Press release -

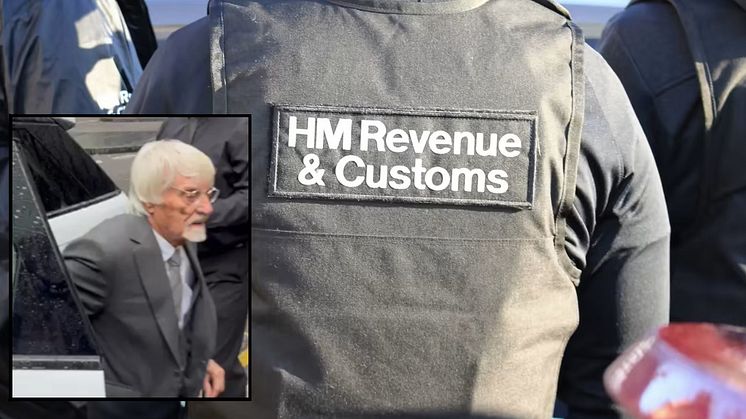

Bernie Ecclestone convicted of fraud

Billionaire businessman Bernie Ecclestone has pleaded guilty to fraud following a lengthy, complex and worldwide investigation into his tax affairs by HM Revenue and Customs (HMRC).

The 92-year-old former Formula One motor racing boss admitted fraud by failing to declare a trust, which held assets worth more than £416m.

He has been sentenced to 17 months in jail, suspended for two years, and made a payment of more than £650m in relation to his tax affairs, covering tax, interest and civil penalties.

The investigation started more than a decade ago when HMRC began a civil tax investigation in 2012.

Ecclestone was offered the chance to correct any mistakes in his tax and pay what was owed plus a penalty through a formal civil process known as a Contractual Disclosure Facility (CDF) or a ‘COP9’.

The COP9 process requires the taxpayer to make a “full, open and honest” disclosure or face a criminal investigation.

The former F1 boss said he was not the settlor or beneficiary of any offshore trust in follow up interviews with civil tax investigators in 2015.

Information provided to HMRC by the authorities in Singapore showed Ecclestone had lied.

HMRC went on to discover with support from authorities in Singapore that Ecclestone was the settlor and beneficiary of trusts, including one which held $646.45 million (£416 million) in 2010.

Eccelstone admitted a single charge of fraud by false representation during a hearing at Southwark Crown Court on October 12, 2023.

The CPS provided extensive early investigative advice to HMRC to help develop the joint prosecution strategy, focused on a single offence of fraud by false representation.

Bernie Ecclestone’s guilty plea was secured following lengthy negotiations under the Attorney General guidelines on plea discussions in complex fraud (2009).

The court also heard he has made a payment of £652m in relation to his wider tax affairs, covering tax, interest and civil penalties.

Part of the payment is a Failure to Correct (FTC) penalty for offshore non-compliance charged at the maximum rate of 200 per cent.

Richard Las, CBE, Chief Investigation Officer and Director Fraud Investigation Service, HMRC, said:

“Bernie Ecclestone has had ample time and numerous opportunities to take responsibility and be honest with HMRC about his tax affairs.

“Instead of taking these opportunities he lied to HMRC and as a result we opened a criminal investigation.

“This investigation has involved enquiries around the world and culminated with Bernie Ecclestone’s guilty plea to fraud. He now has a criminal record and has paid £652 million relating to his wider tax affairs.

“This conviction demonstrates no-one is above the law and HMRC will work tirelessly to ensure the tax system is fair to all and pays for our vital public services.”

Andrew Penhale, Chief Crown Prosecutor, said:

“Bernie Ecclestone has pleaded guilty to a single offence of fraud relating to dishonest representations to HMRC. All members of UK society, regardless of how wealthy or famous they are, must pay their taxes and be transparent and open with HMRC about their financial affairs.

“We are pleased to bring such a complex case to a successful conclusion. We worked very closely with HMRC throughout and it is rewarding to see that they have also secured such a significant civil tax settlement, through the negotiation process.”

The CPS is committed to continue working effectively with HMRC to bring tax fraudsters to justice.

Anyone with information about suspected tax fraud can report it to HMRC online.

Notes for editors

1. Bernard Charles Ecclestone DOB: 22/10/1930, of Princes Gate, London and Oberbortstrasse, 3780 Gstaad, Switzerland, admitted one count of Fraud by False Representation contrary to Section 2 of the Fraud Act (2006) at Southwark Crown Court on 12 October 2023 and was sentenced to 17 months in jail, suspended for two years.

The full charge was:

“On 7 July 2015, dishonestly and intending thereby to make a gain for himself or another, or to cause loss to another, or expose another to a risk of loss, made a representation to officers of Her Majesty's Revenue and Customs which was, and which he knew was or might have been, untrue or misleading, namely that:

(i) he had established only a single trust, that being one in favour of his daughters; and

(ii) other than the trust established for his daughters he was not the settlor nor beneficiary of any trust in or outside the UK, in breach of section 2 of the Fraud Act 2006.”

2. Code of Practice 9 (COP9) is the civil investigation procedure that HMRC follows to respond to tax fraud. It is HMRC’s main tool for investigating cases of suspected tax fraud when a civil procedure is considered to be the most appropriate action.

3. Under the investigation of fraud procedure, the recipient of COP9 is given the opportunity to make a complete and accurate disclosure of all their deliberate and non-deliberate conduct that has led to irregularities in their tax affairs https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1168681/COP9_06_23.pdf

4. The Contractual Disclosure Facility (CDF) is part of the process used to deliver COP9. It is a contractual arrangement whereby HMRC undertakes not to criminally investigate, in return for the customer’s open full, open, and honest disclosure of all the tax fraud committed.

6. Find out more about HMRC's approach to tax fraud at gov.uk.

7. Interviews with HMRC’s Director of Fraud Investigation Service, Richard Las and the CPS Chief Crown Prosecutor, Andrew Penhale, are available on request

8. Plea discussions in cases of serious or complex fraud - GOV.UK (www.gov.uk)

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.