluntary and community sector to support customers who may need extra help with their tax affairs.

Almost 28,000 customers have used the HMRC app to renew their annual tax credits claim, HM Revenue and Customs (HMRC) can reveal.

Today marks one month until the biggest Alcohol Duty reforms in 140 years come into effect.

On 1 August 2023, the Alcohol Duty system will become much simpler, taxing all alcoholic drinks based on their alcohol by volume (ABV).

This replaces the current Alcohol Duty system, which consists of four separate taxes covering beer, cider, spirits, wine and made-wine.

It will make the system

Tax credits customers have a month to renew their claim or risk having their payments stopped, HM Revenue and Customs (HMRC) has warned.

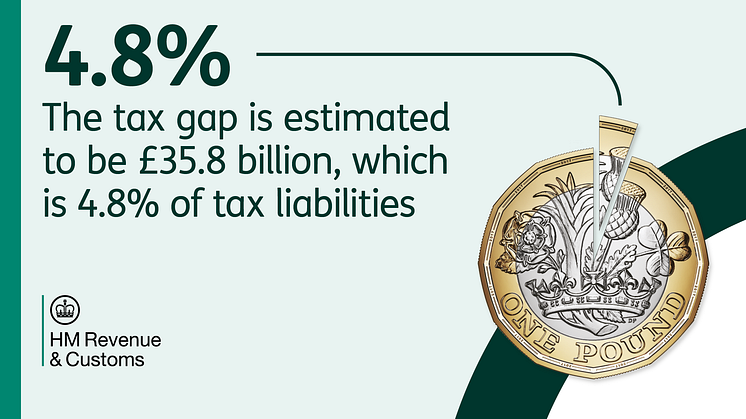

The amount of unpaid UK tax has remained at an all-time low of 4.8%, HM Revenue and Customs (HMRC) revealed today (22 June).