Press release -

VAT fraudster to cough up £1.2m or face longer in jail

A jailed fraudster who bought three Spanish villas after stealing from the taxpayer must pay £1.2 million back or face another seven years in jail.

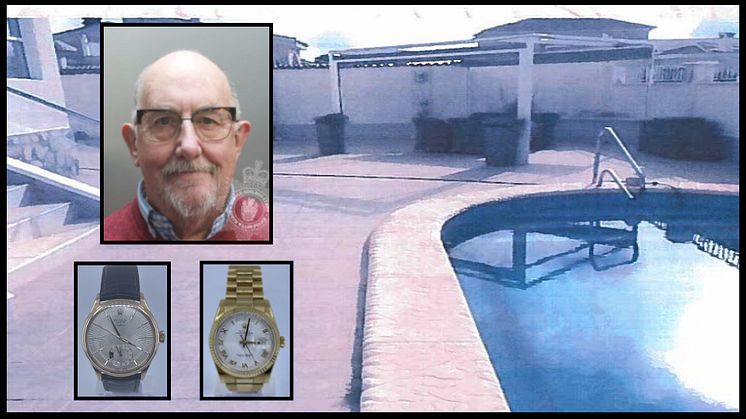

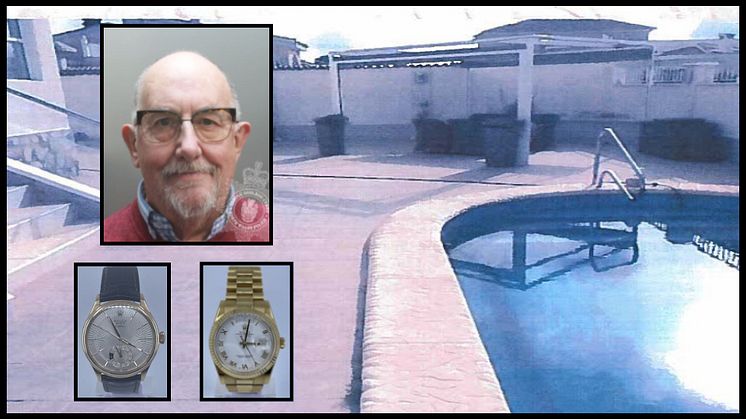

Graham Drury, 71, formerly of Strathalyn, Rossett, Wrexham, was jailed for five-and-a-half years in 2021 after submitting fraudulent VAT returns to HM Revenue and Customs (HMRC).

At a hearing in Mold Crown Court on Friday (28 July 2023), Drury was told to pay a £1.2m confiscation order within three months or have seven years added to his prison sentence.

Debbie Porter, Operational Lead, Fraud Investigation Service, HMRC, said:

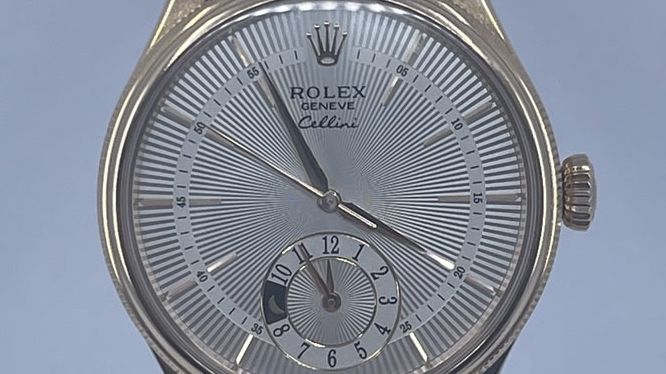

“Drury stole almost £2m of taxpayers’ money to fund a lavish lifestyle, which included Spanish villas, a luxury car and Rolex watches.

“He’s already paying the price for his crimes in jail and now must sell his assets or face even longer without his freedom. If he fails to pay the full order, he will still owe the money due after he is released.

“HMRC will always seek to recover stolen money and if you know of anyone who is committing tax fraud, you can report them to HMRC on gov.uk.”

Drury, using his company, Drury Machine Sales Ltd, was claiming fraudulent VAT repayments from HMRC on machinery that was never purchased.

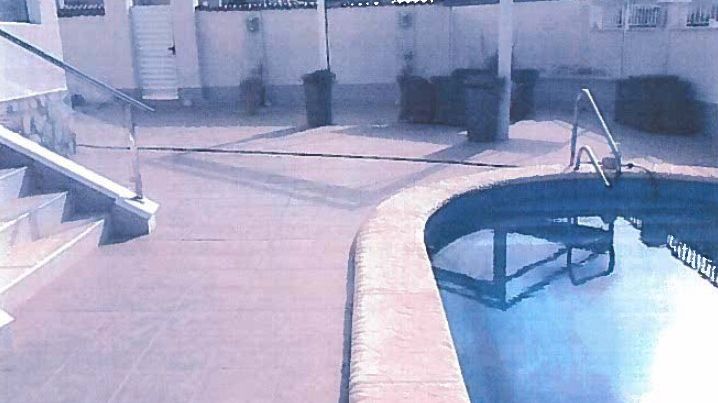

He used stolen money to buy several properties; one in the UK and three villas in Spain which he regularly visited on holiday. Other assets included a BMW X6, two Rolex watches and £100,000 in a bank account. HMRC restrained the three villas, two watches and the £100,000. If Drury fails to pay his confiscation order, these assets will be disposed of and the proceeds transferred into the public purse.

Drury was arrested on 13 January 2019 and subsequently charged with VAT fraud totalling £1,887,010. He pleaded guilty to the VAT fraud at Mold Crown Court on 2 August 2021 and was sentenced to five-and-a-half years behind bars the following day.

Notes for editors

- Graham Drury, DOB 03/11/1951, of Strathalyn, Rossett, Wrexham, pleaded guilty to the fraudulent evasion of £1,887,010 VAT between July 2014 and August 2017 at Mold Crown Court on 2 August 2021. He was jailed for five-and-a-half years before the same court on 3 August 2021 and disqualified from being a company director for 10 years.

- At Mold Crown Court on 28 July 2023, Drury was told to pay a confiscation order of £1,263,939.36 within three months or face seven years being added to his jail sentence.

- The three Spanish villas are in the Quesada region of the country.

- You can find out more about HMRC's approach to tax fraud at gov.uk.

- Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Topics

Categories

Regions

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.